Coffee Market Volatility: Traders' Quick Guide to Navigating Rapid Price Shifts

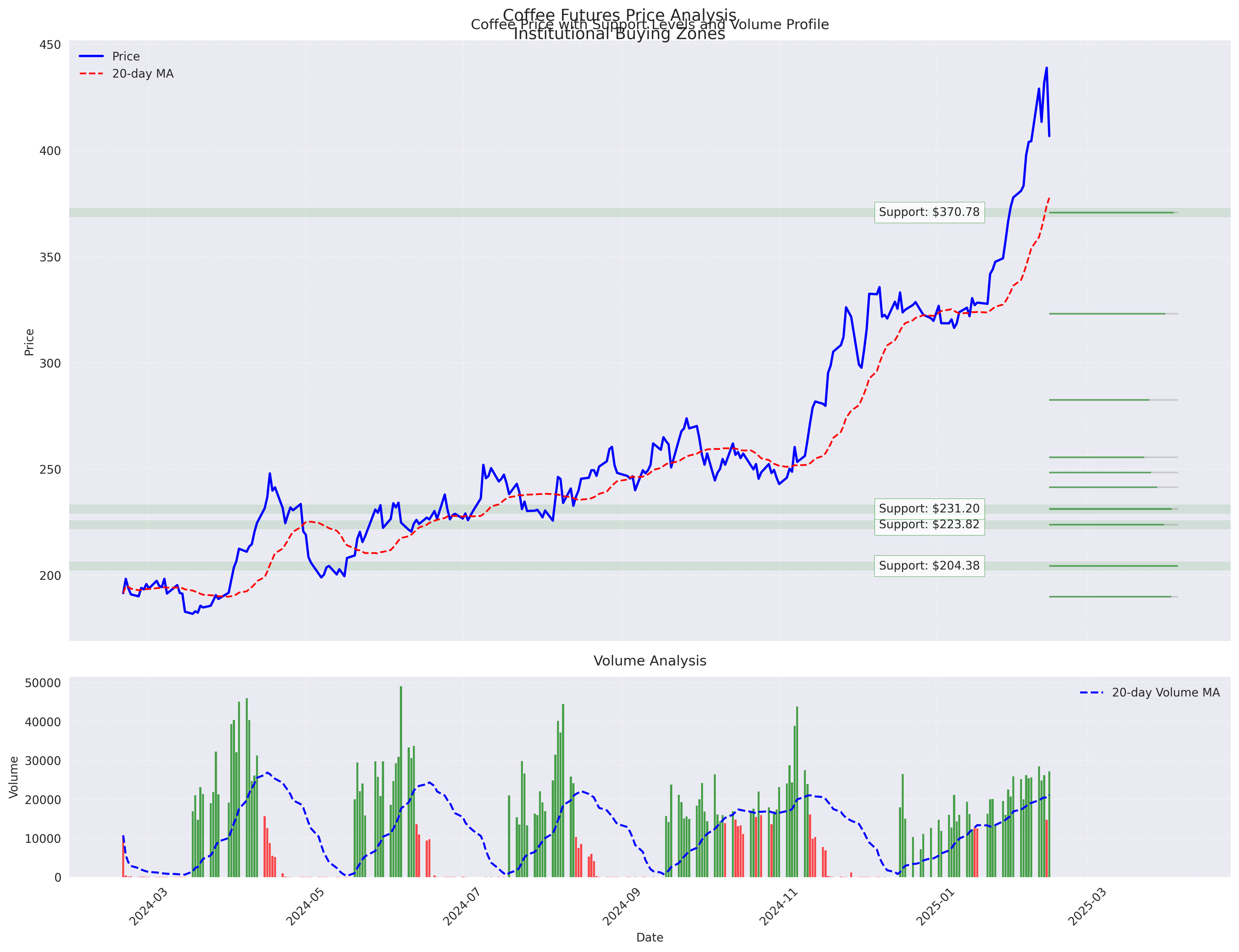

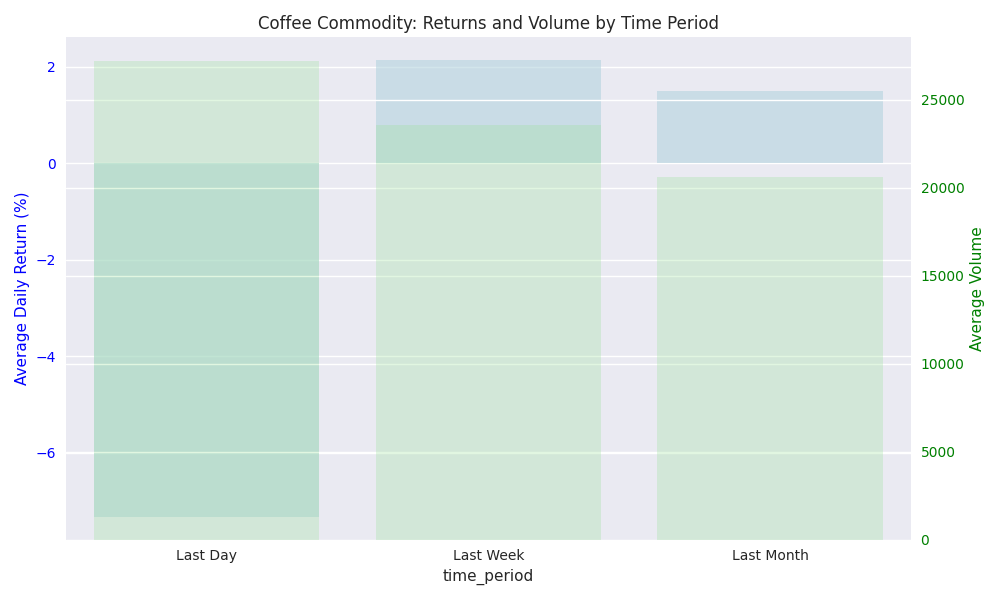

Coffee Market Sees Sharp Reversal but Maintains Bullish Trend

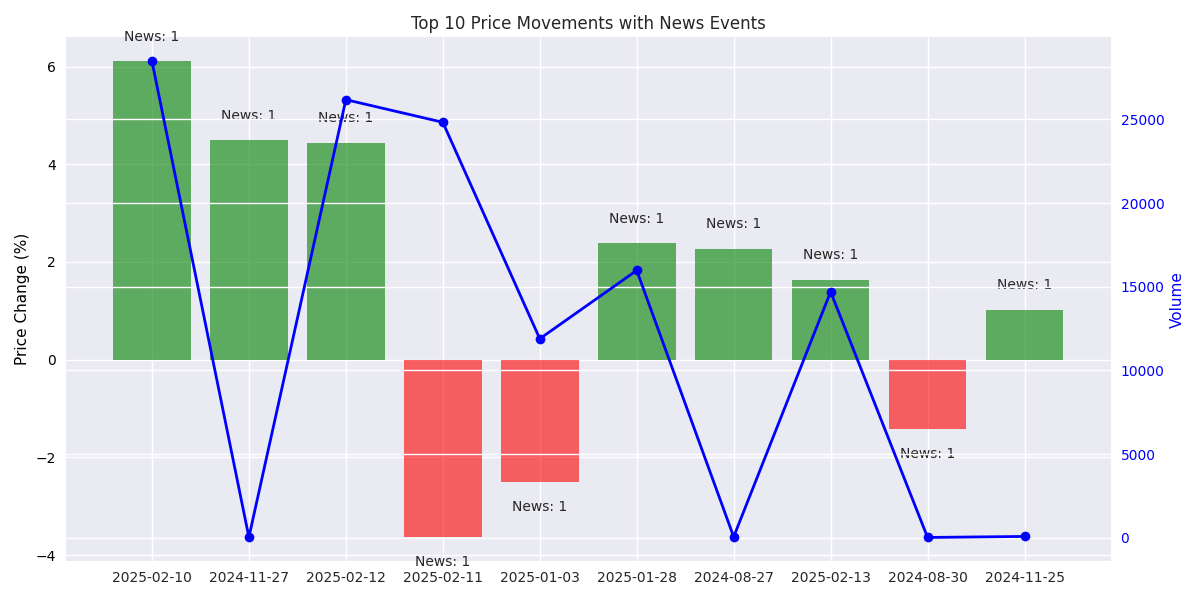

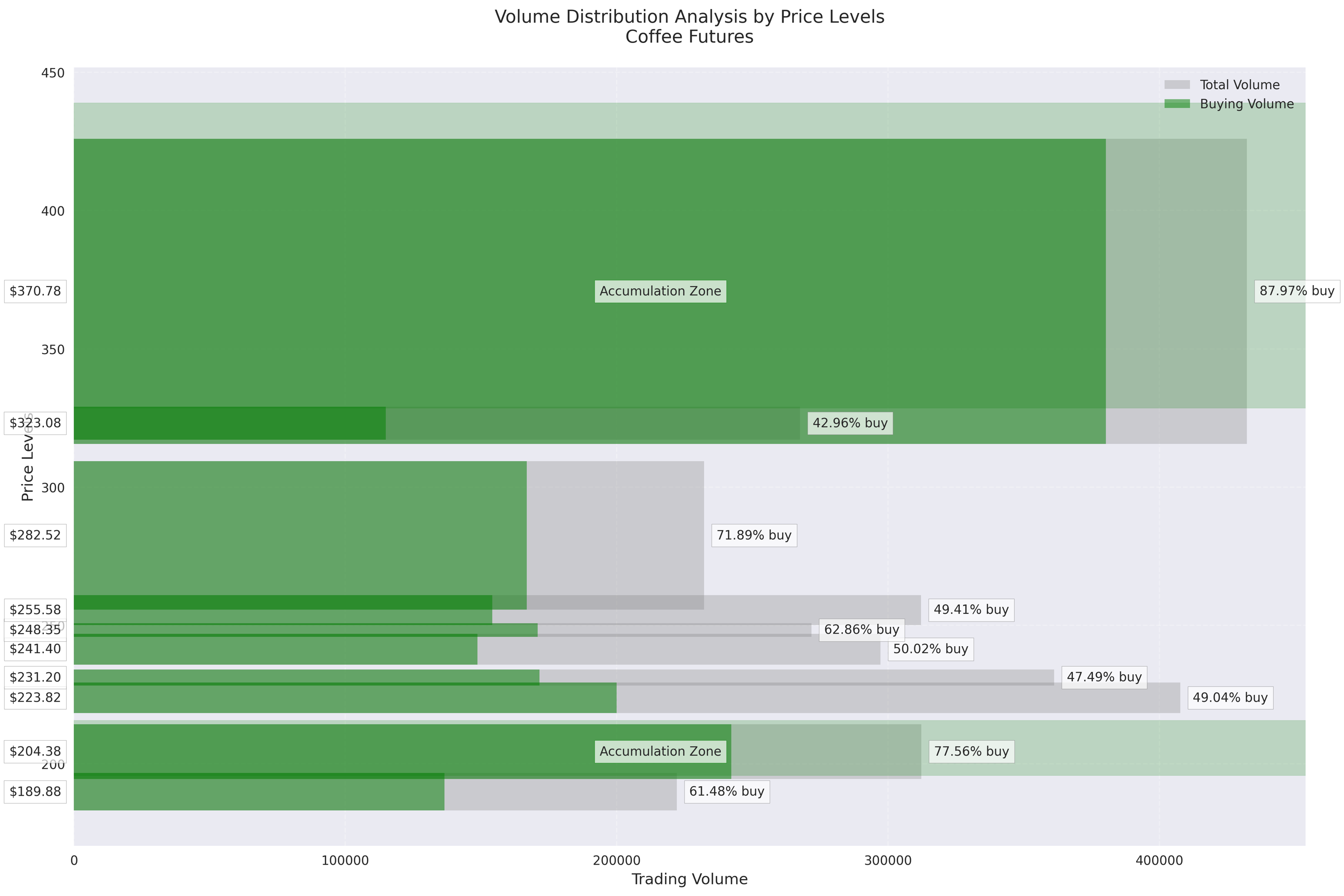

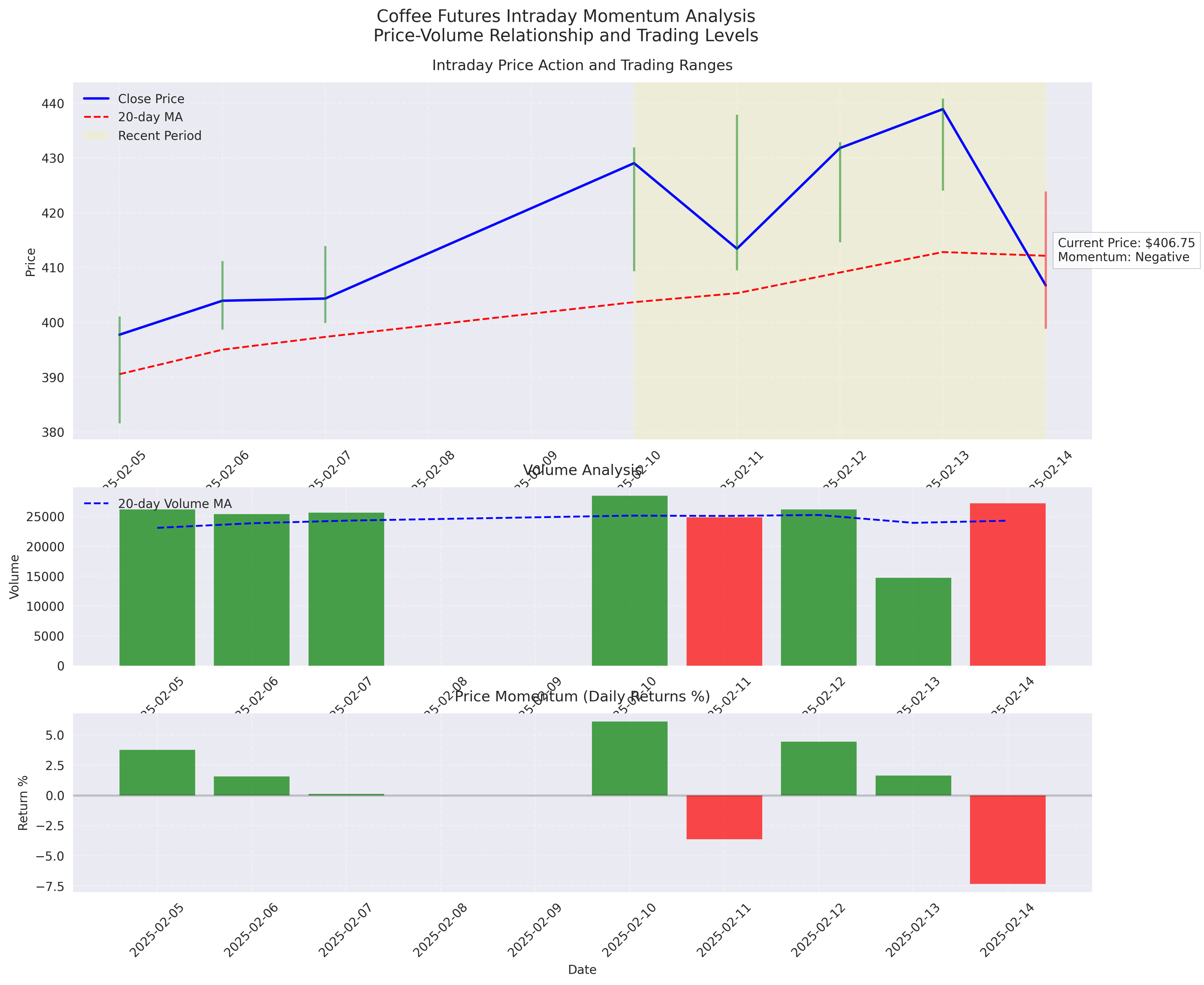

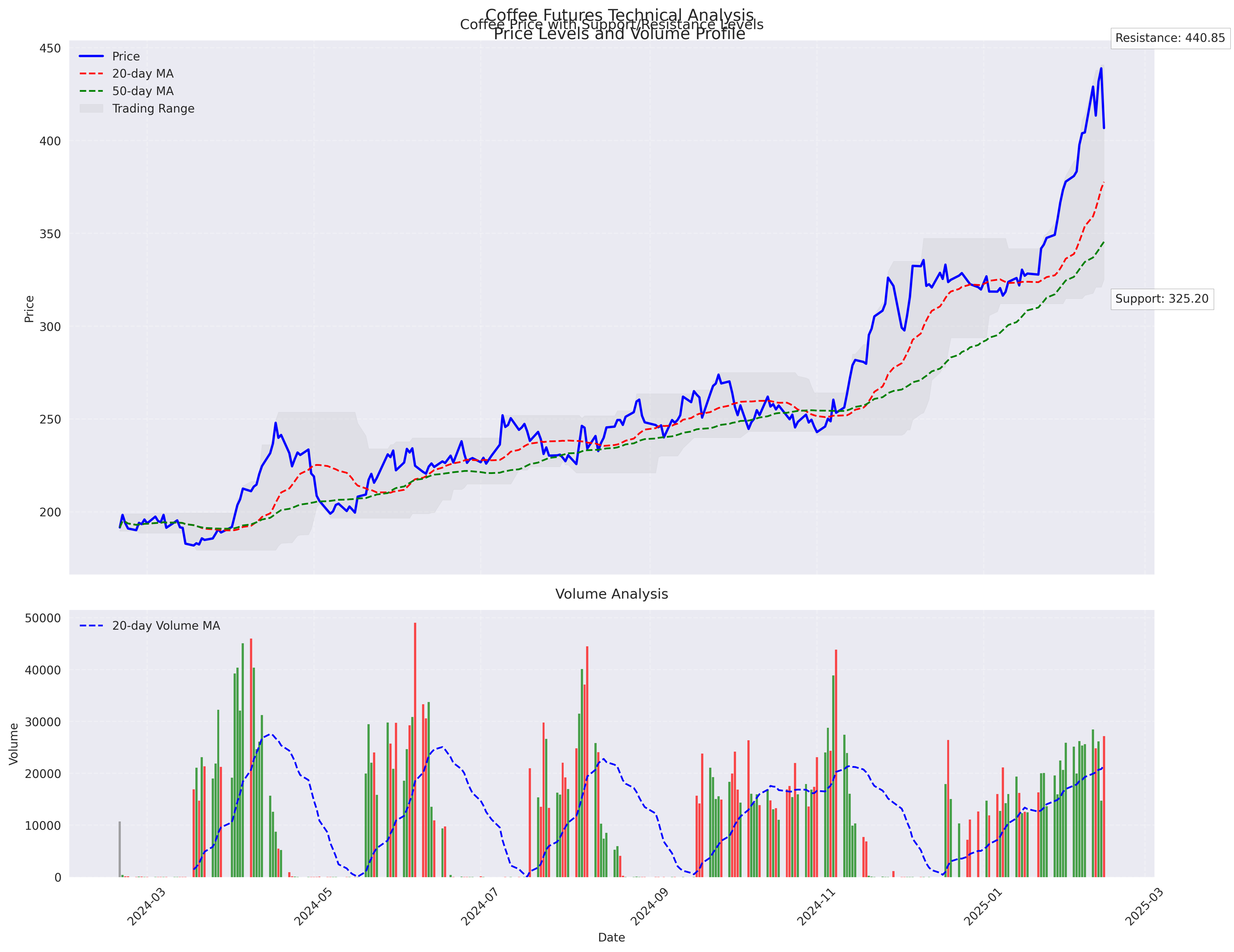

Institutional Buying Surges with Volume Spike

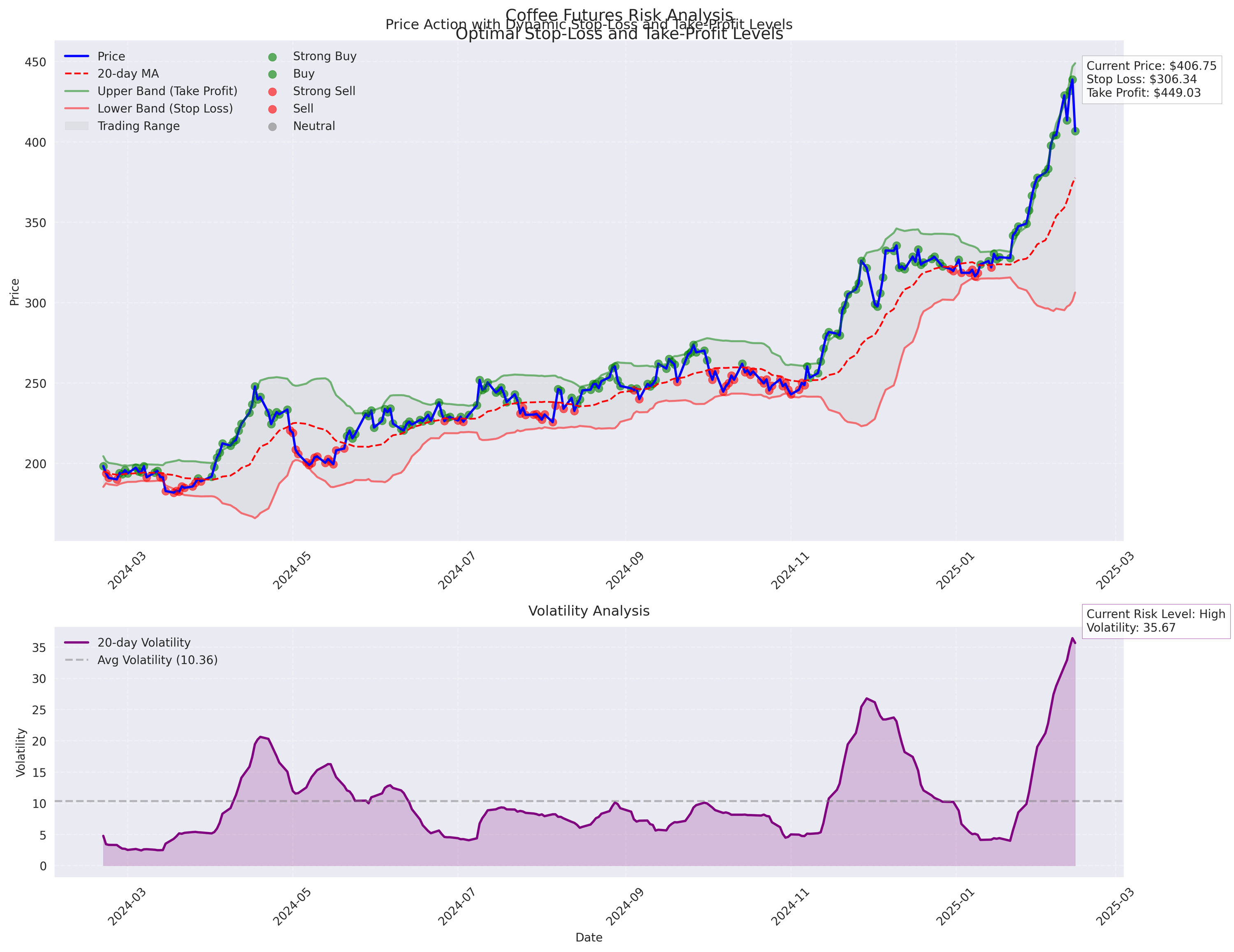

Key Trading Levels and Risk Management Strategy

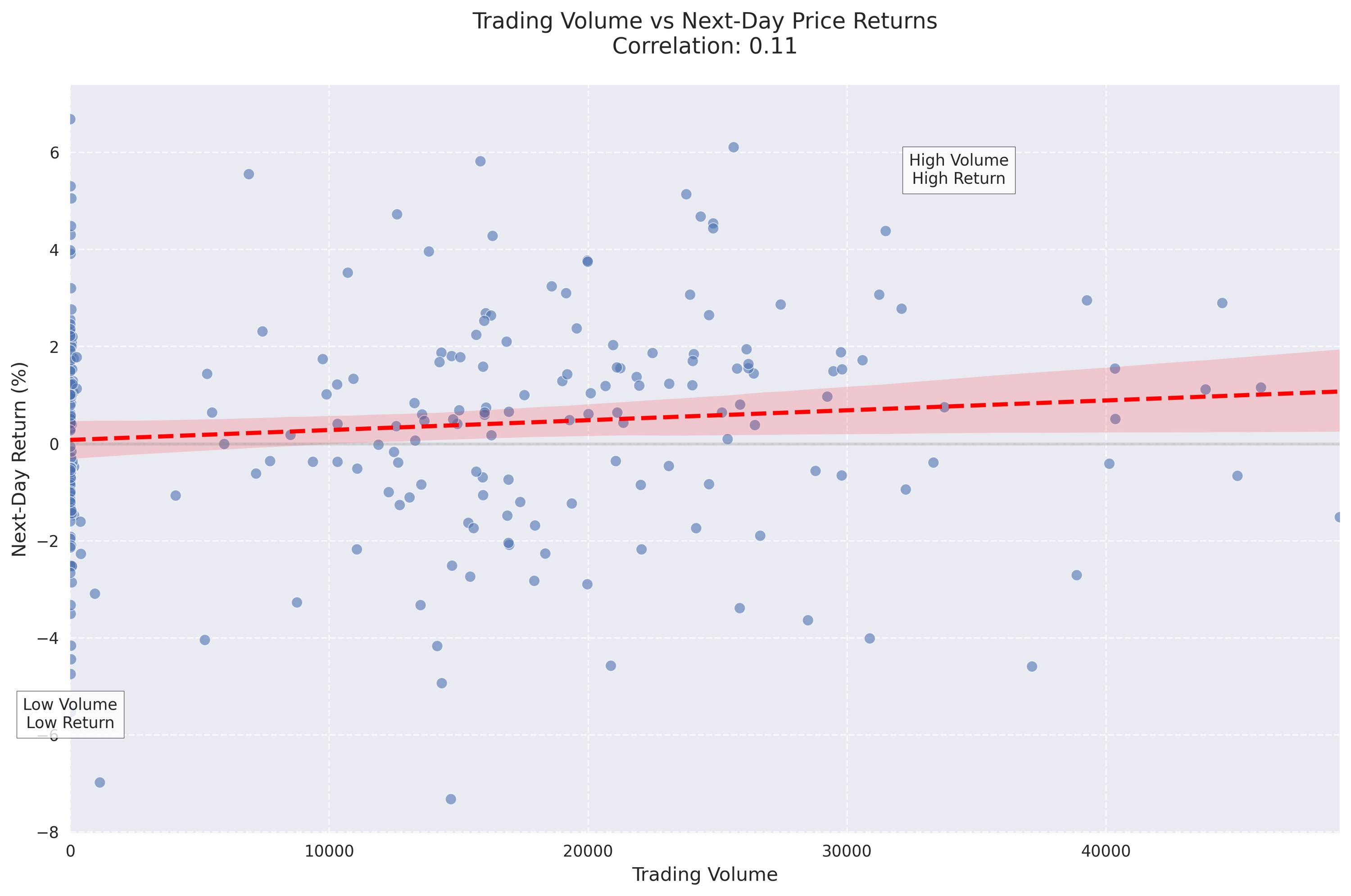

Volume Analysis Predicts Further Upside

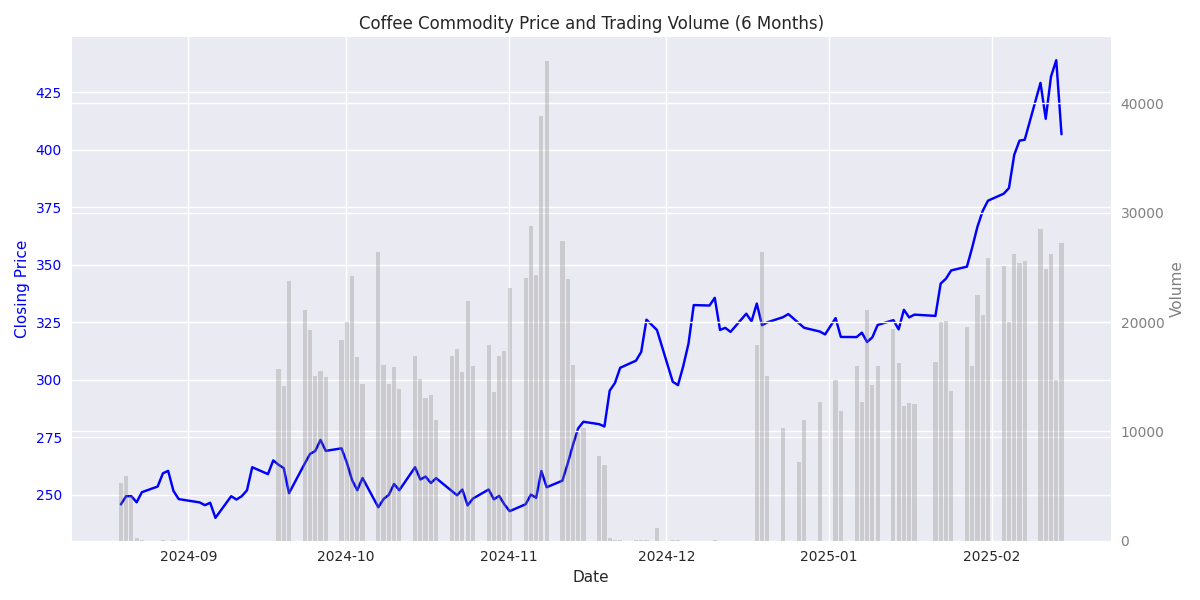

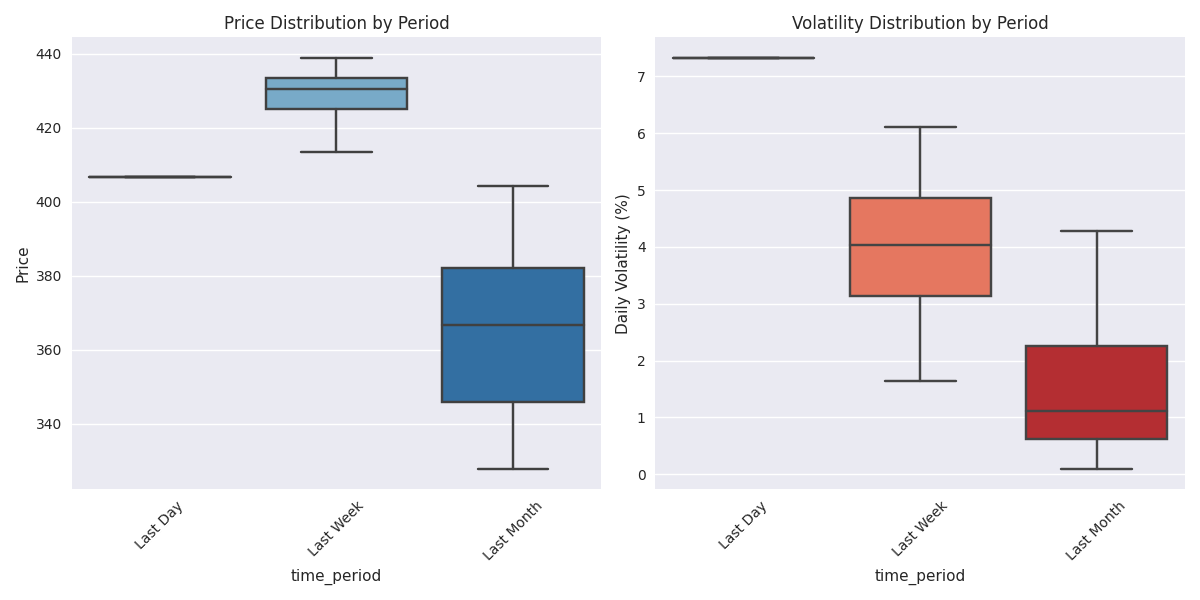

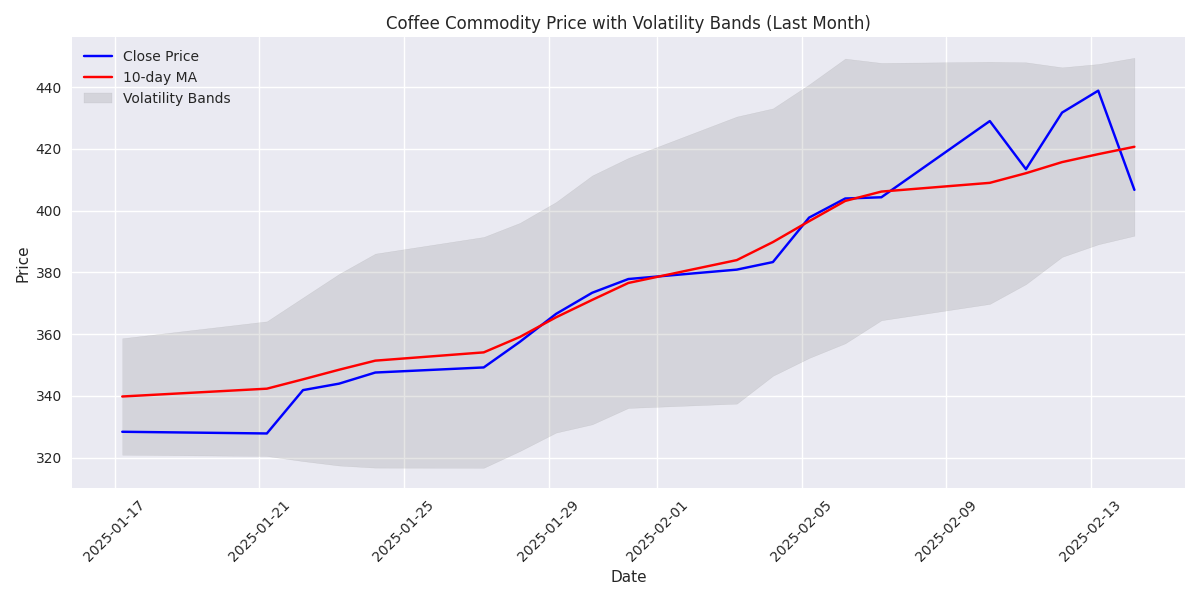

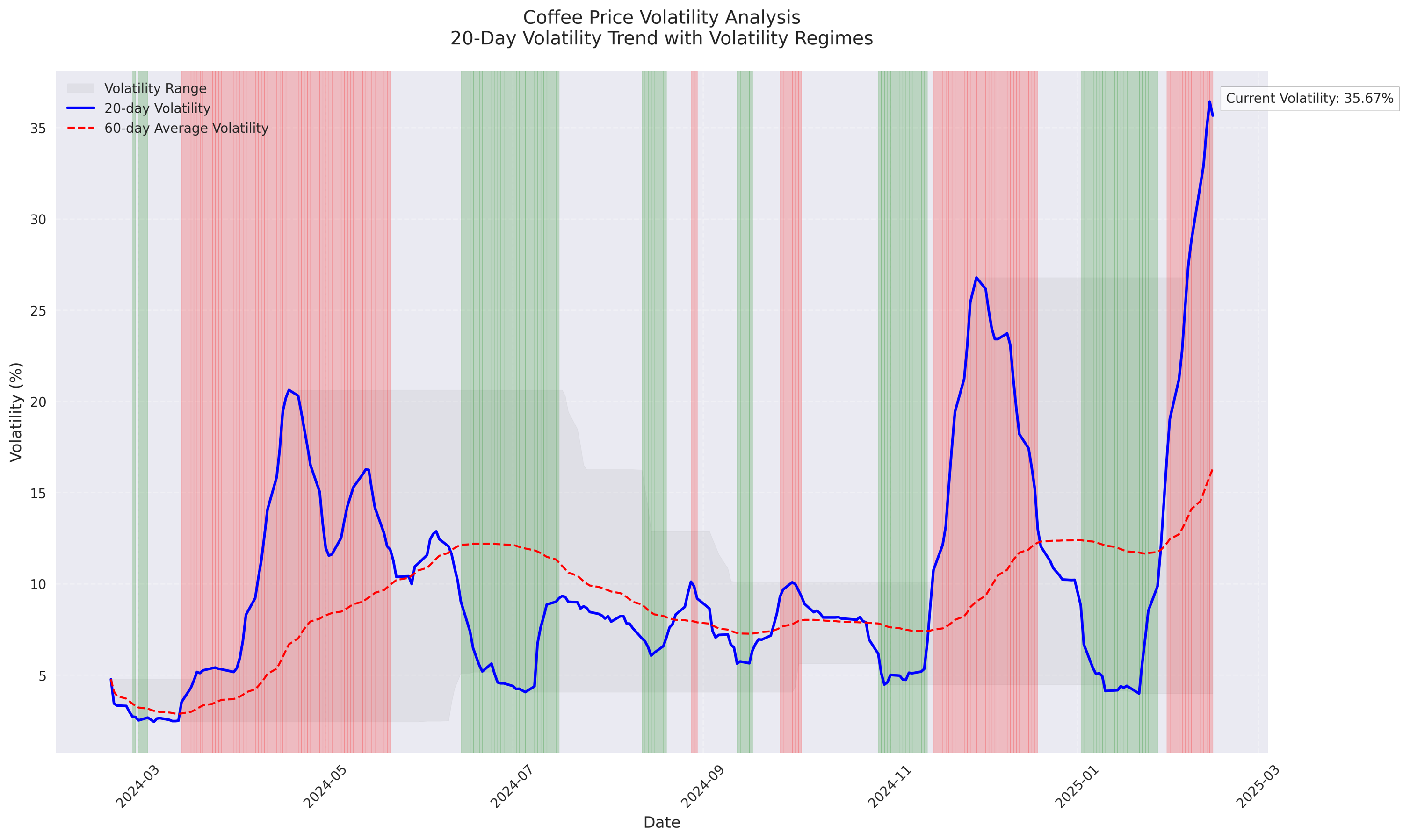

Coffee Commodity Shows High Volatility with Strong Recent Price Movements

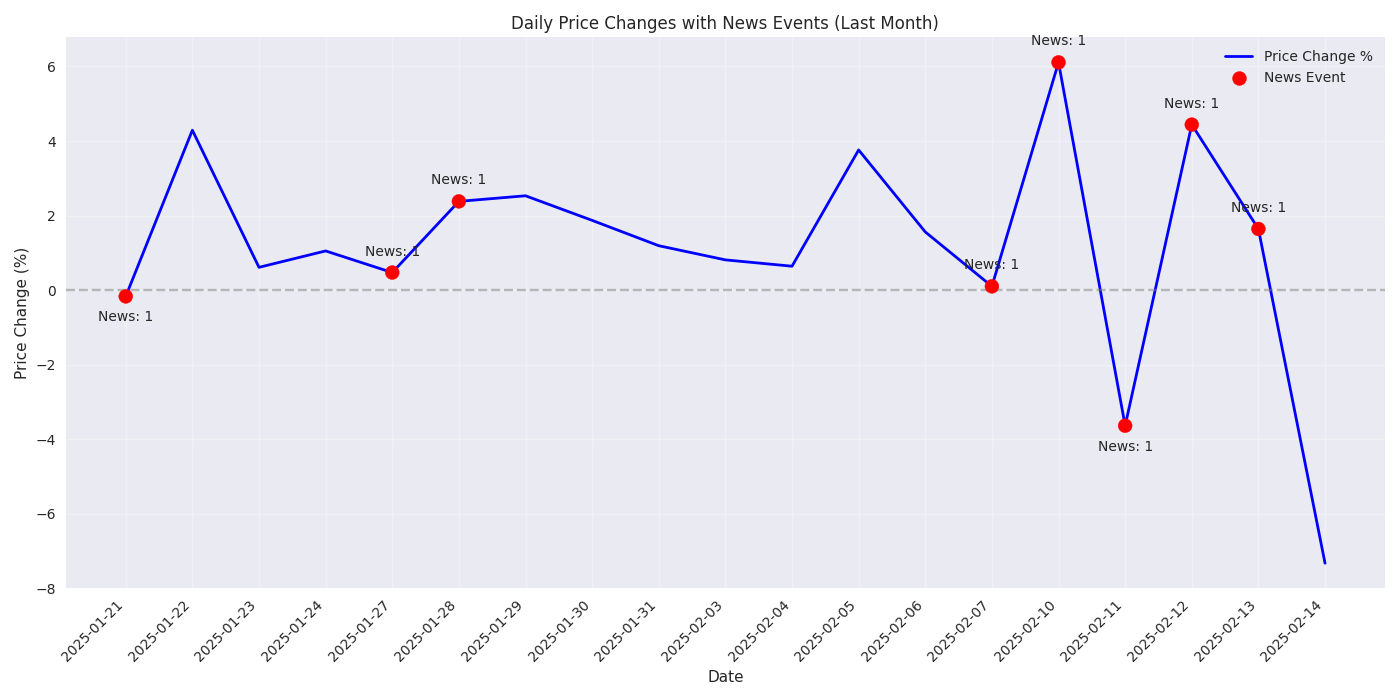

Recent Market Analysis Shows Significant Short-term Price Volatility

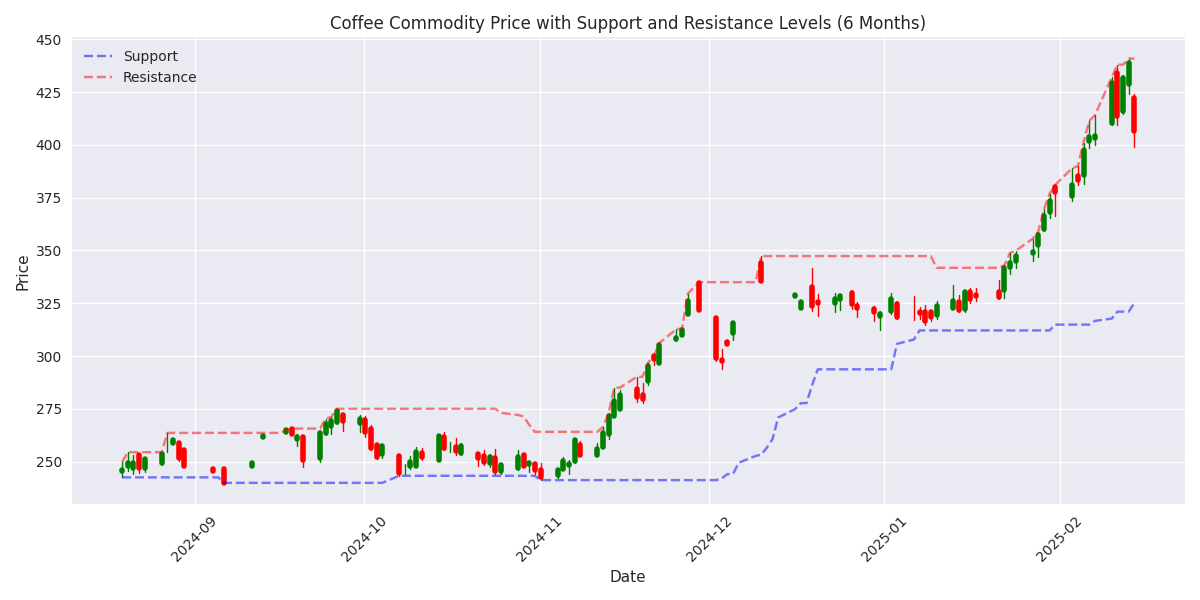

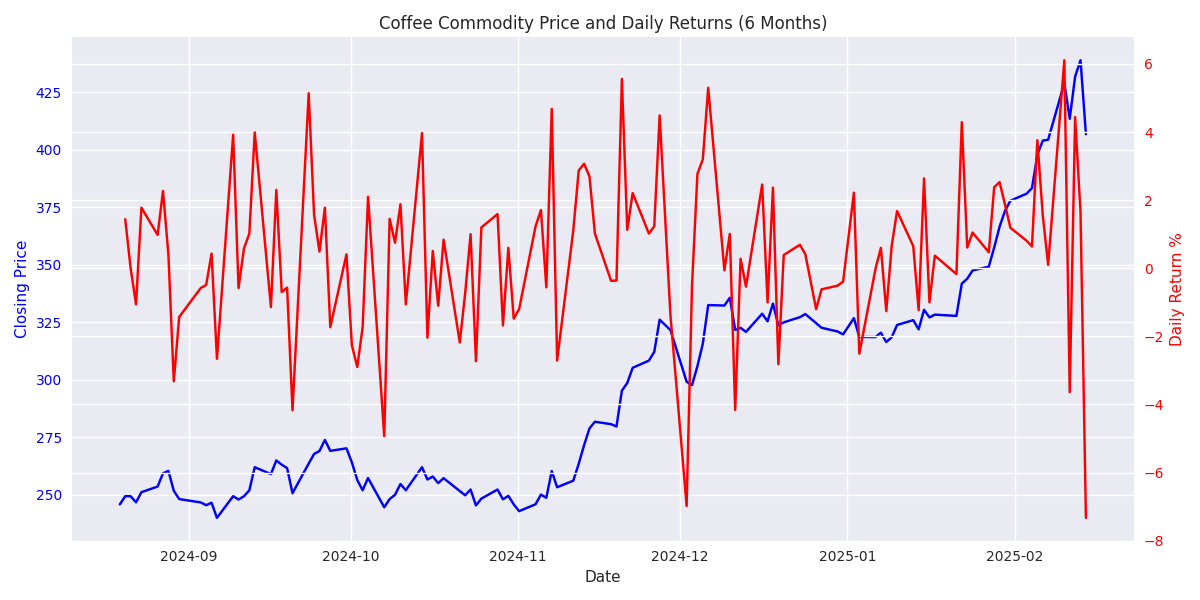

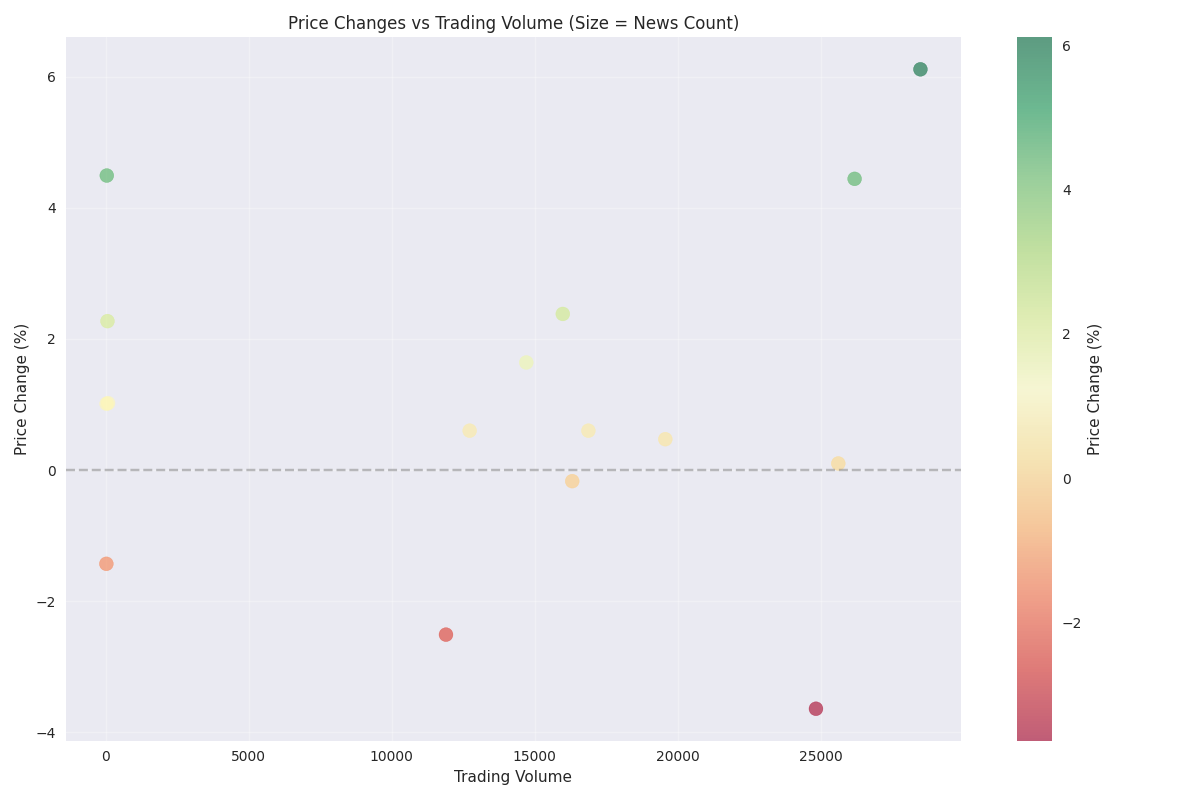

News Events Show Strong Correlation with Major Price Movements

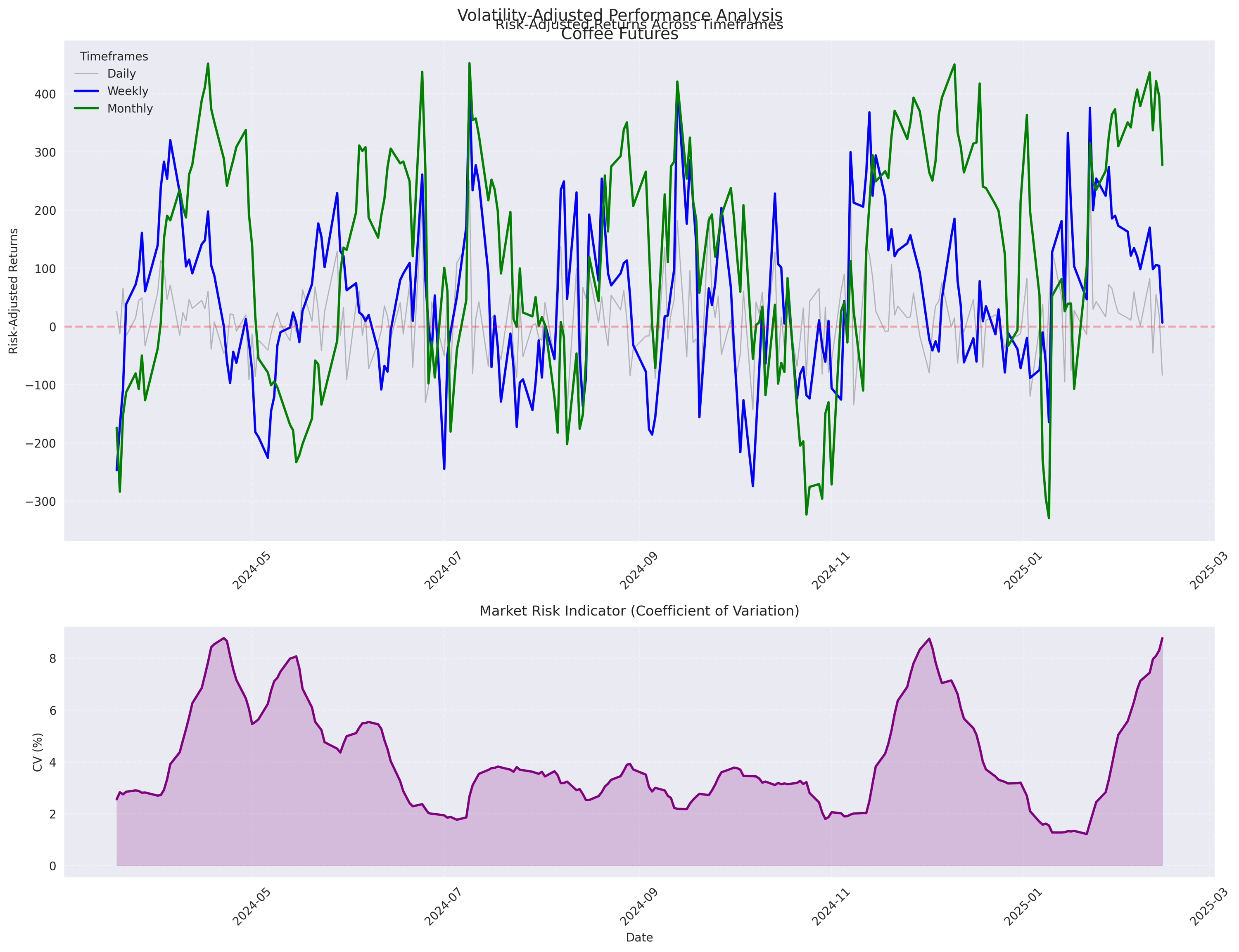

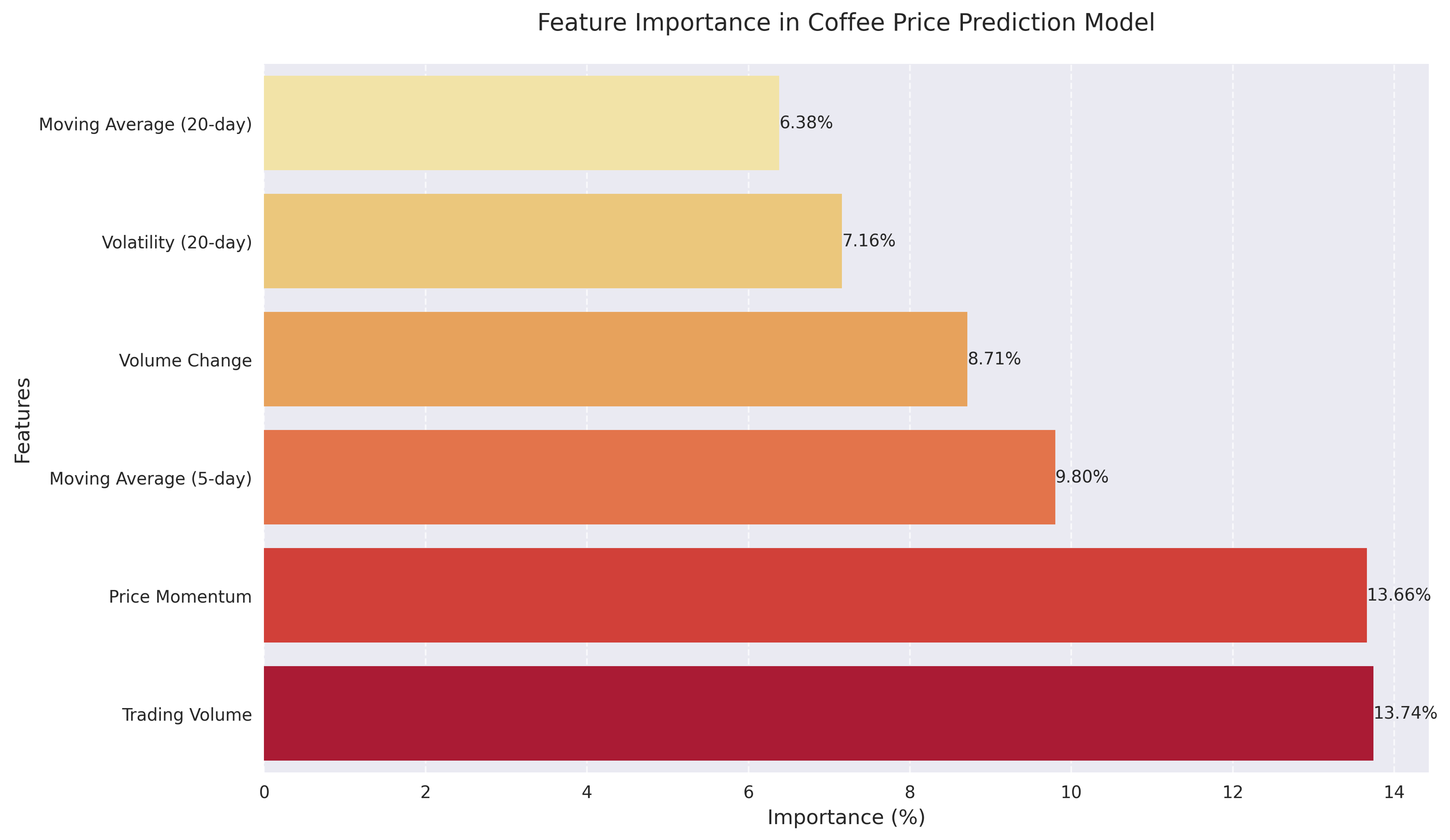

Coffee Price Prediction Model Performance and Key Drivers

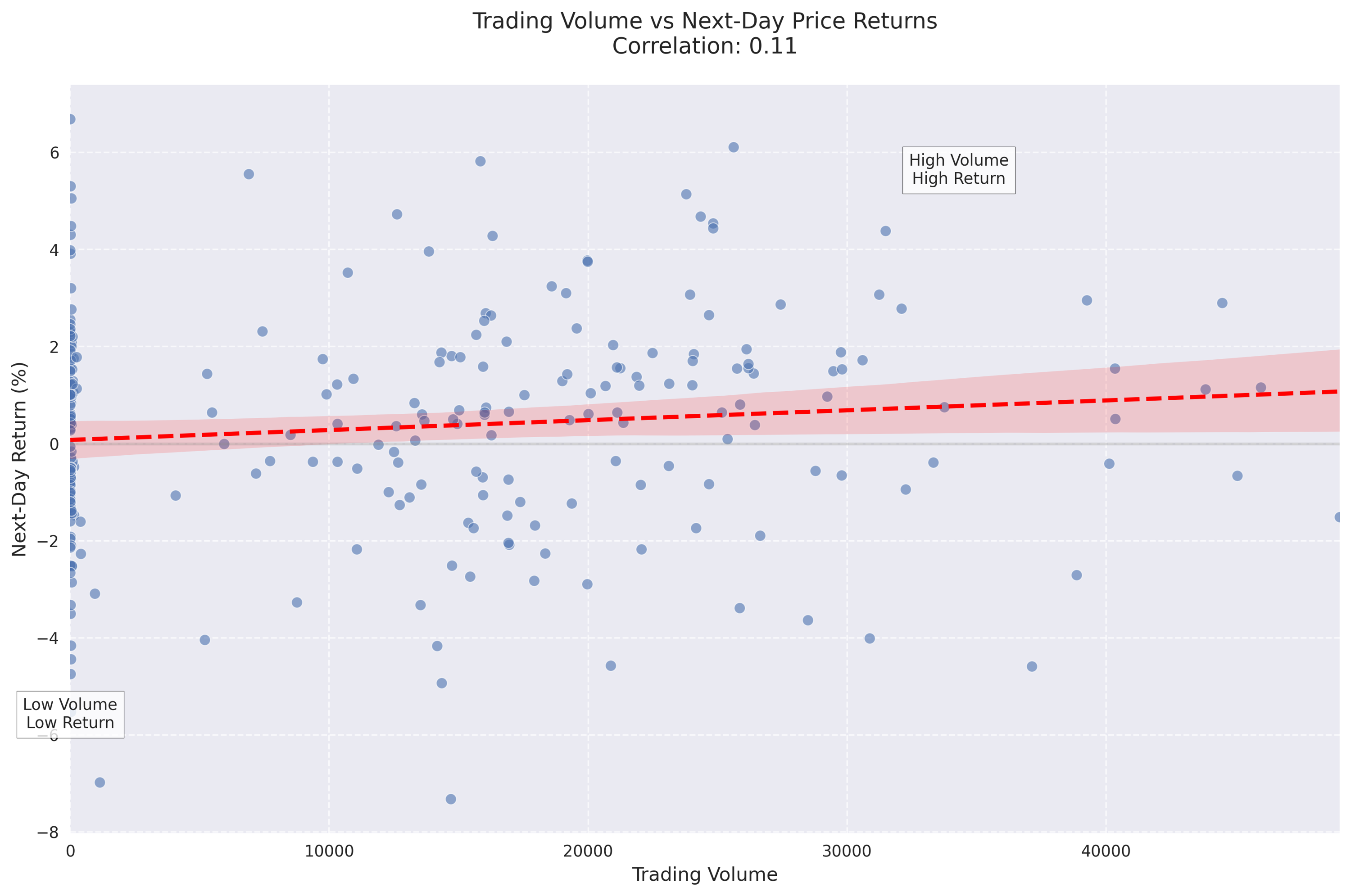

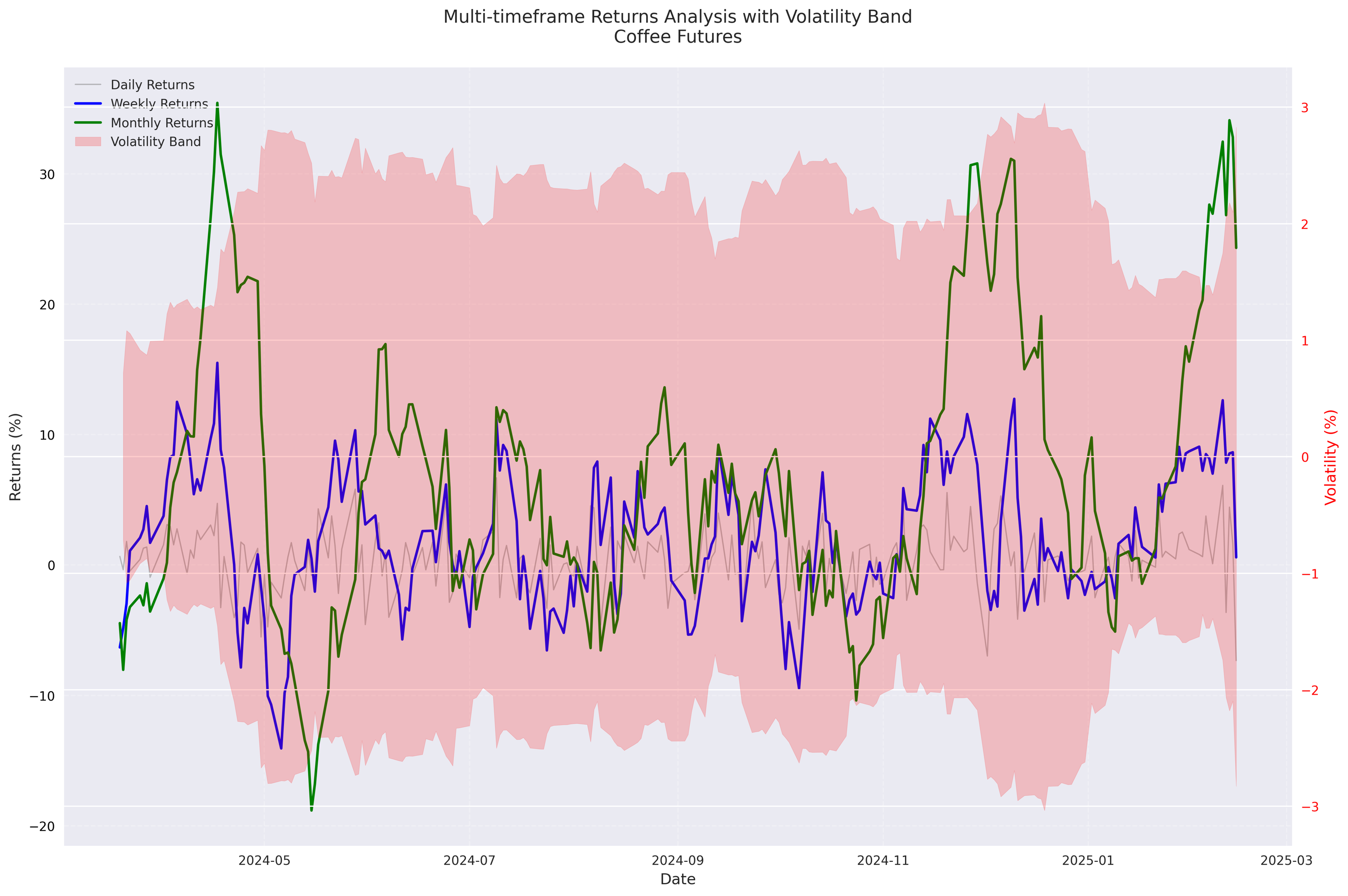

Coffee Price Returns Analysis Reveals Significant Market Momentum

Coffee Price Forecast and Key Trading Levels Analysis

Coffee Price Forecast and Trading Recommendations