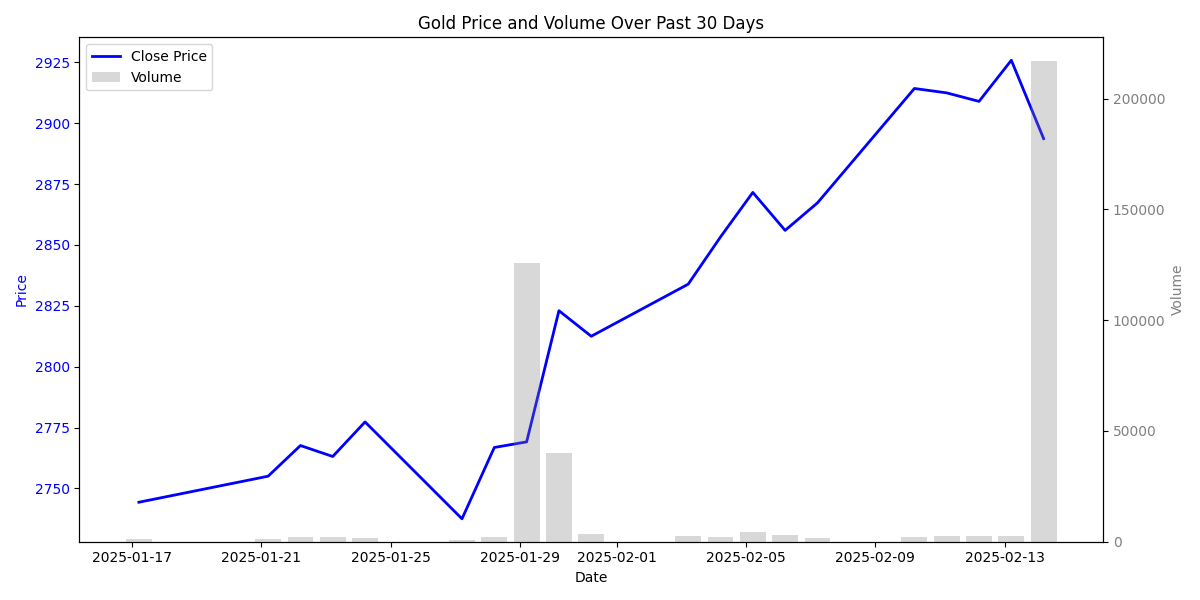

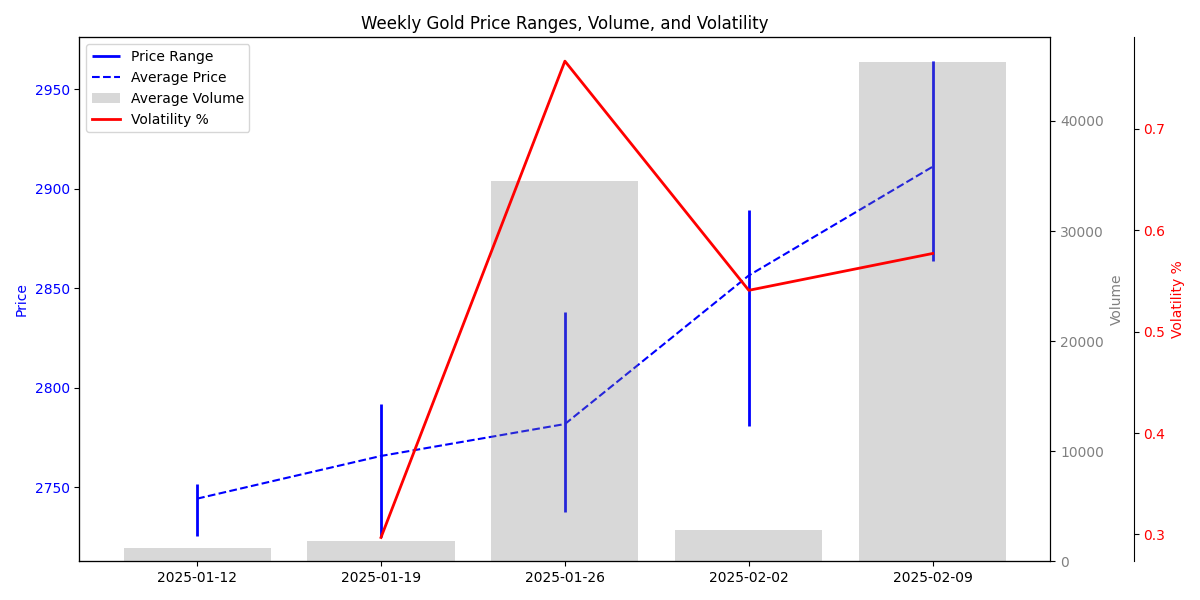

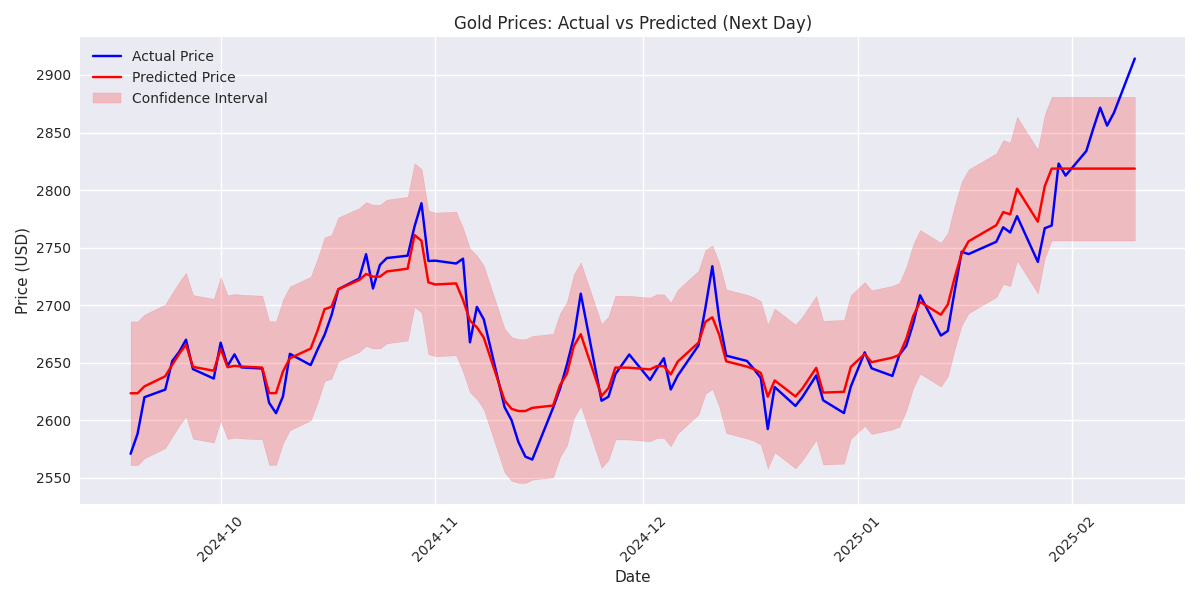

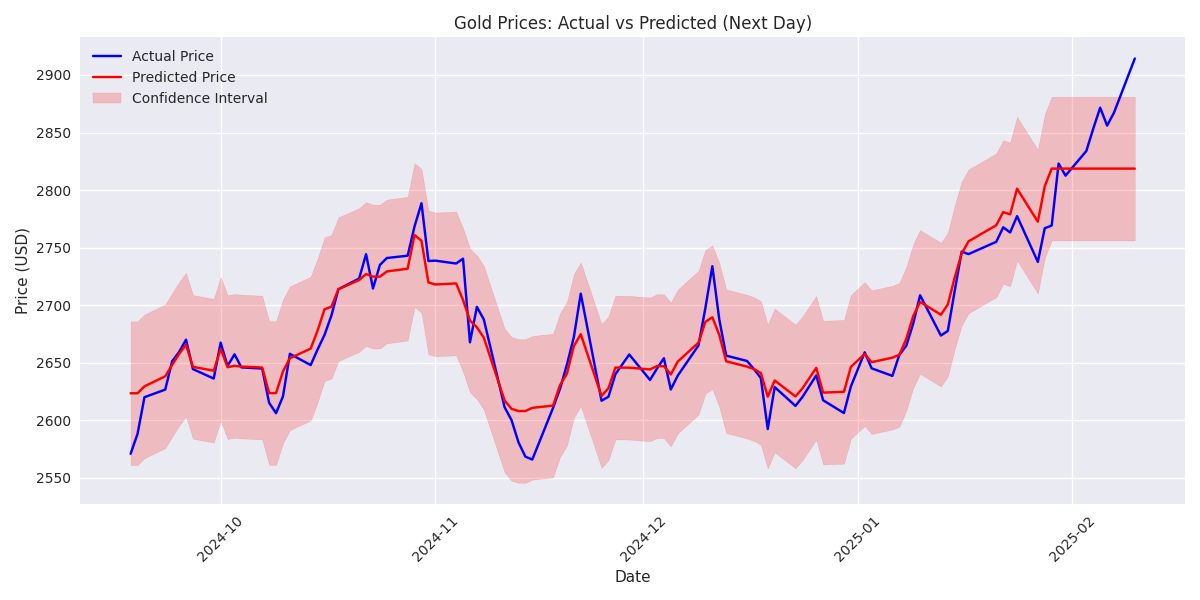

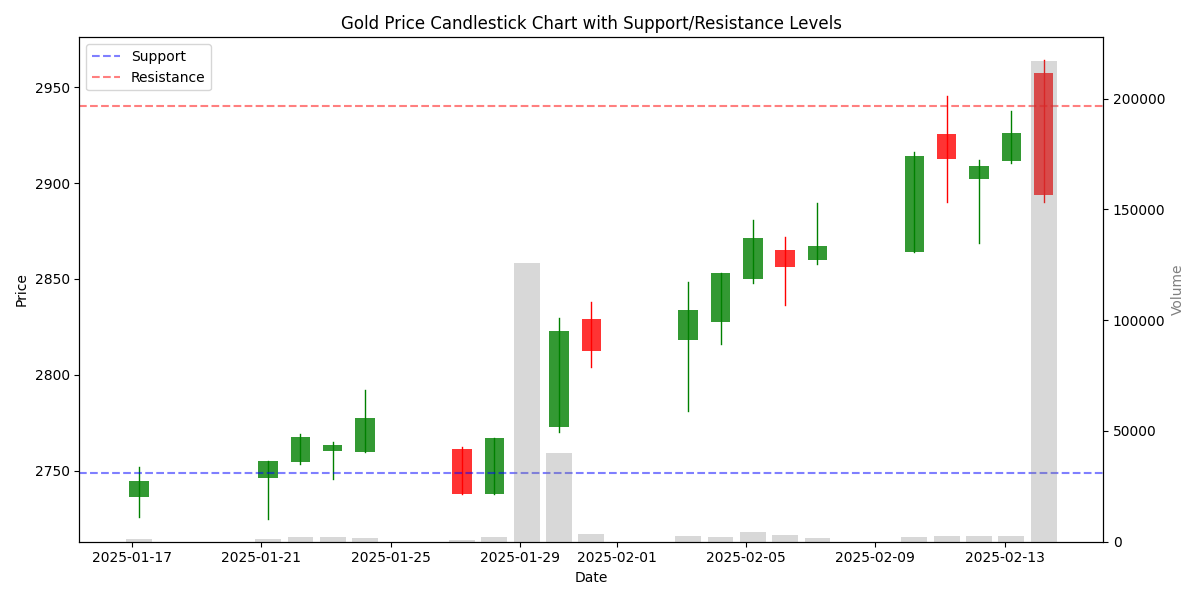

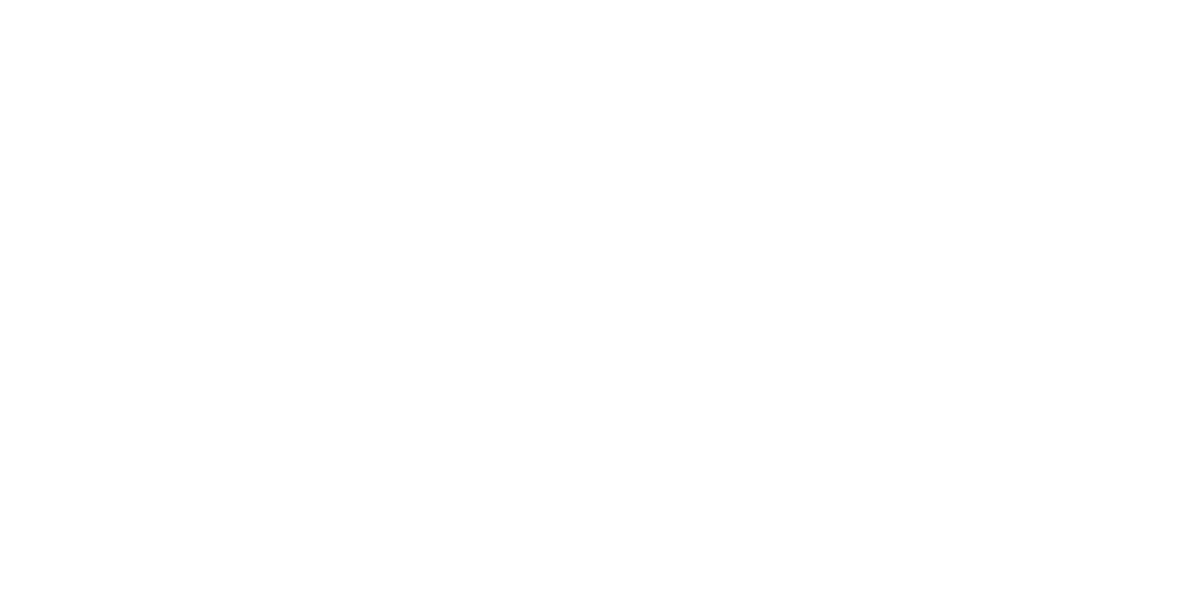

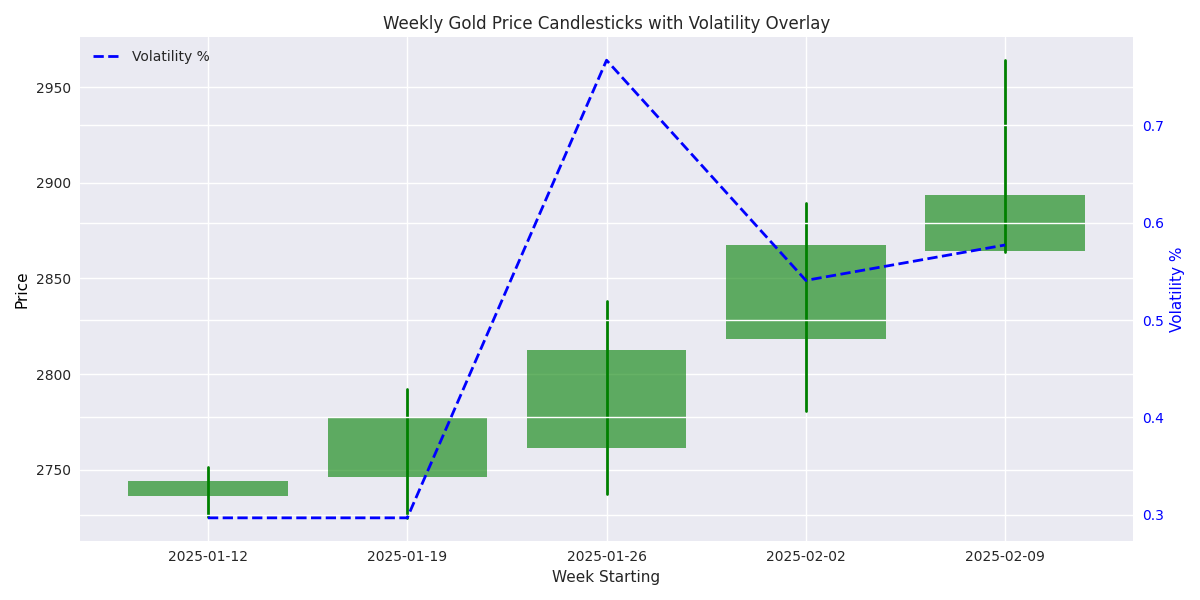

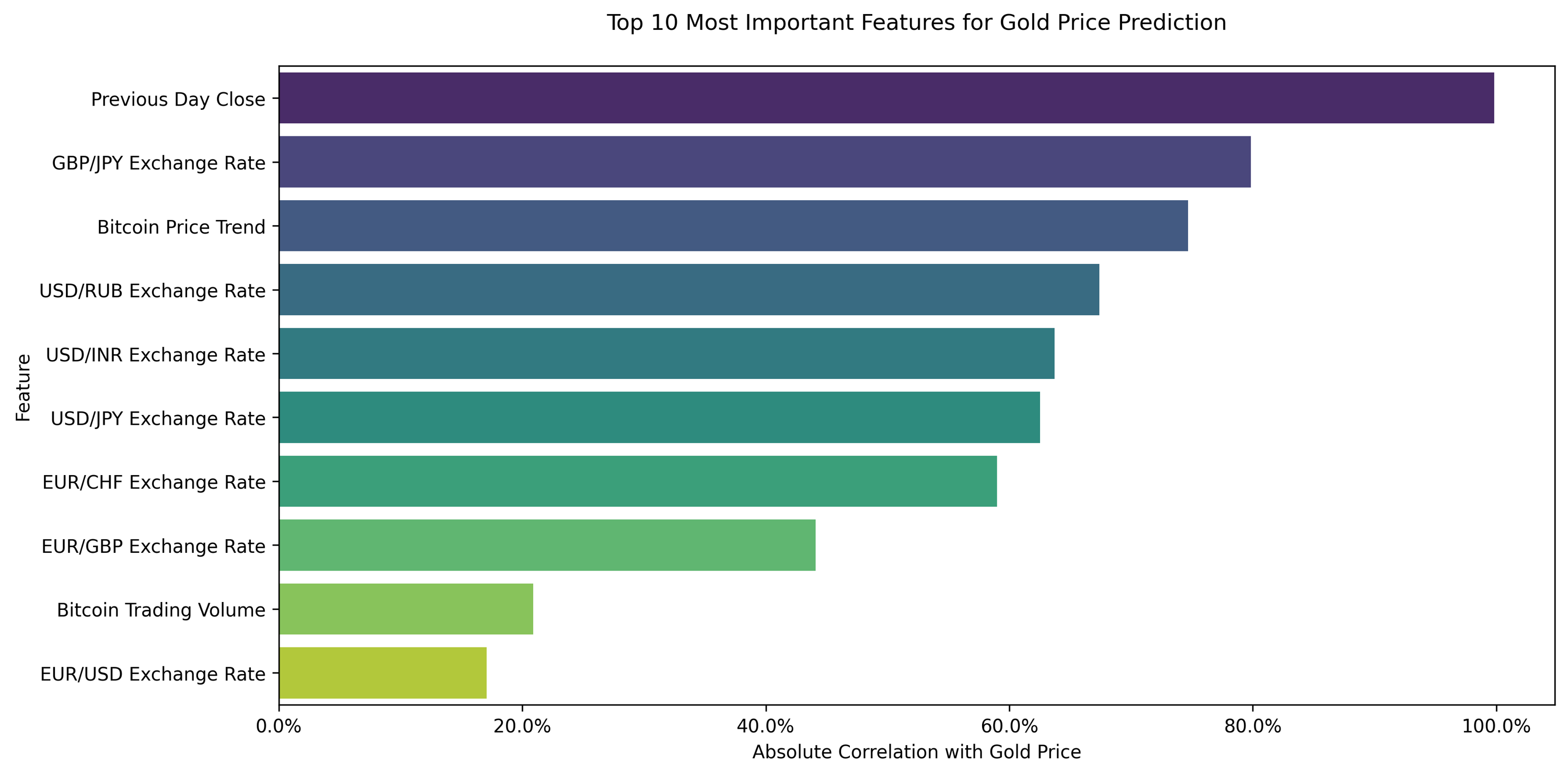

The predictive model reveals that gold prices exhibit strong short-term momentum with recent prices being highly influential for next-day predictions. The current price range shows significant volatility between $2,780 and $2,964, indicating an active trading market. The model identifies currency pairs, particularly USD/INR and EUR/CHF, as important external factors affecting gold prices. High volatility in recent trading volumes (ranging from 1,822 to 216,832) suggests potential market uncertainty.