Ethereum's Market Pulse: Traders' Quick Guide to Price Movements and Hidden Opportunities

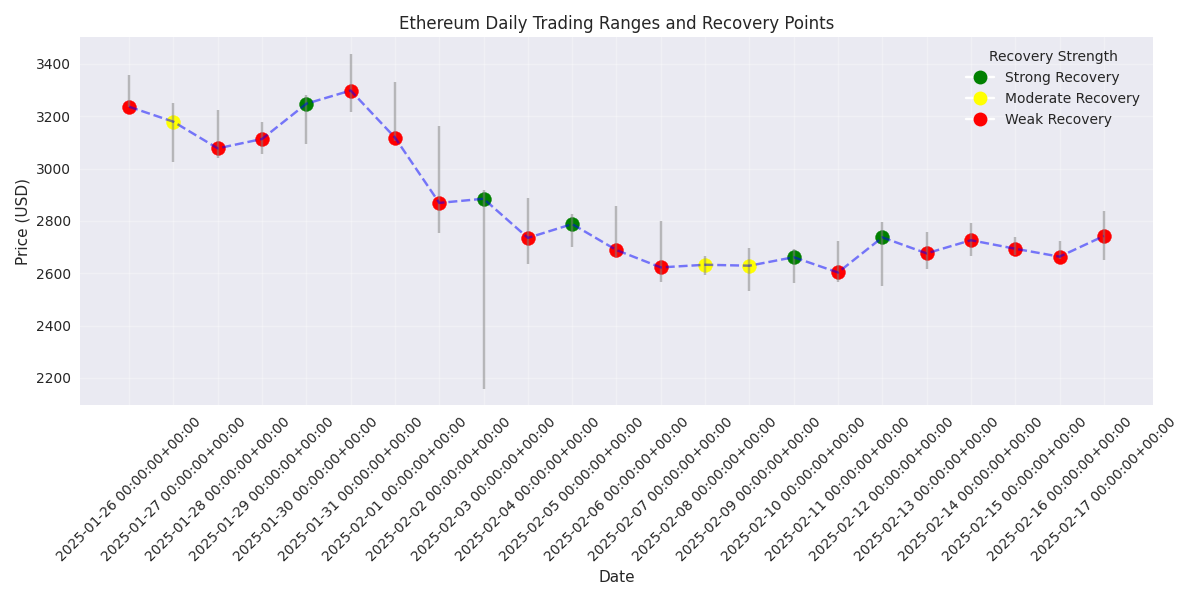

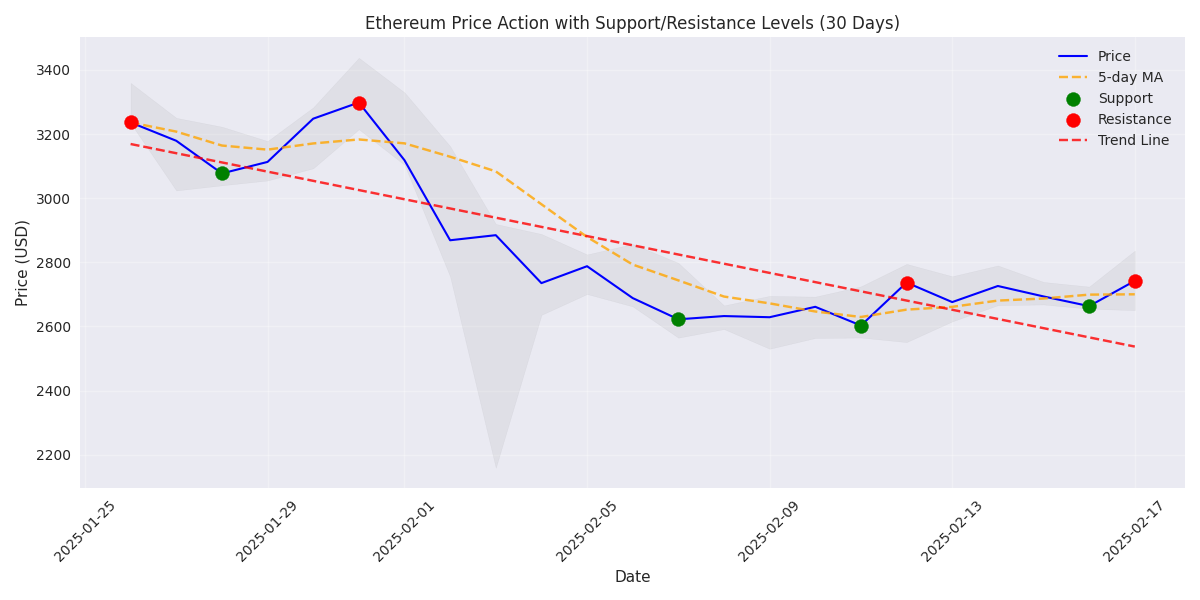

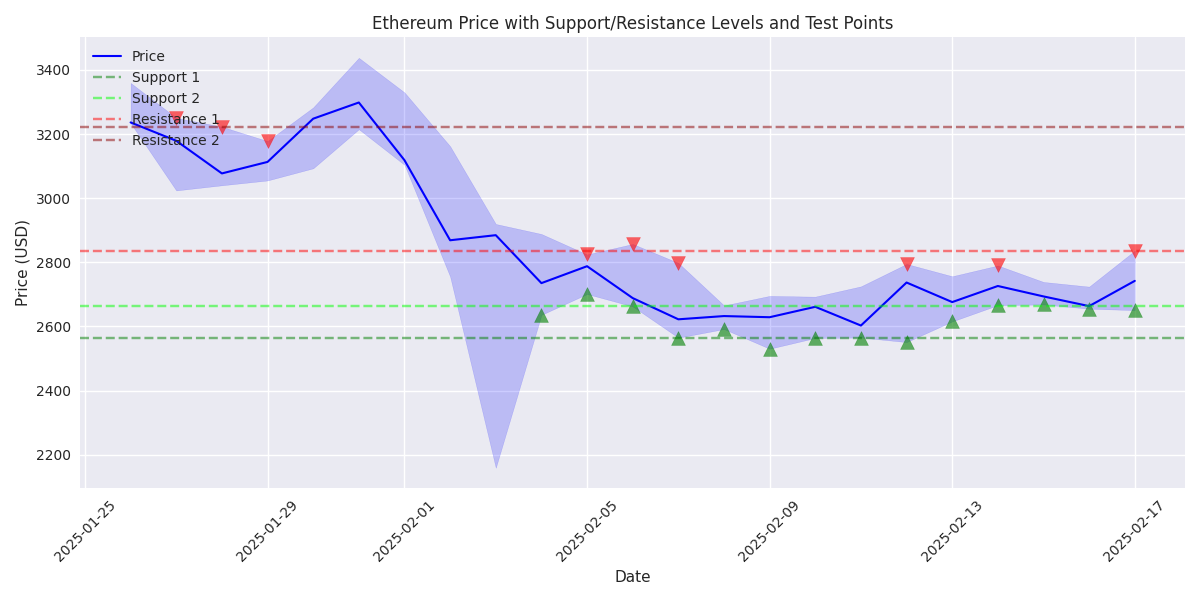

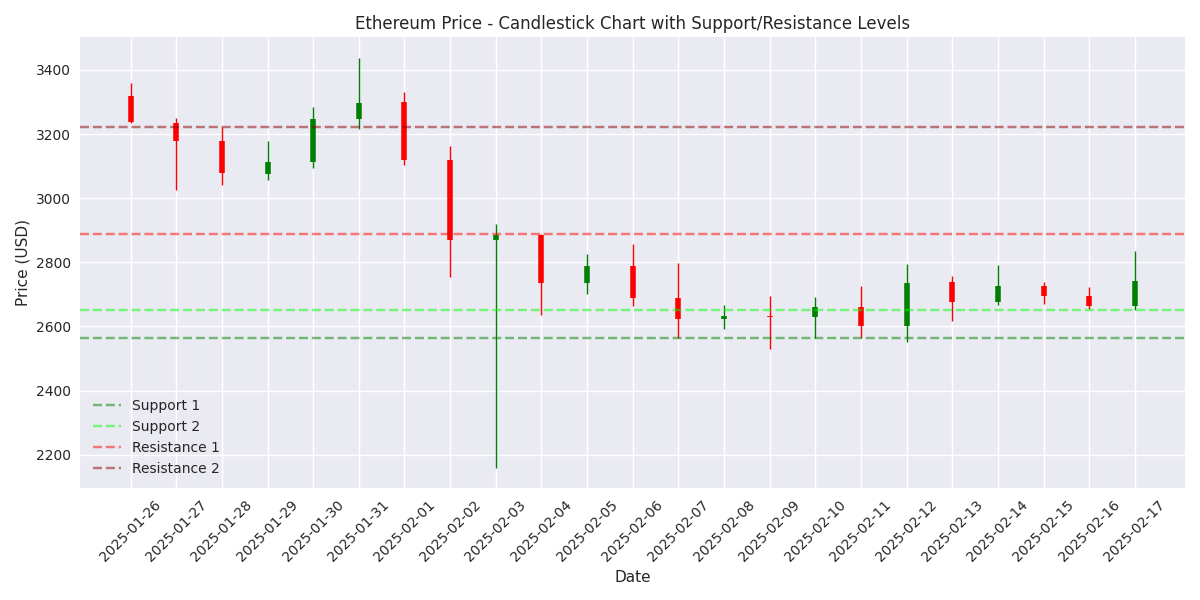

Ethereum Forms Double Bottom at $2,600 After 17% Drop

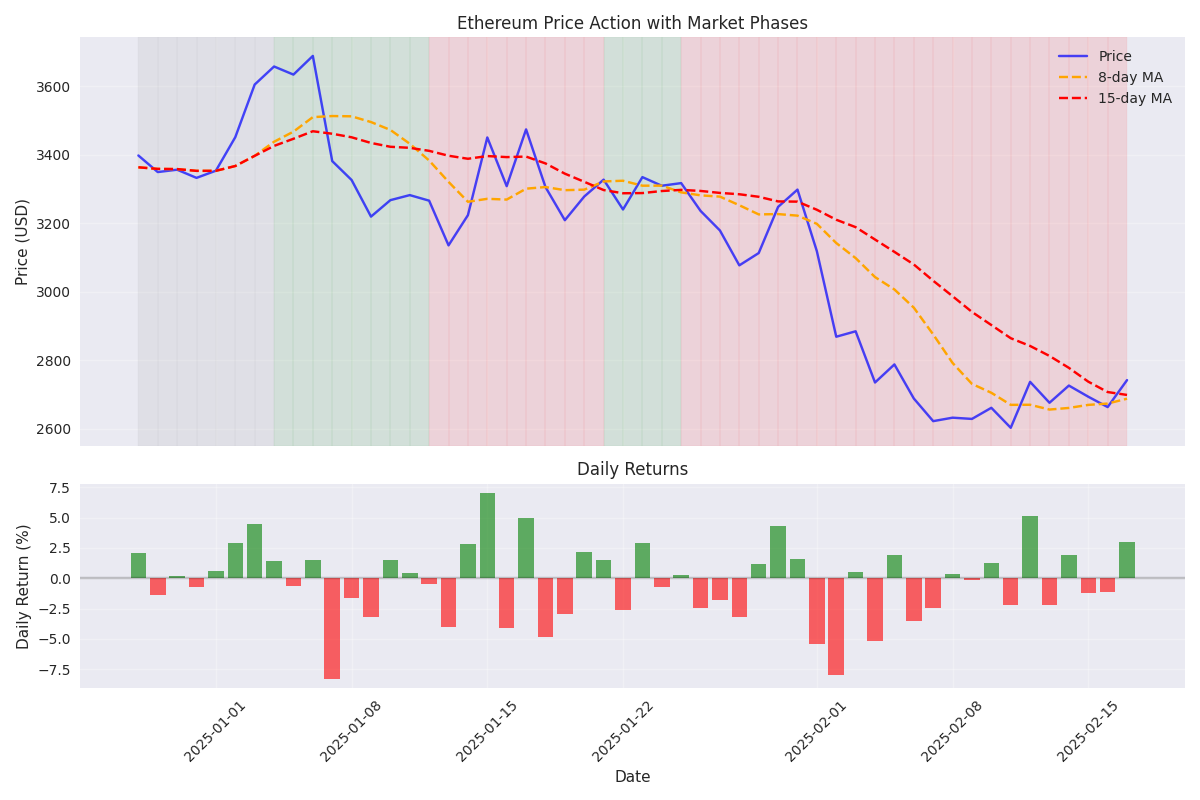

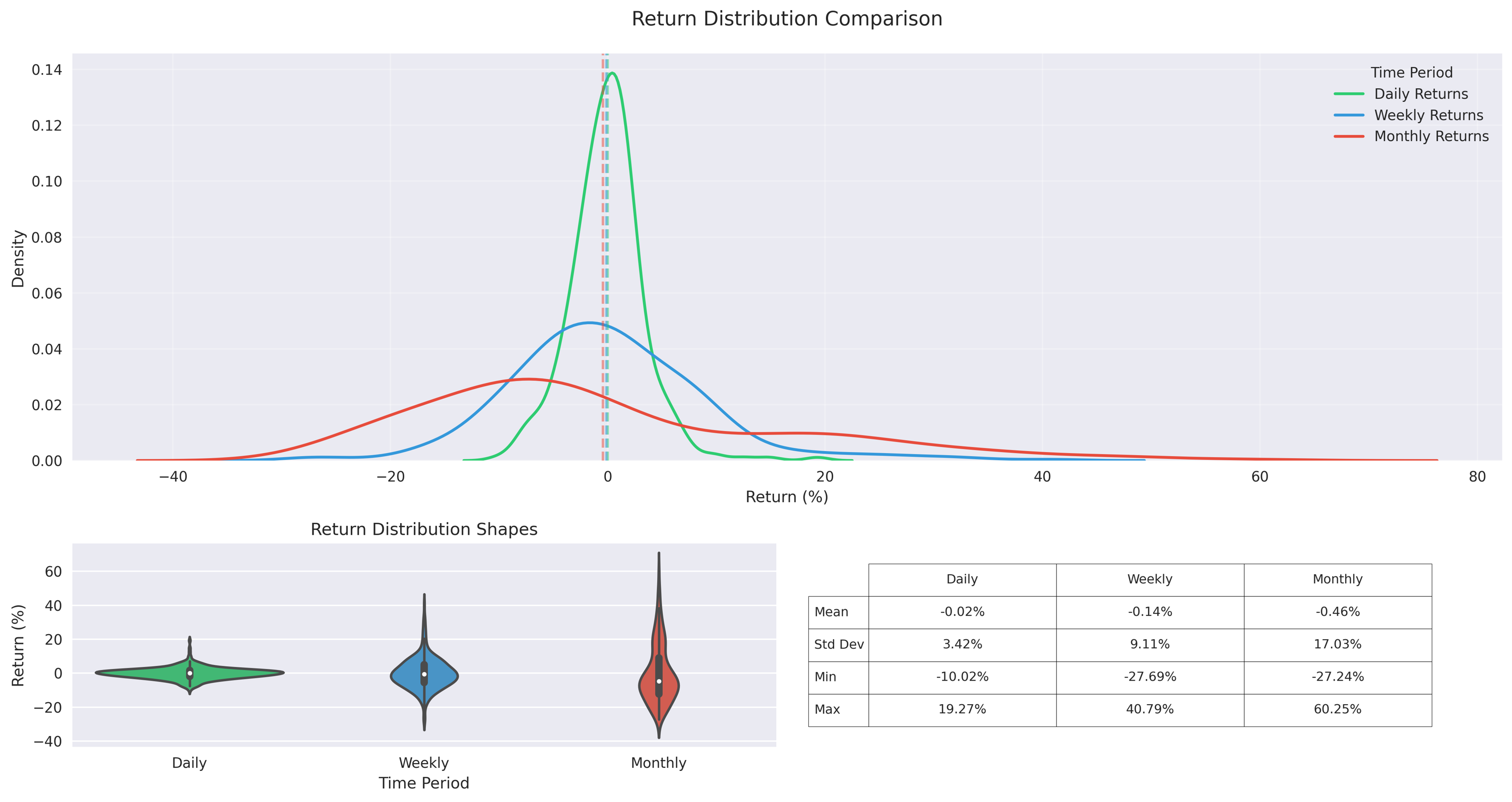

Volume Analysis Suggests Active Accumulation Phase

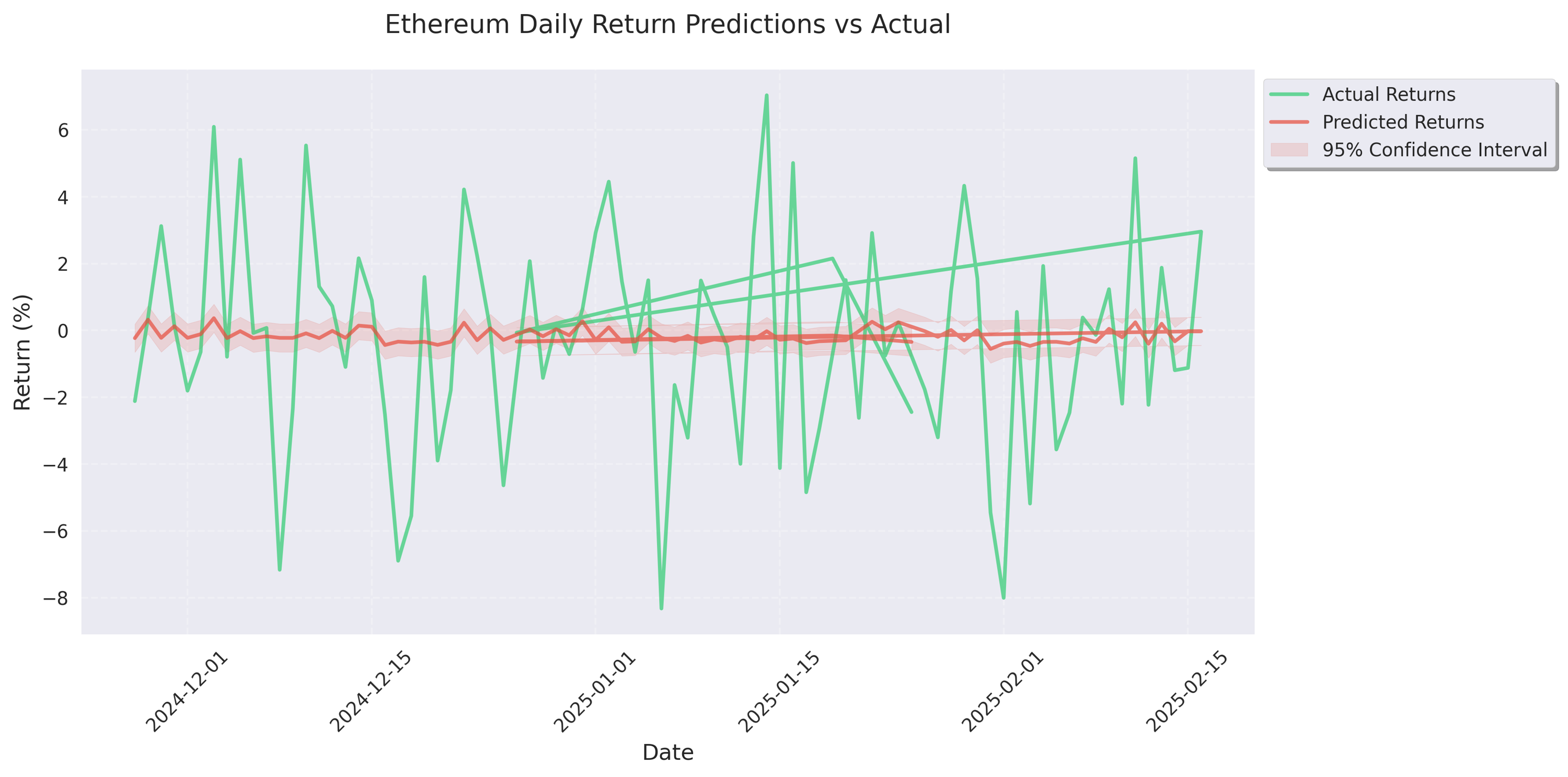

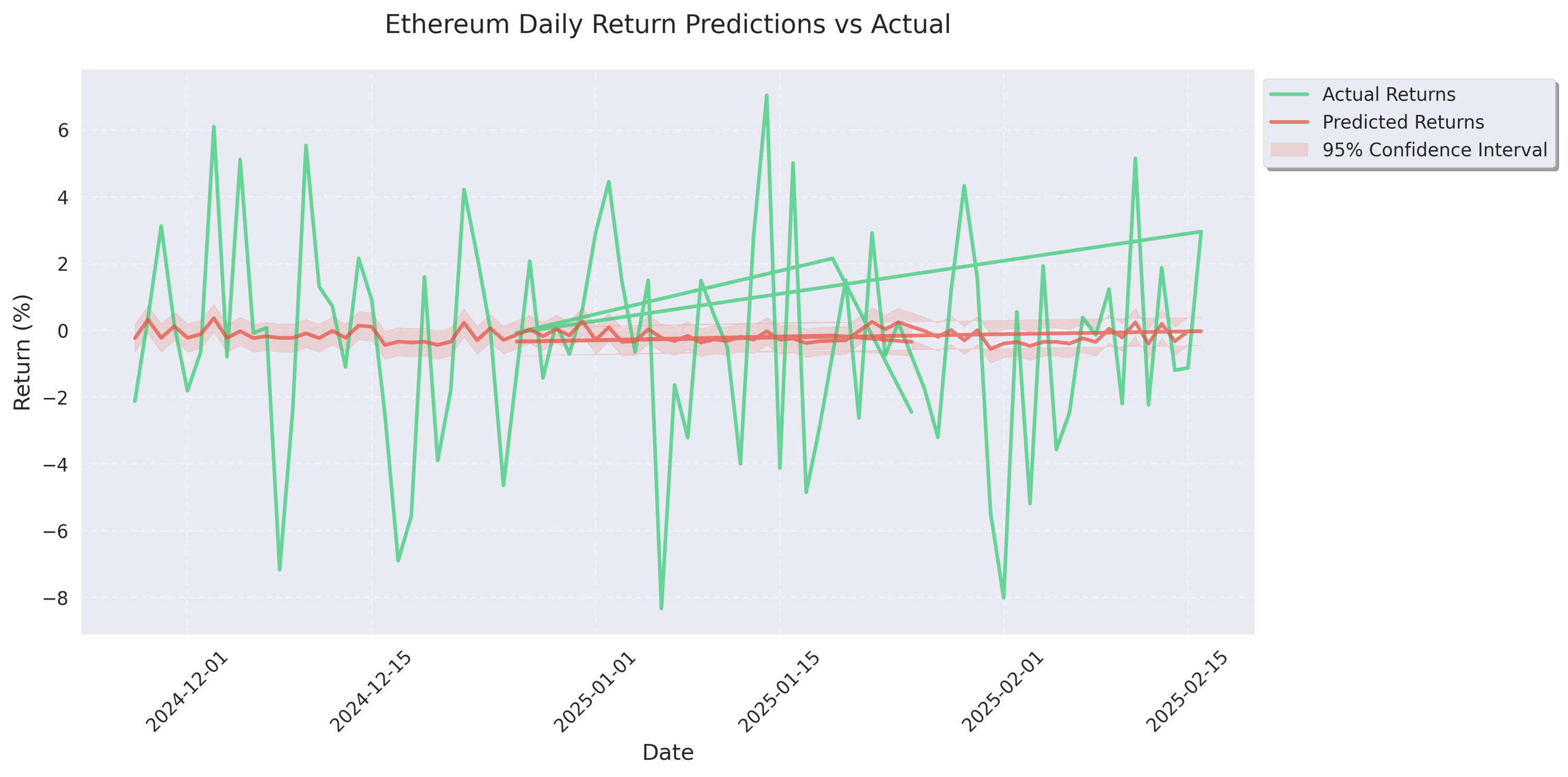

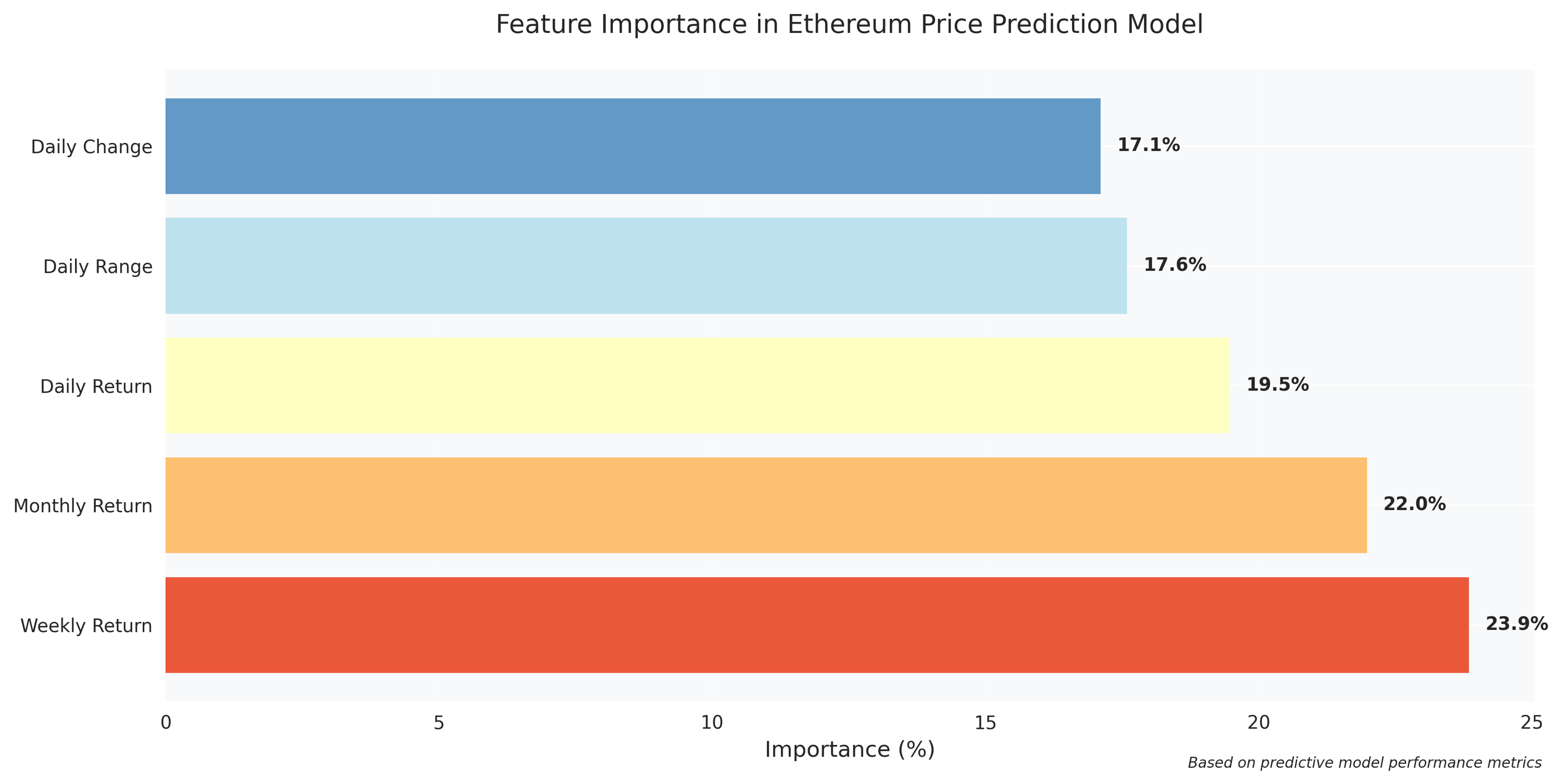

Trading Models Favor Short-Term Positions

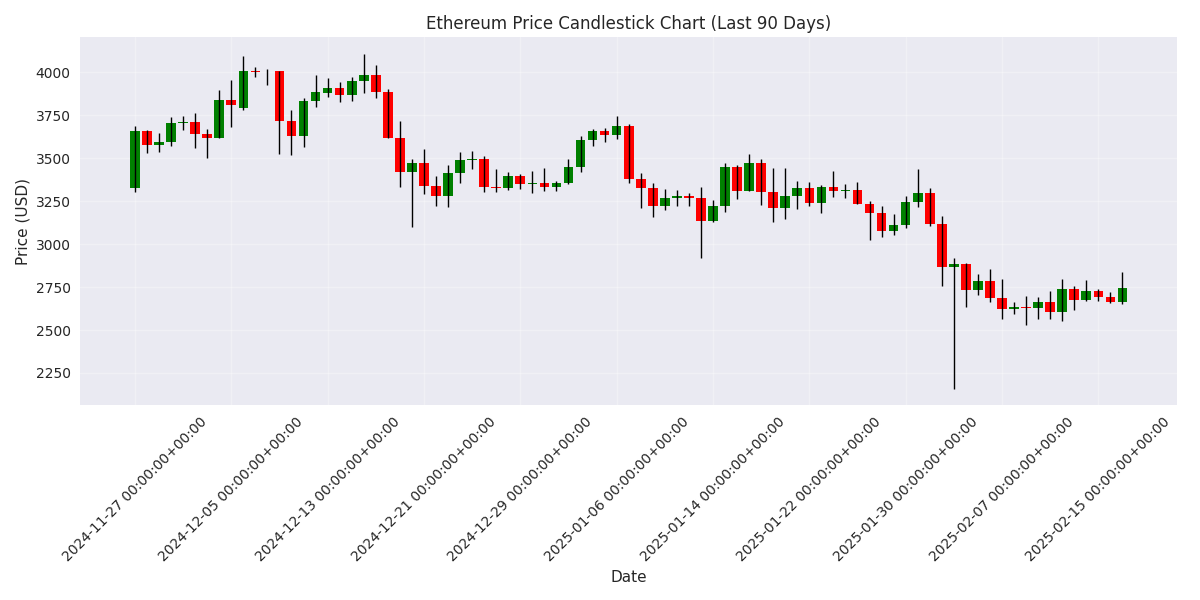

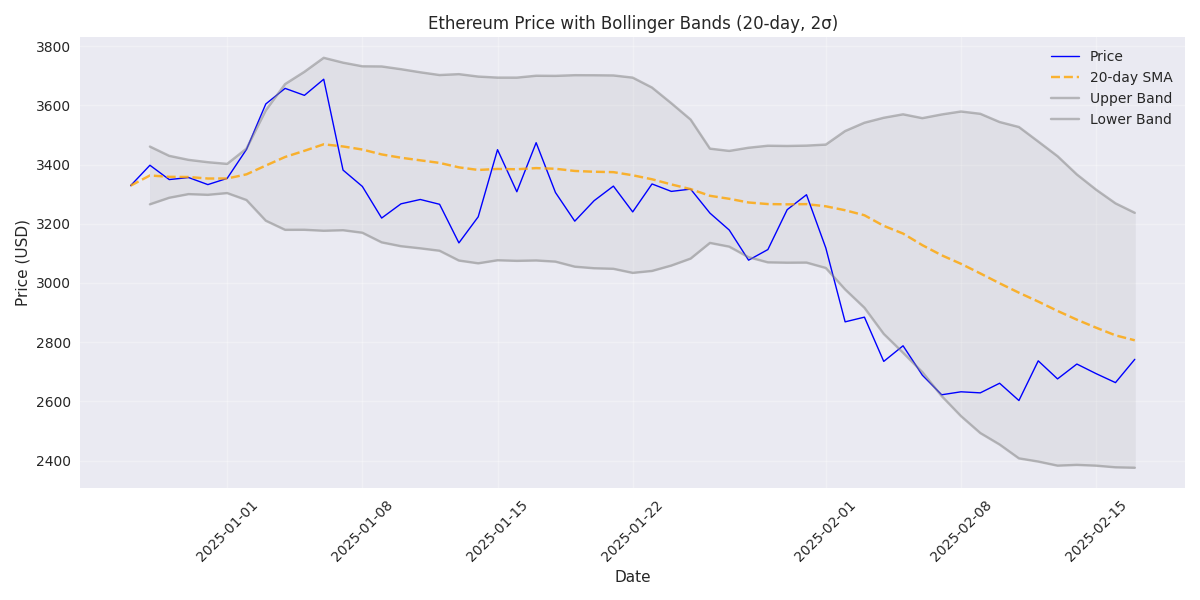

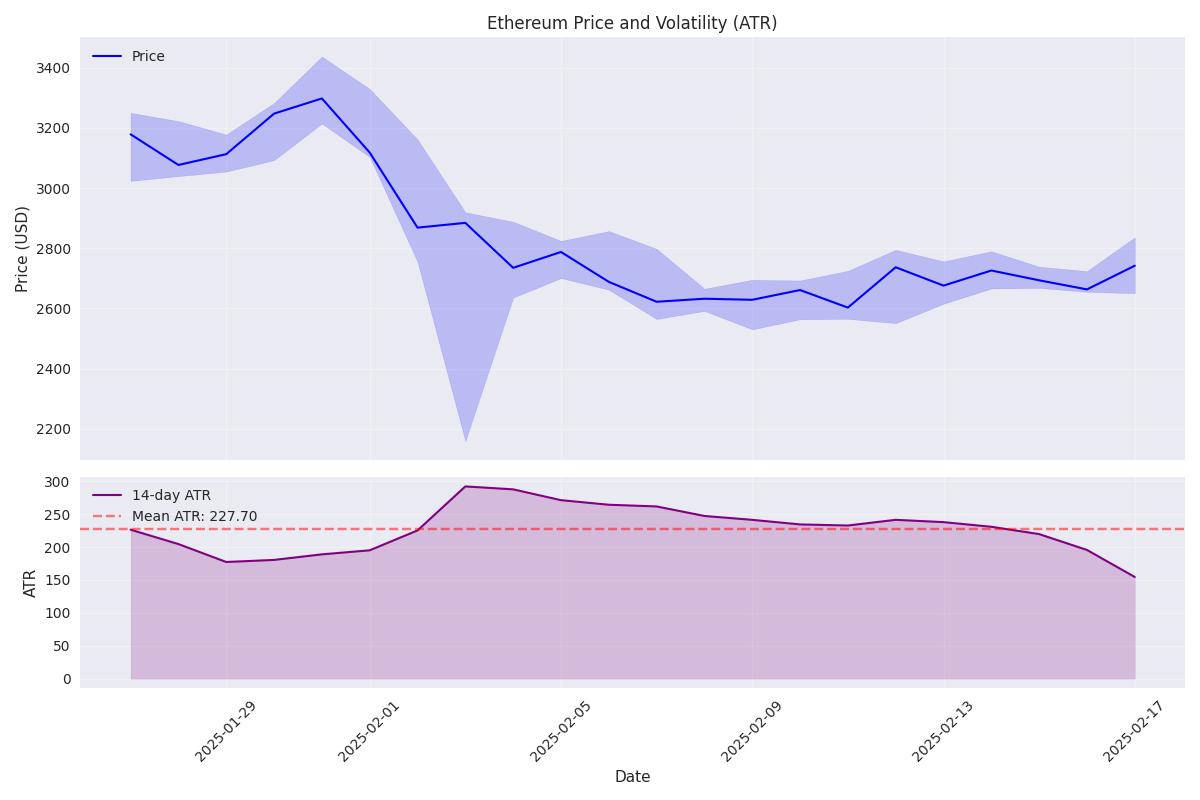

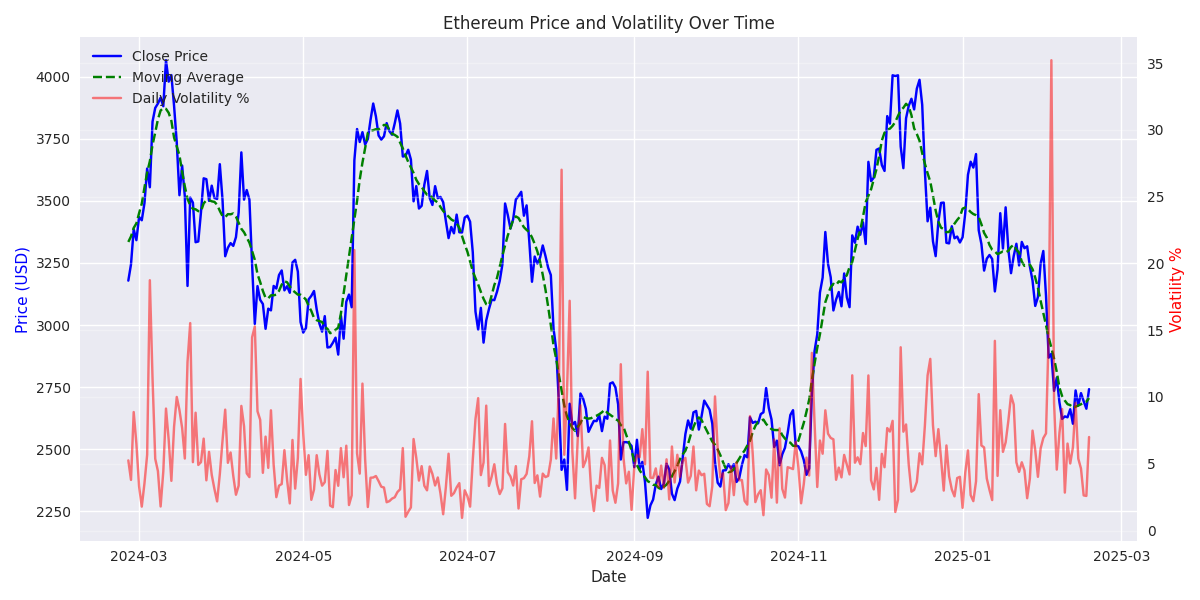

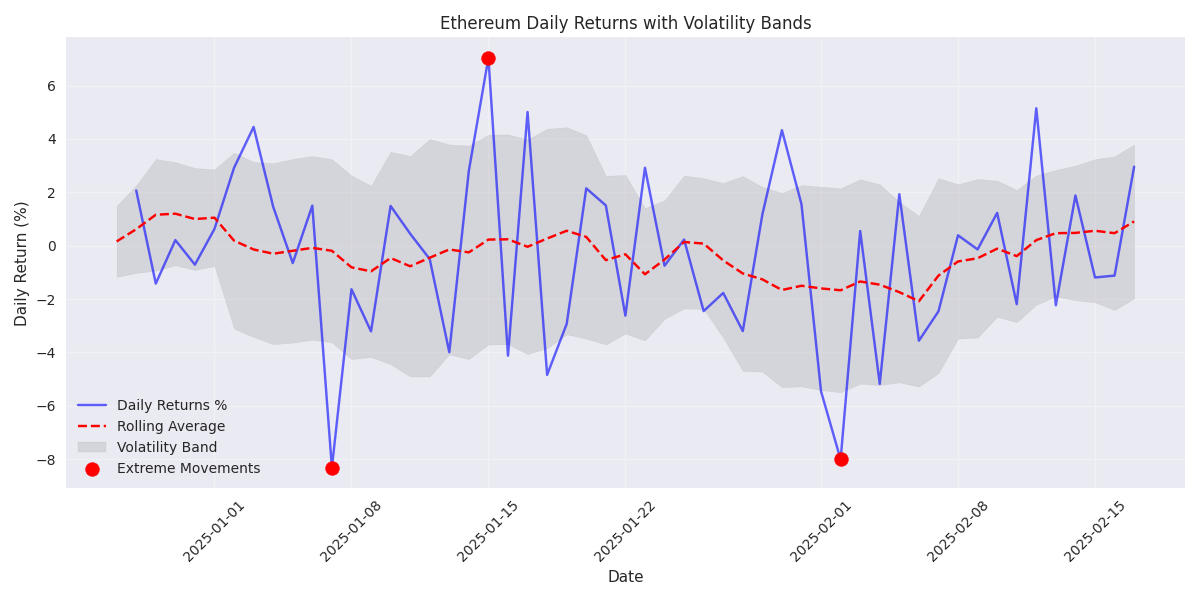

Recent Ethereum Price Analysis Shows High Volatility and Key Support Levels

Recent Ethereum Price Analysis Shows Significant Market Correction and Stabilization

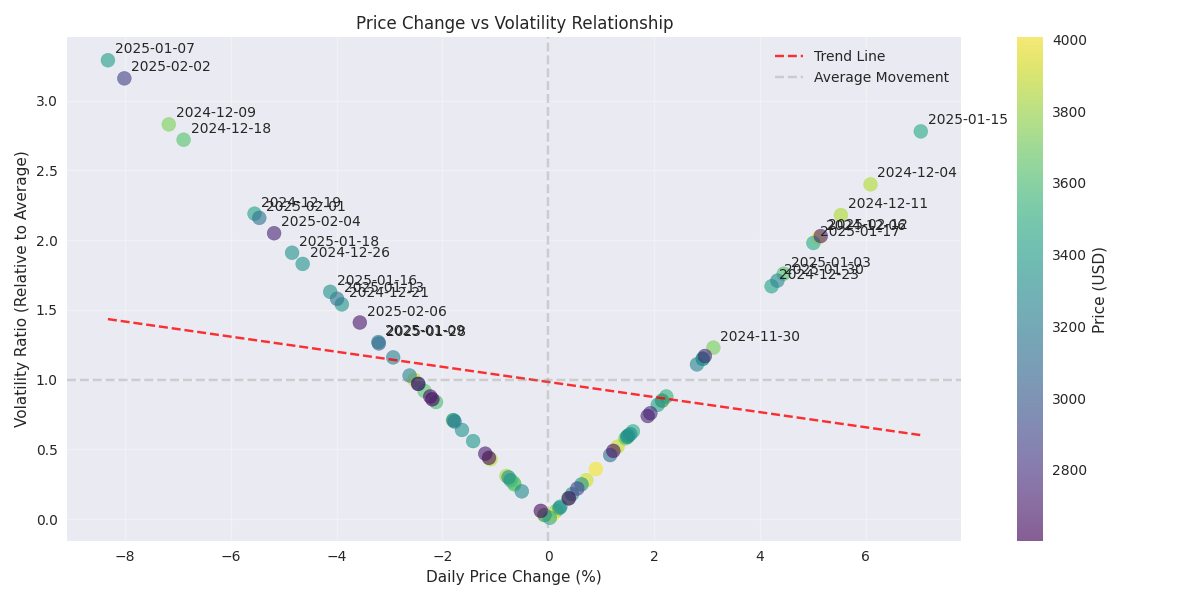

Volume Analysis Reveals Strong Market Participation During Price Movements

Technical Analysis Reveals Significant Market Transition and Support Levels

Initial Ethereum Price Movement Analysis Reveals Key Patterns