Soybean Meal Market: Traders' Quick Guide to Price Movements and Profit Opportunities

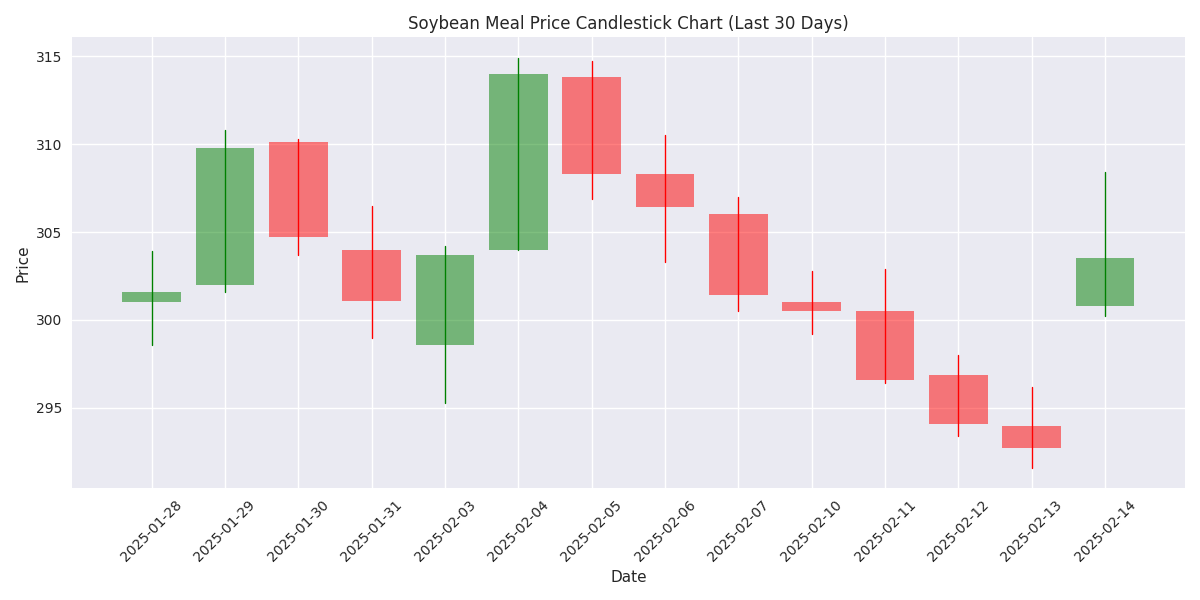

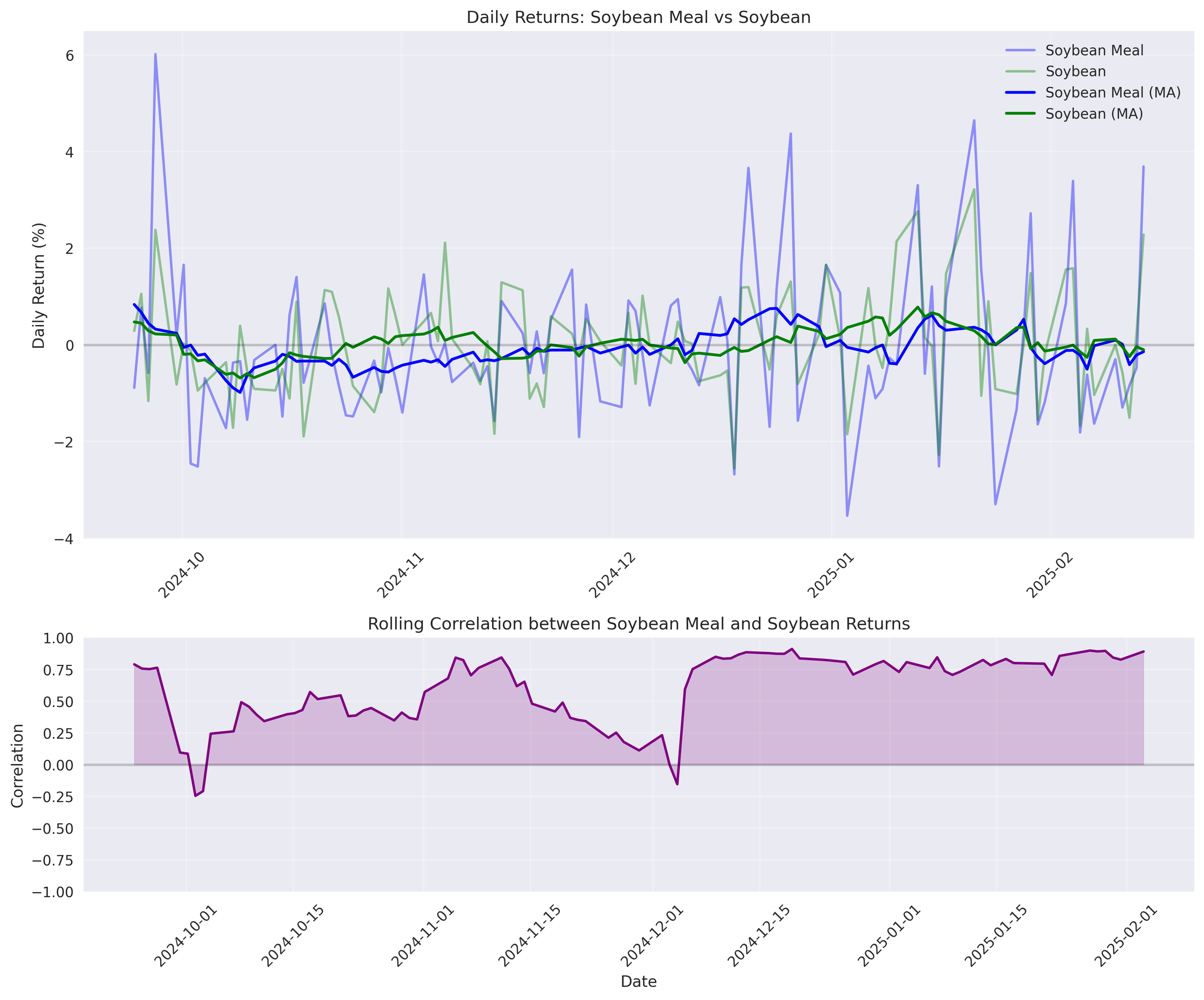

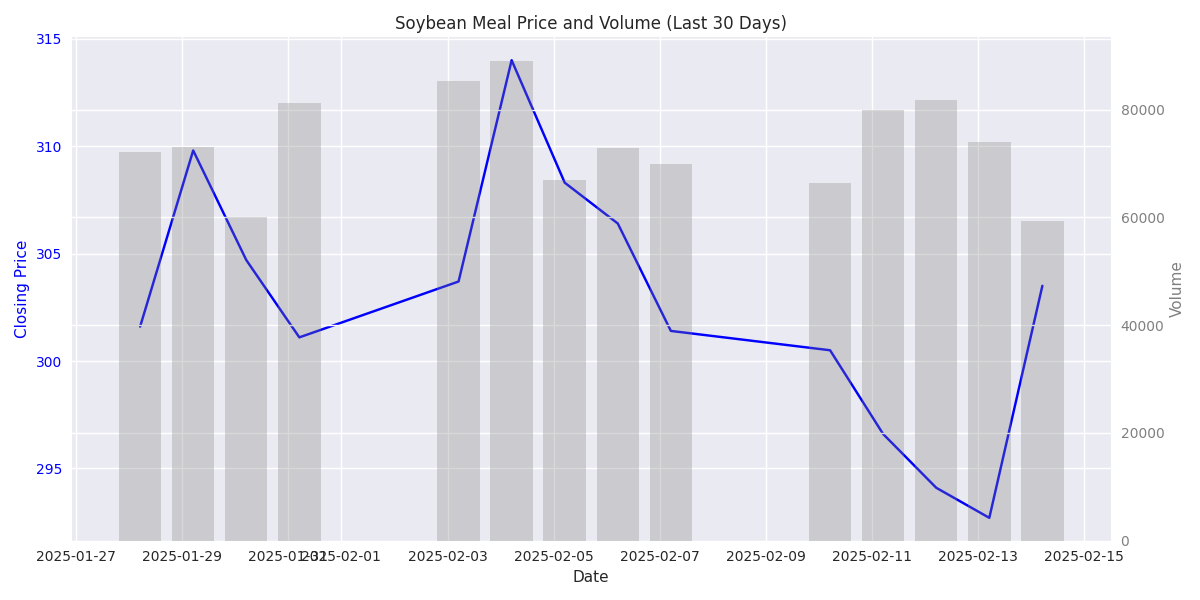

Soybean Meal Stages Strong Recovery, Breaking Bearish Trend

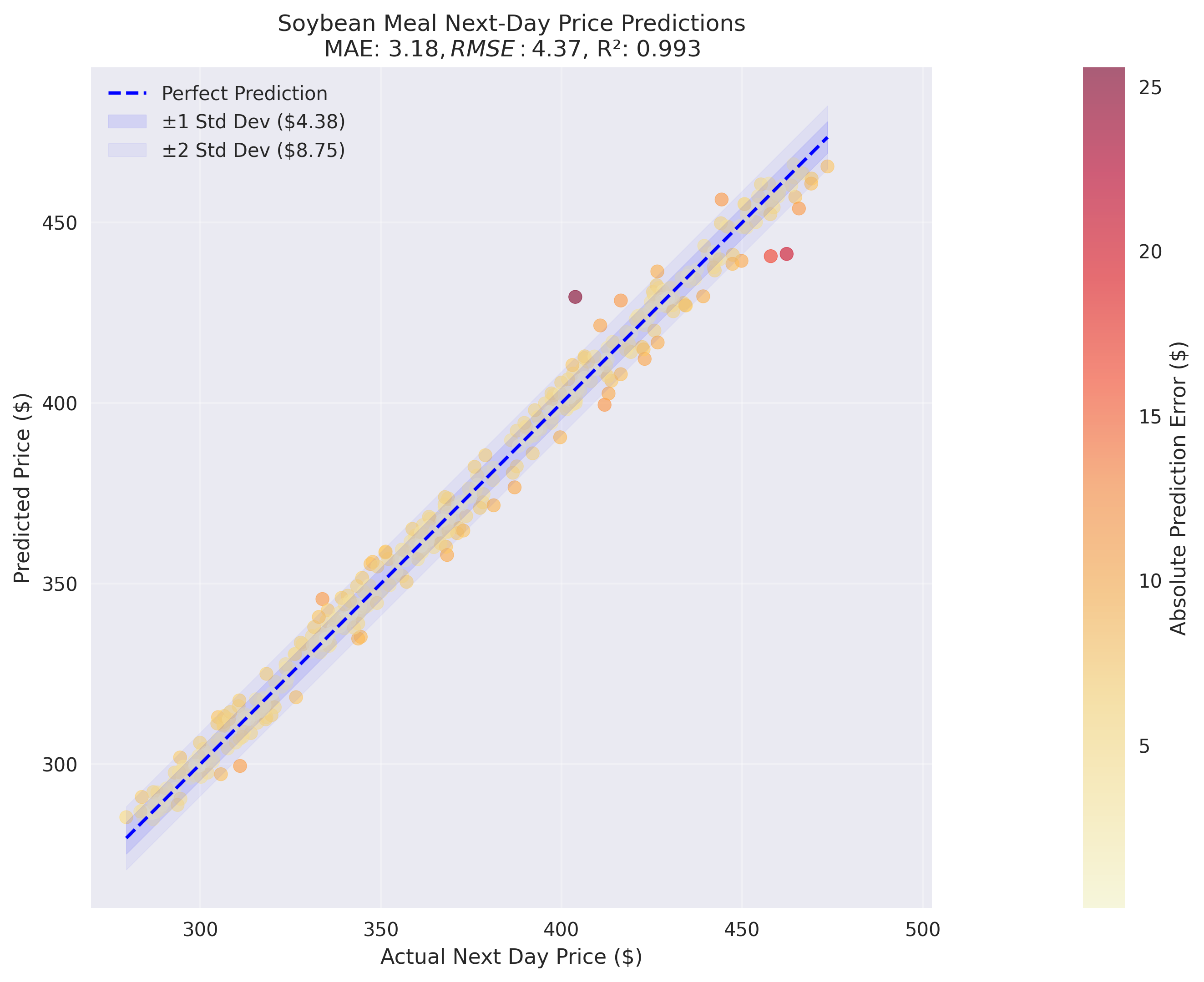

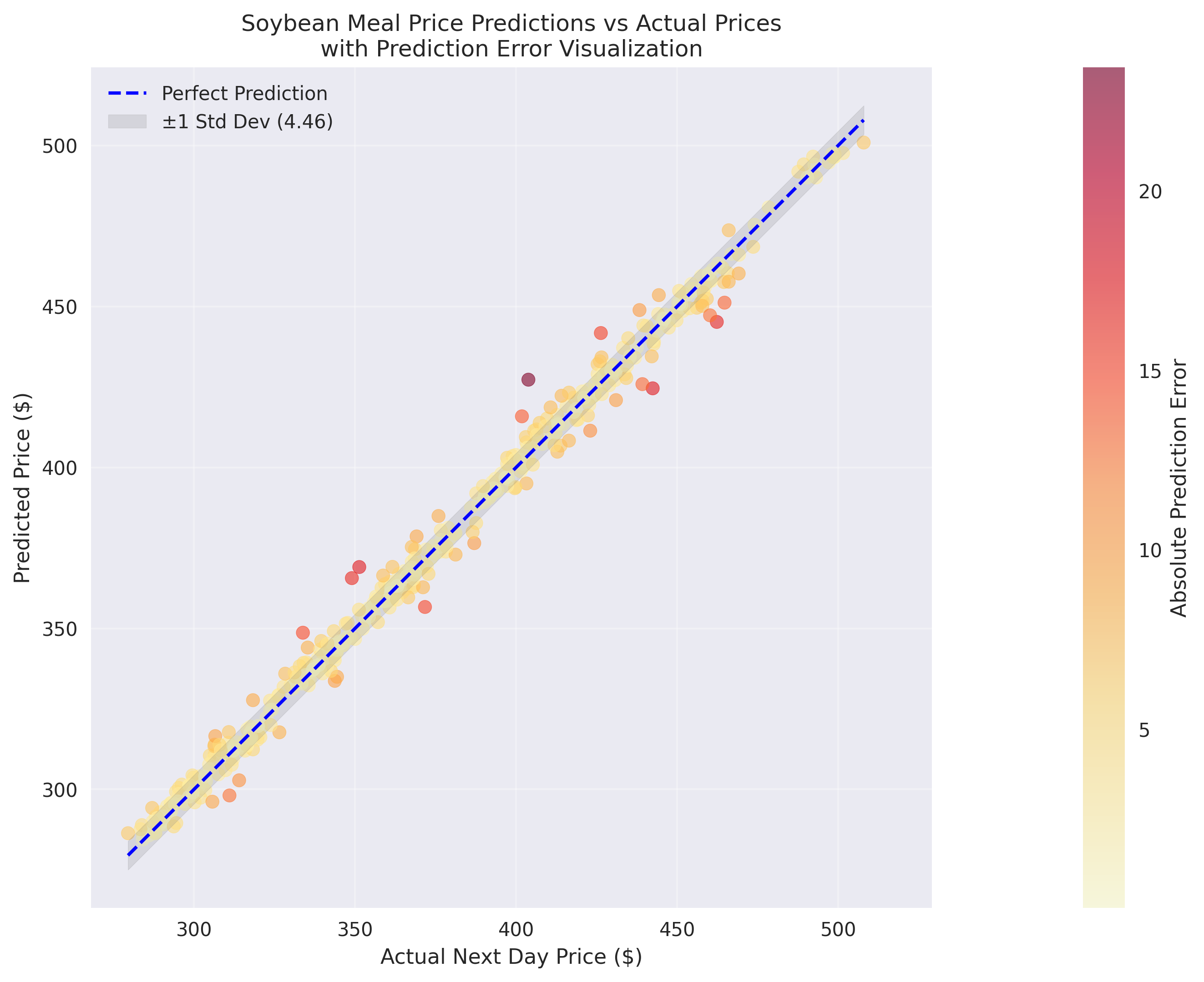

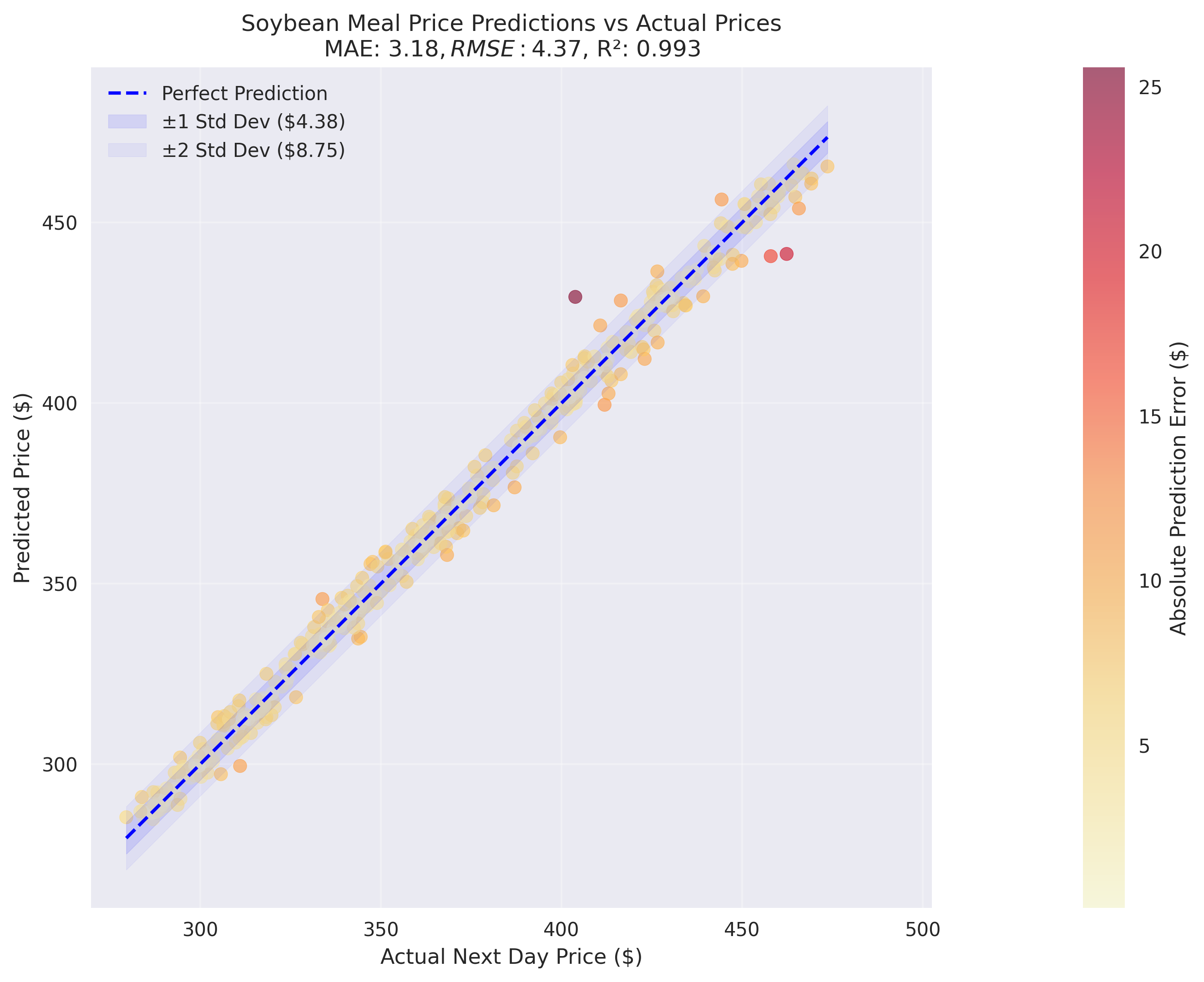

Next-Day Price Predictions Show Exceptional Accuracy

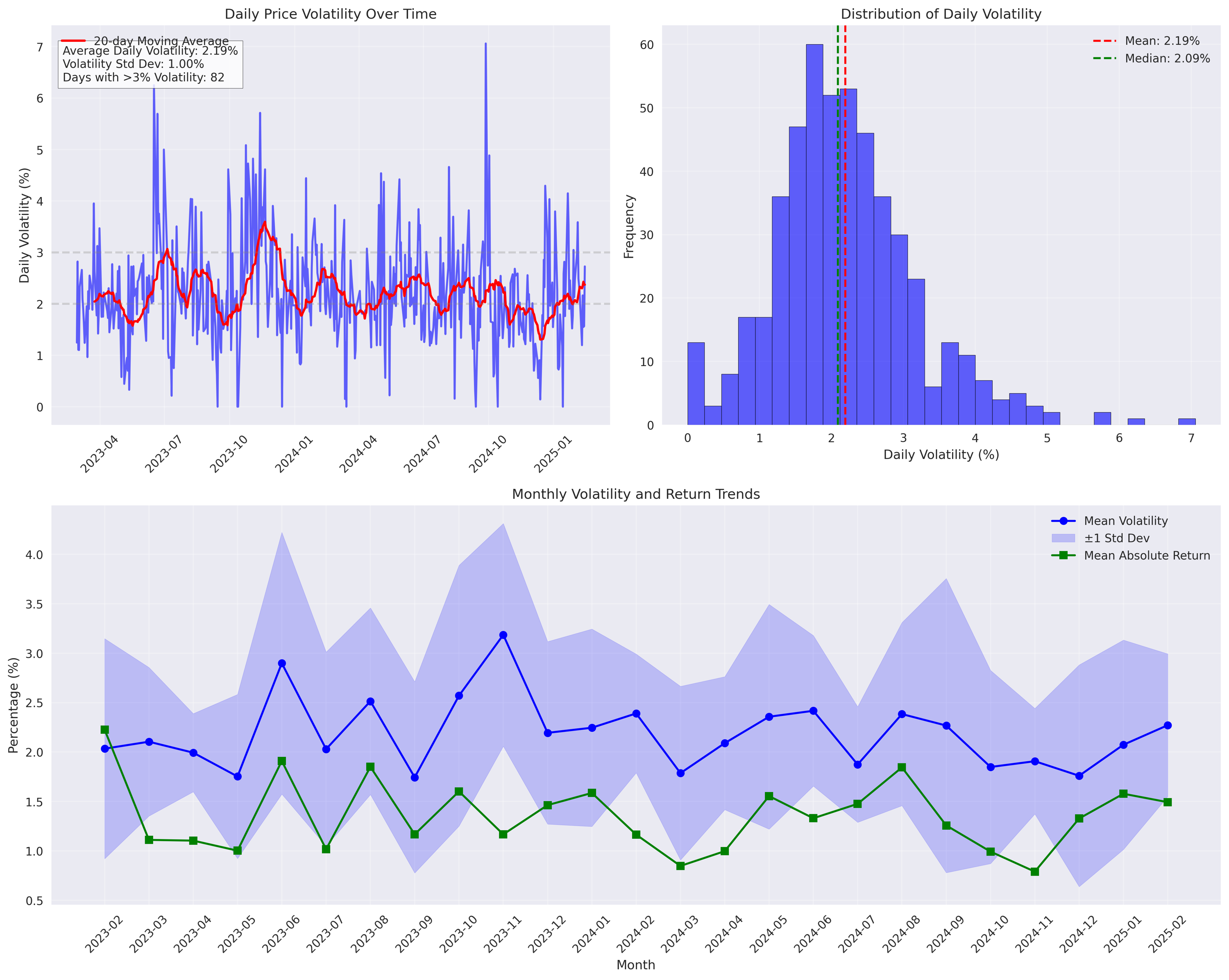

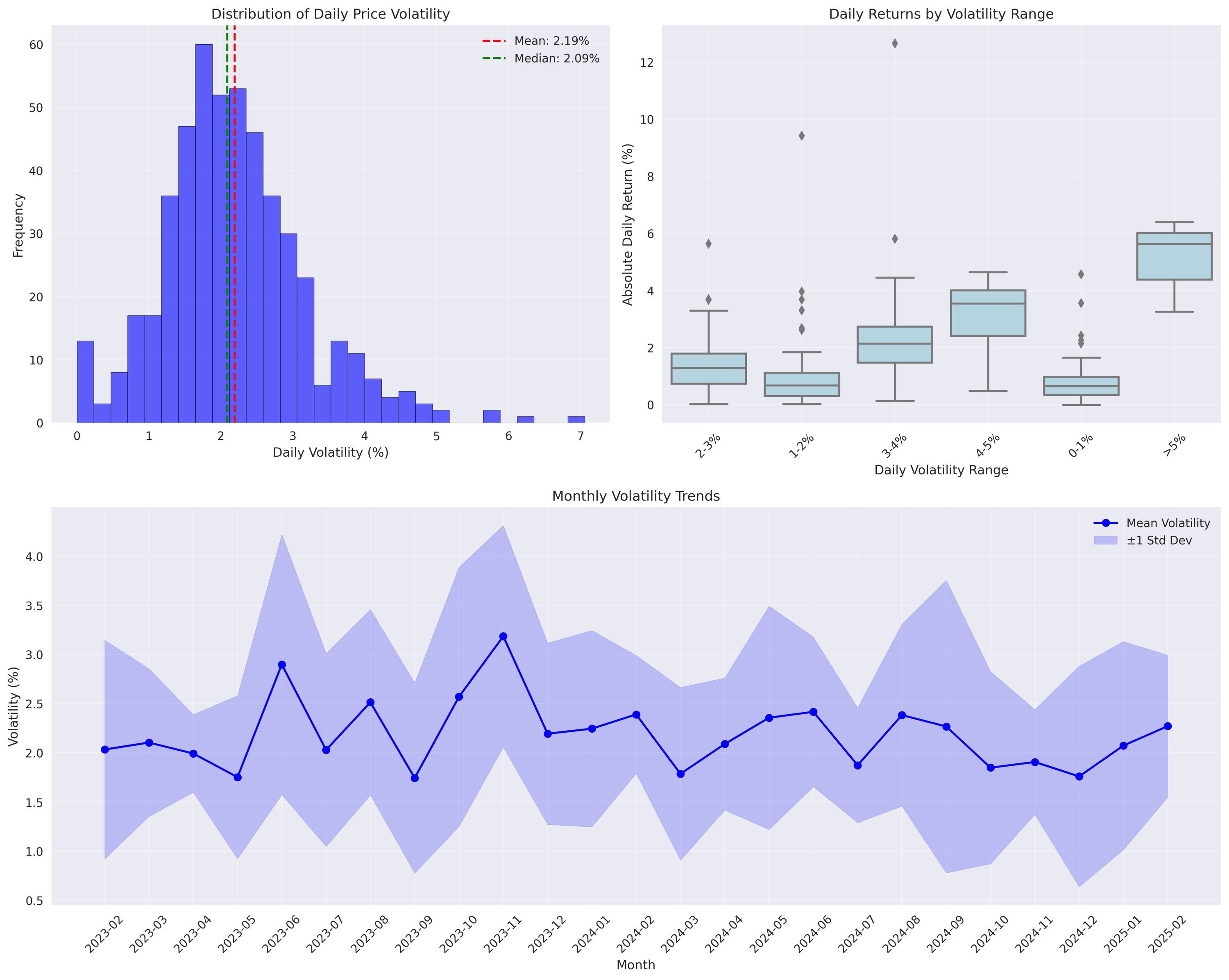

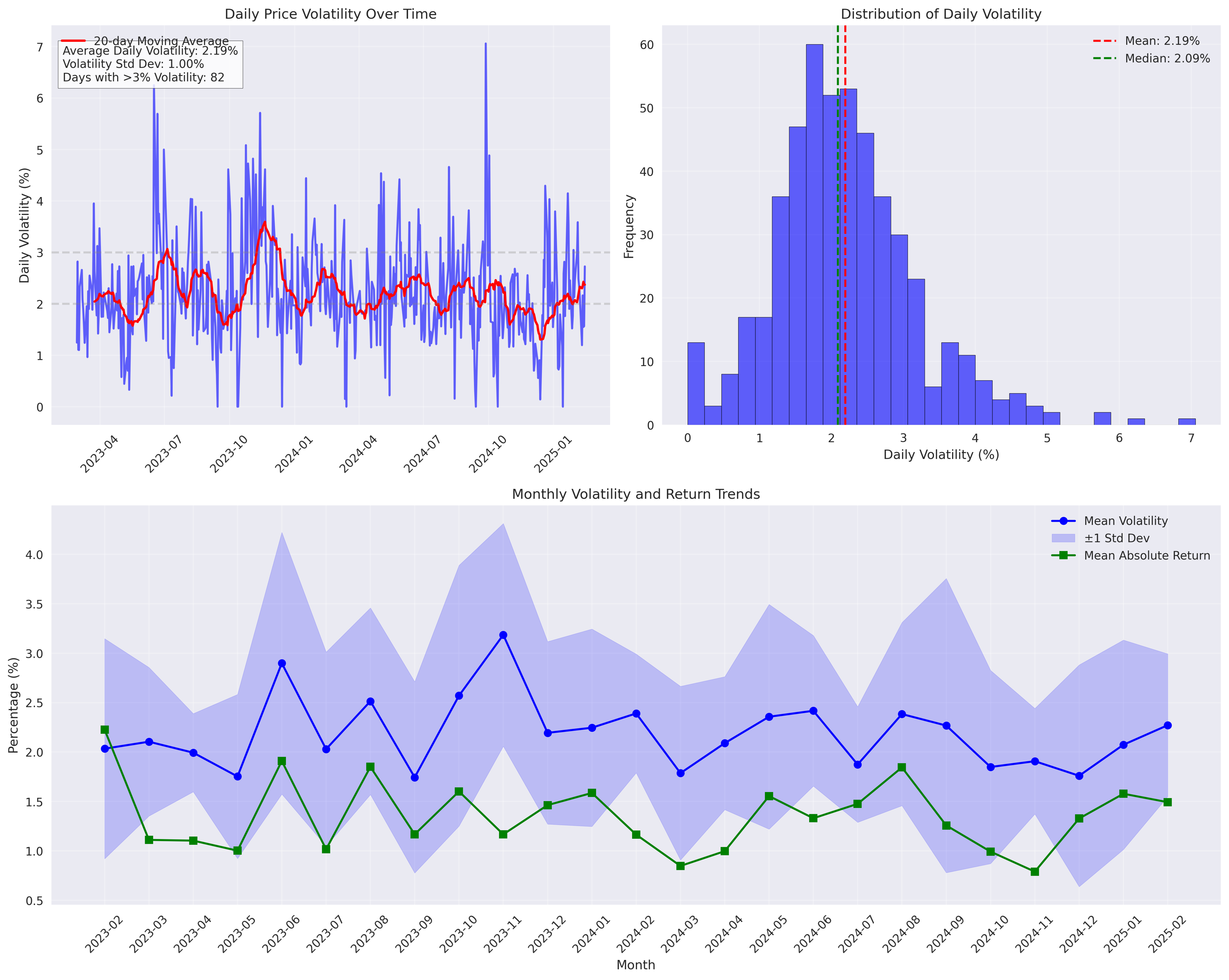

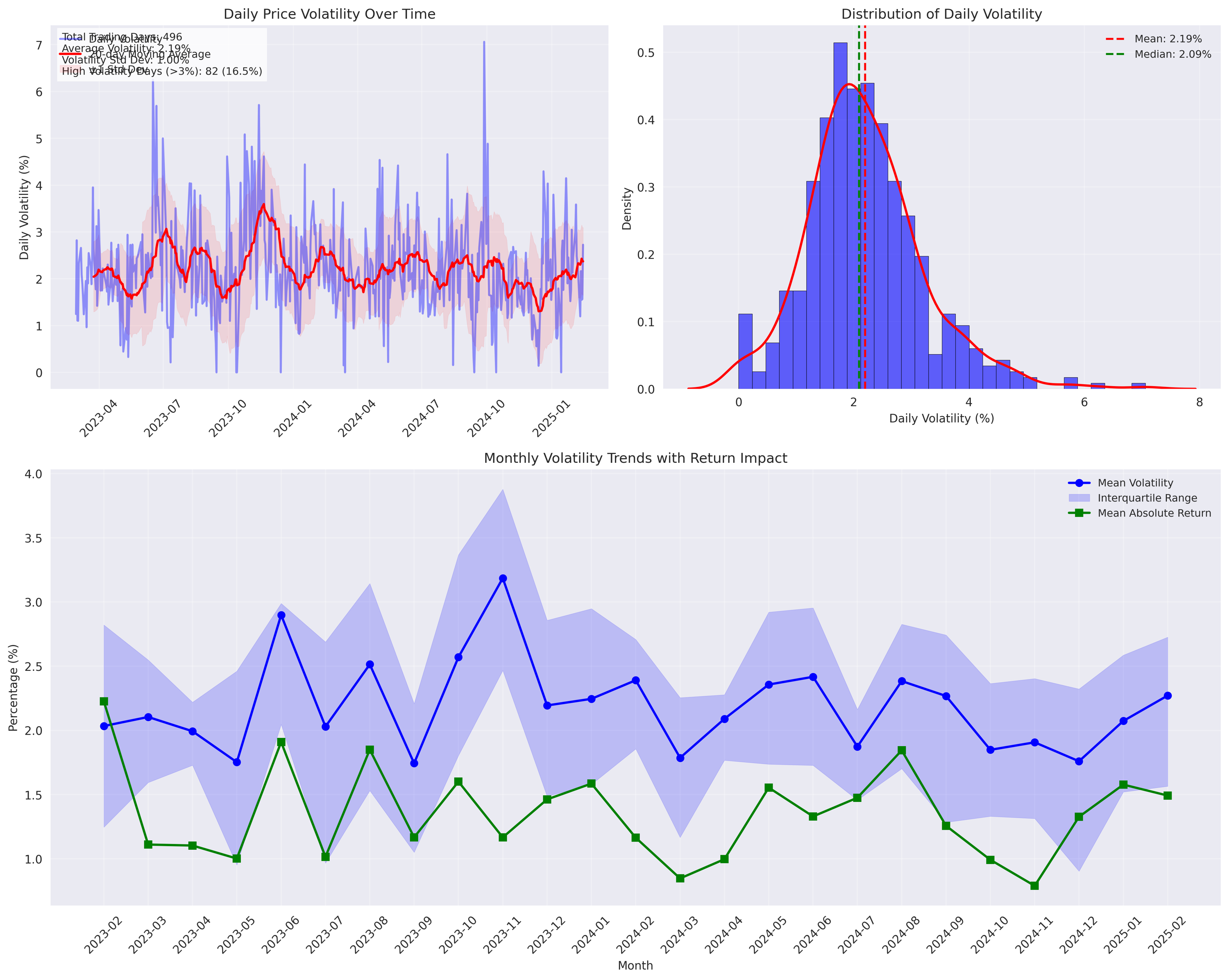

Volatility Creates High-Probability Trading Opportunities

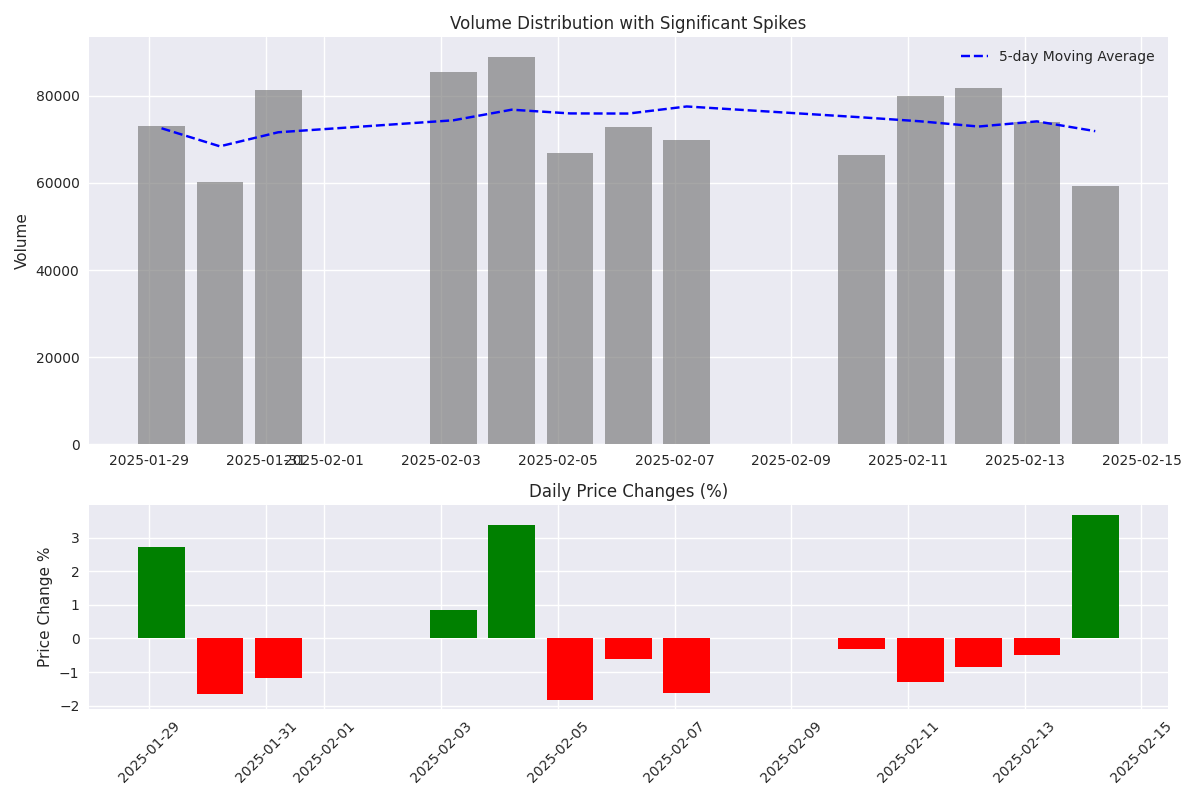

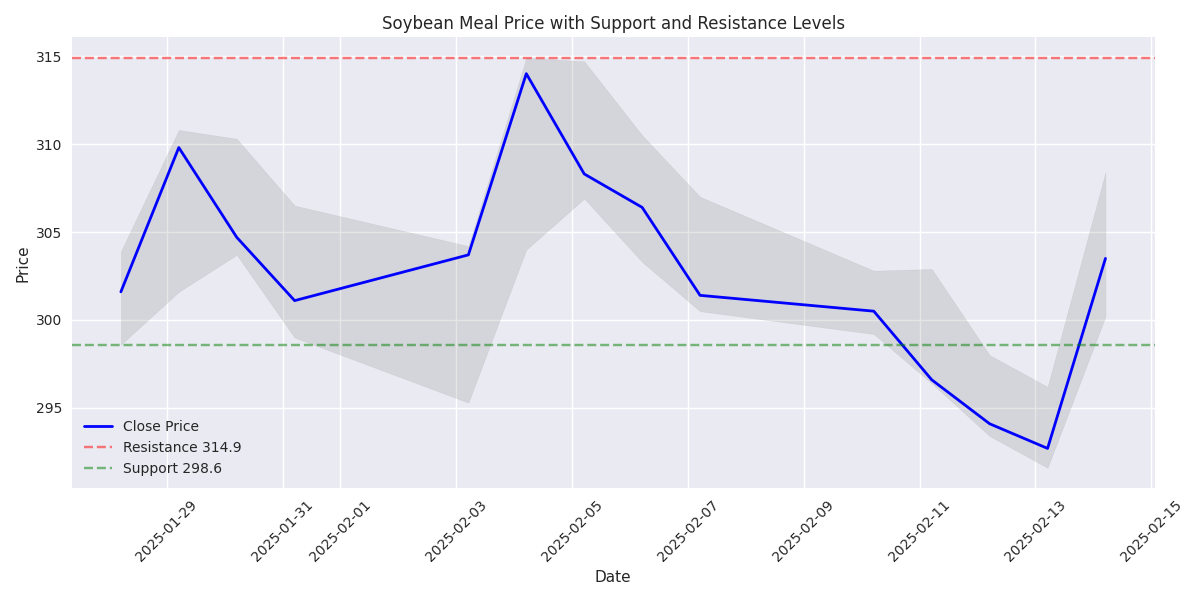

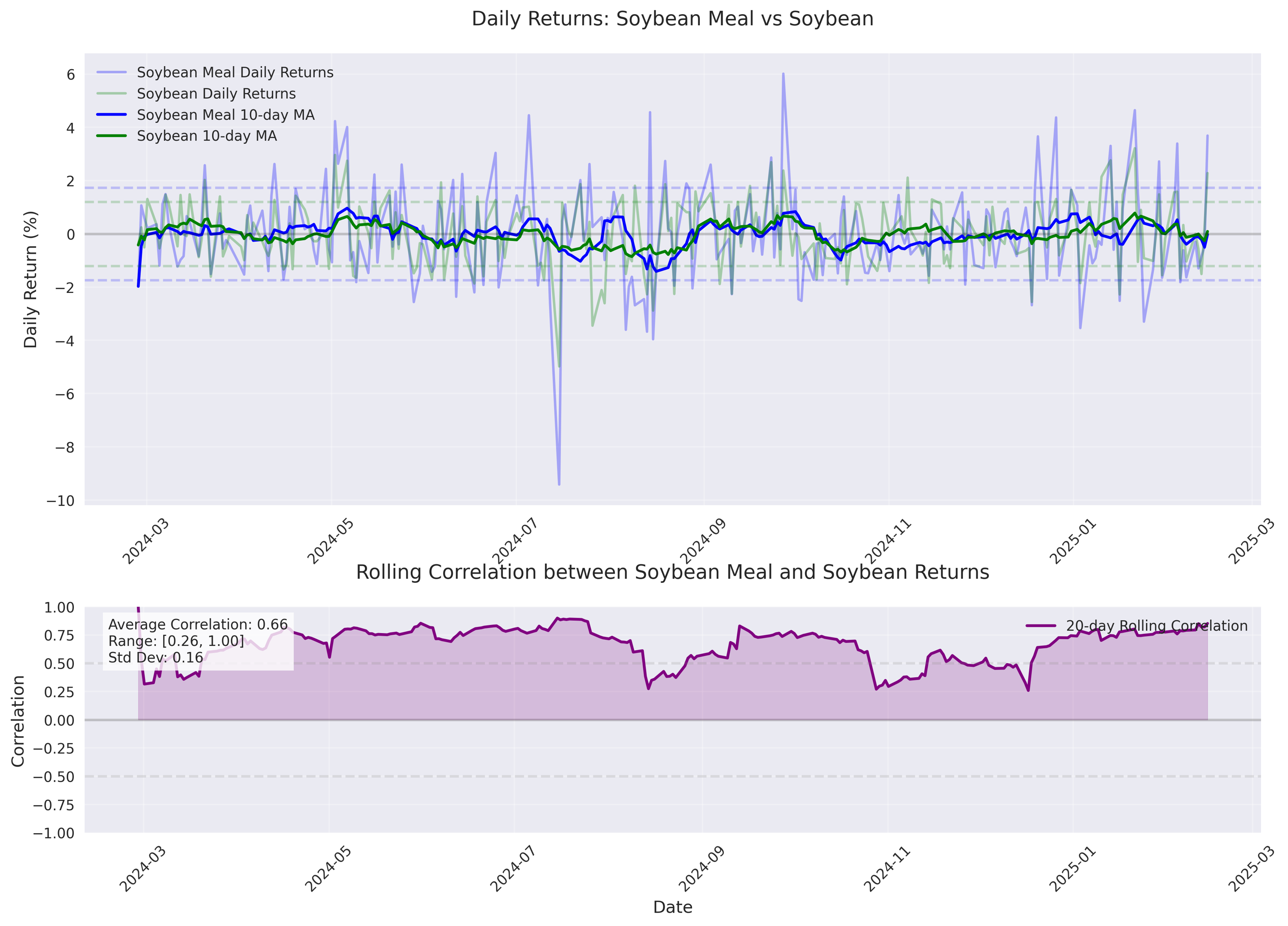

Recent Soybean Meal Price Analysis Shows Mixed Momentum with Bearish Trend

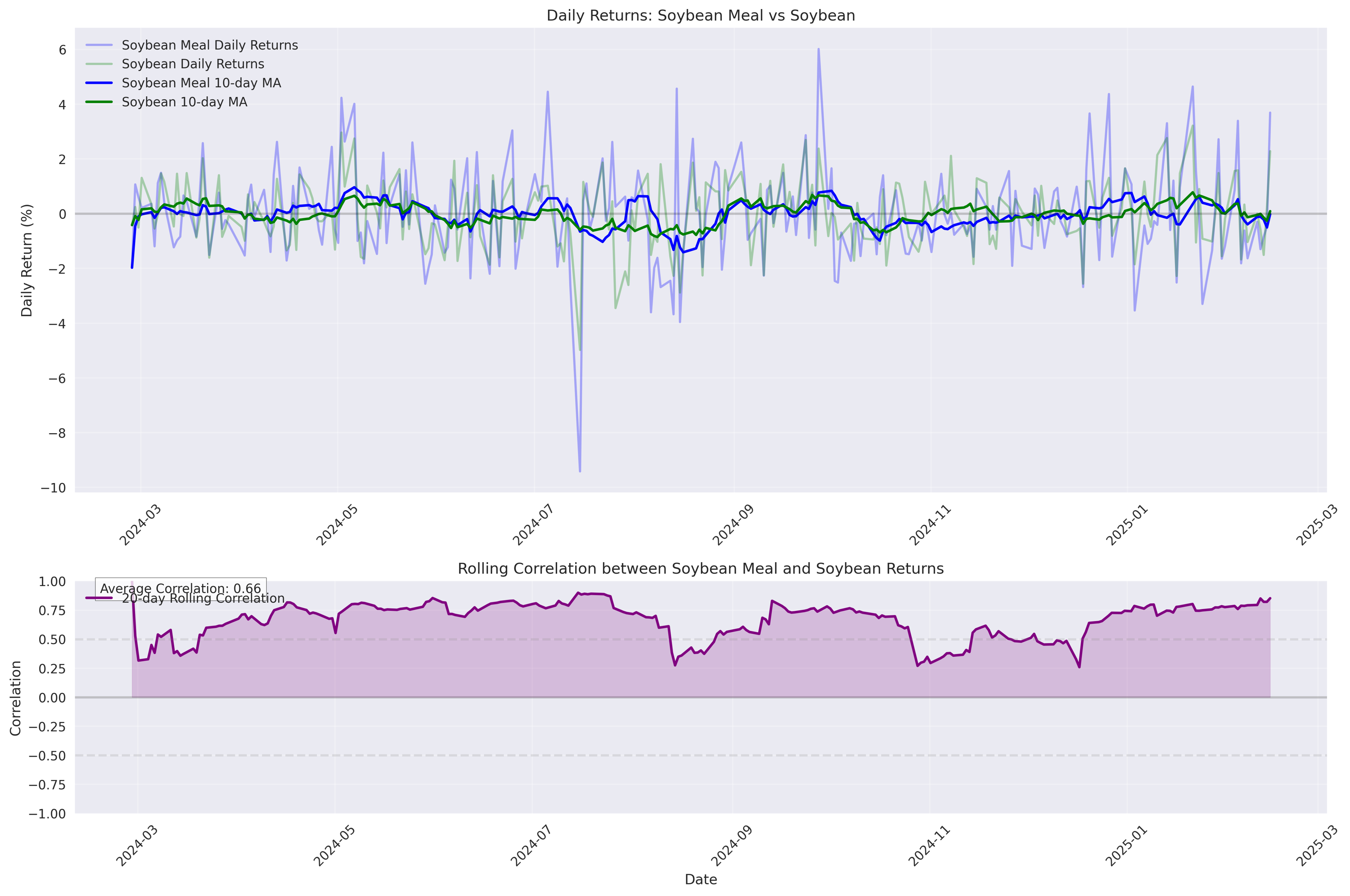

Short-term Soybean Meal Price Prediction Model Performance

Soybean Meal Price Prediction Analysis and Risk Assessment

Advanced Price Movement Analysis and Risk Assessment