Saving...

USD/CNY Market Pulse: Traders' Quick Guide to Currency Movements and Risks

Saving...

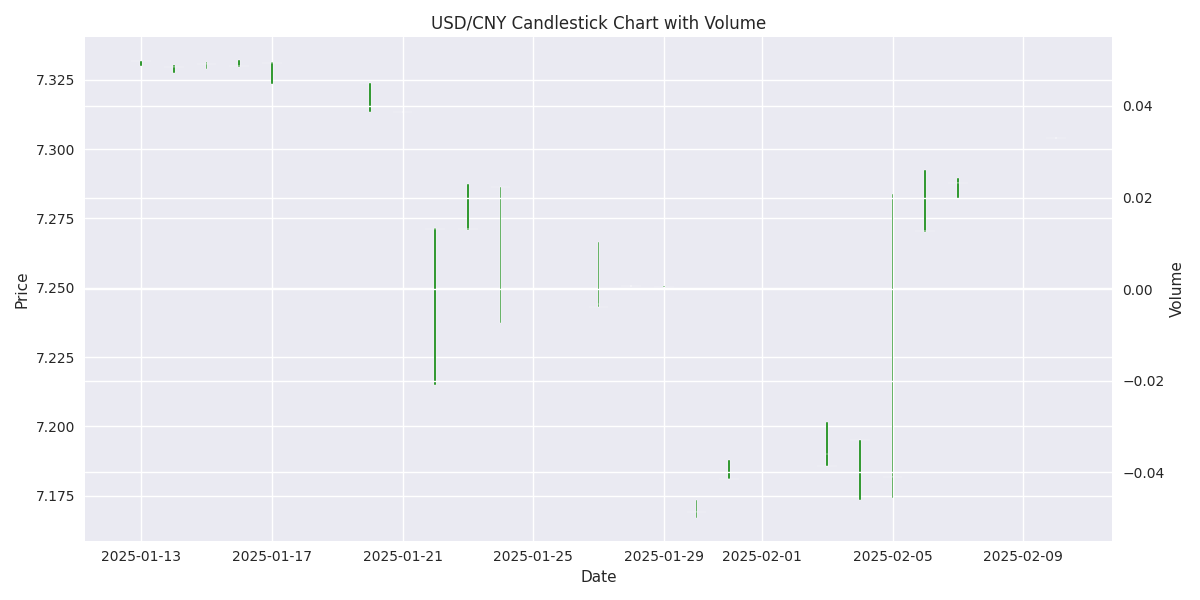

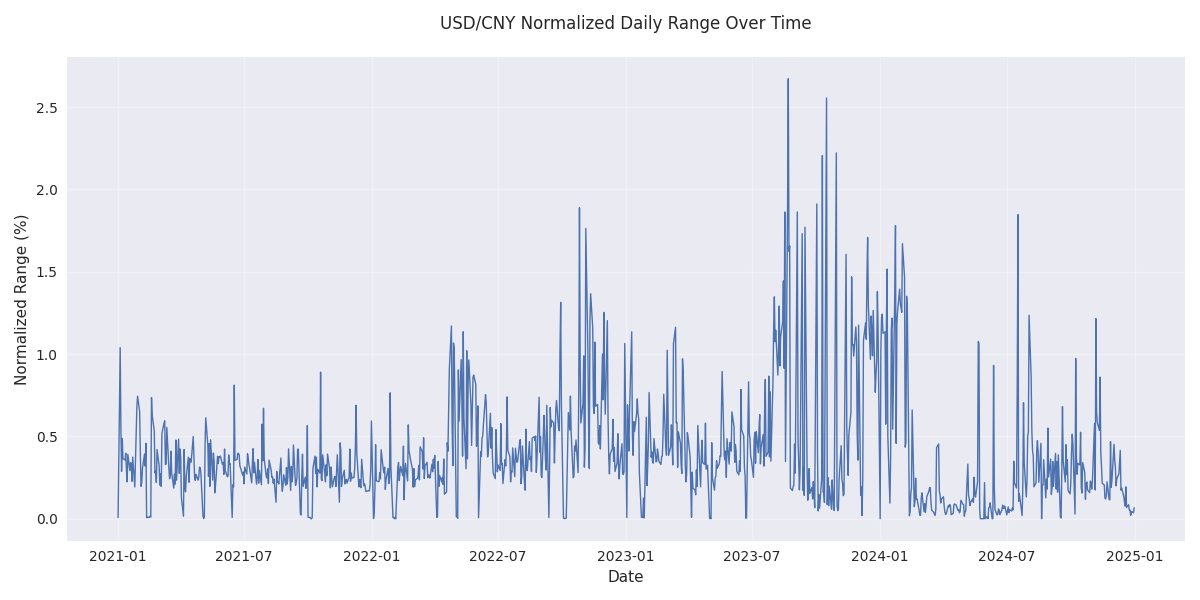

USD/CNY Trading Range Offers Clear Short Opportunities

Saving...

USD/CNY Trading Range Offers Clear Short Opportunities

Saving...

Saving...

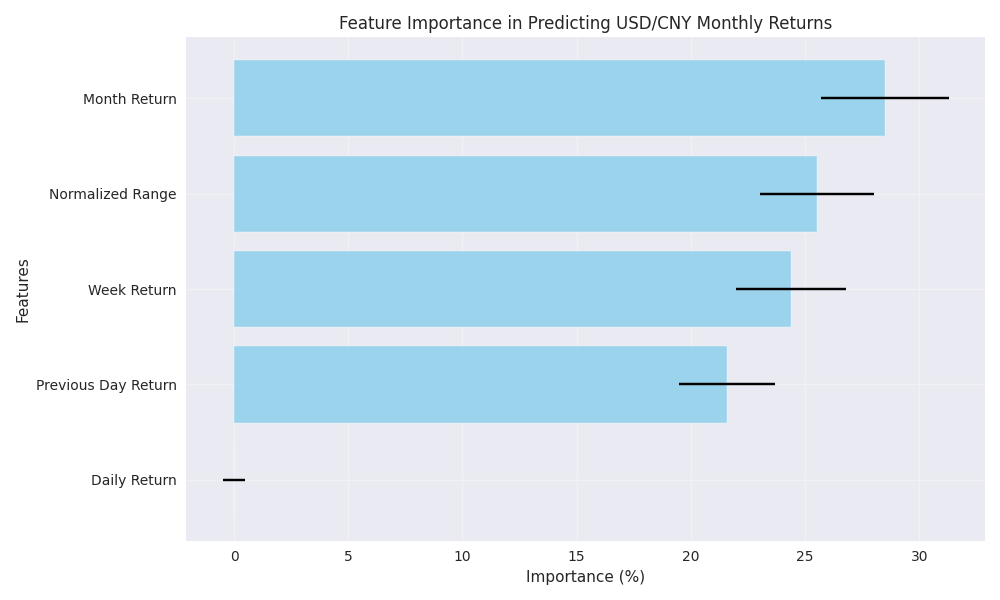

High-Probability Range Trading Strategy Identified

Saving...

High-Probability Range Trading Strategy Identified

Saving...

Saving...

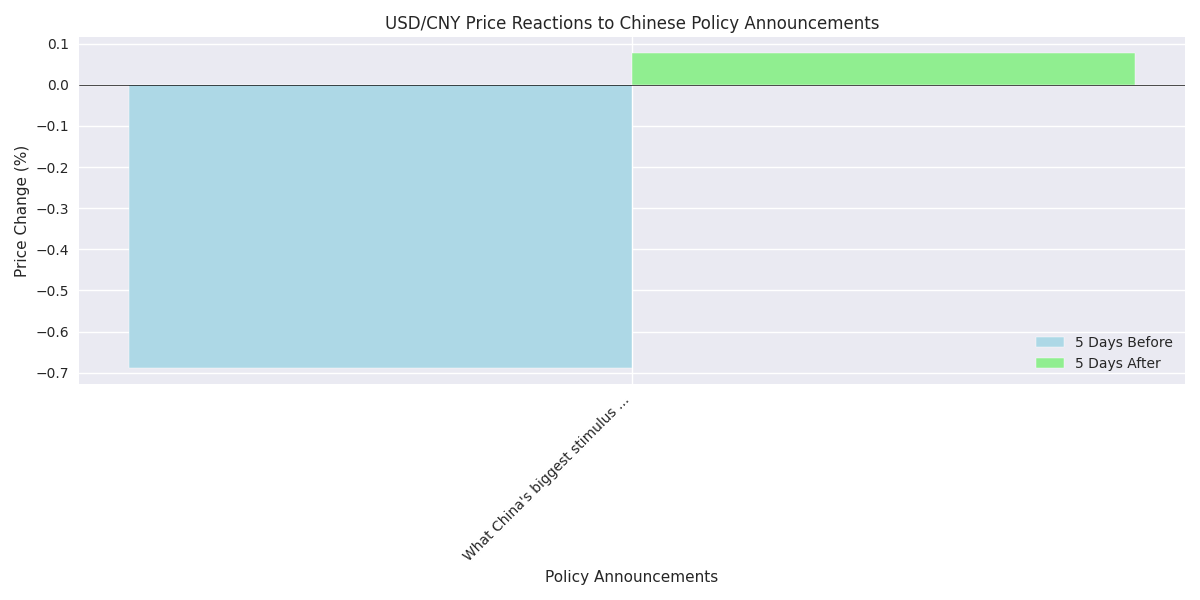

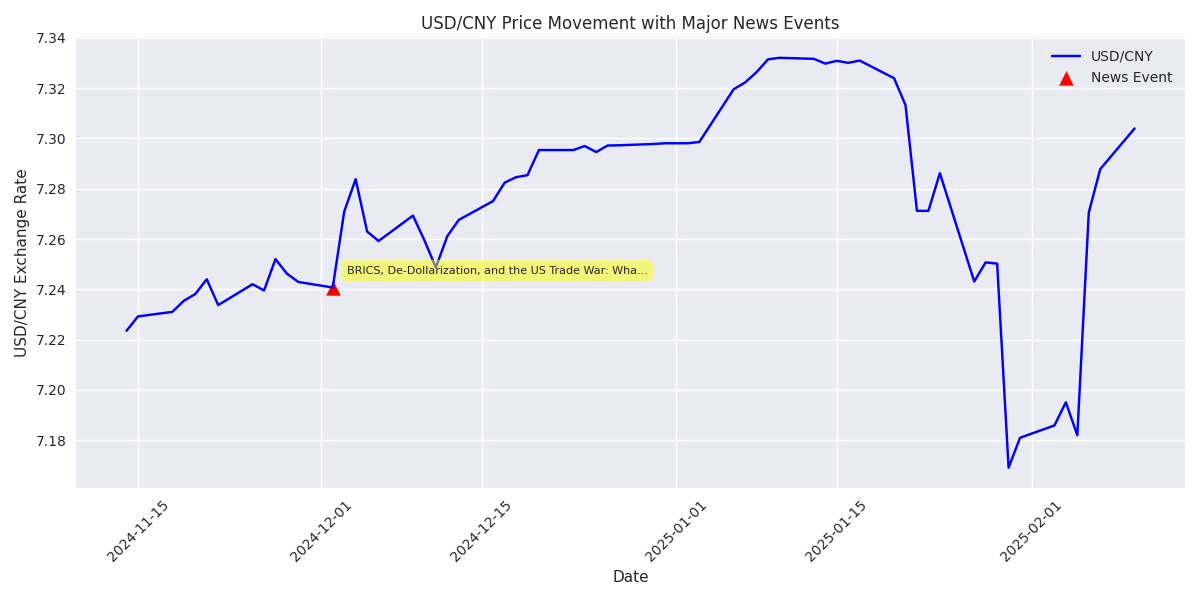

Political Events Create Volatility Trading Opportunities

Saving...

Political Events Create Volatility Trading Opportunities

Saving...

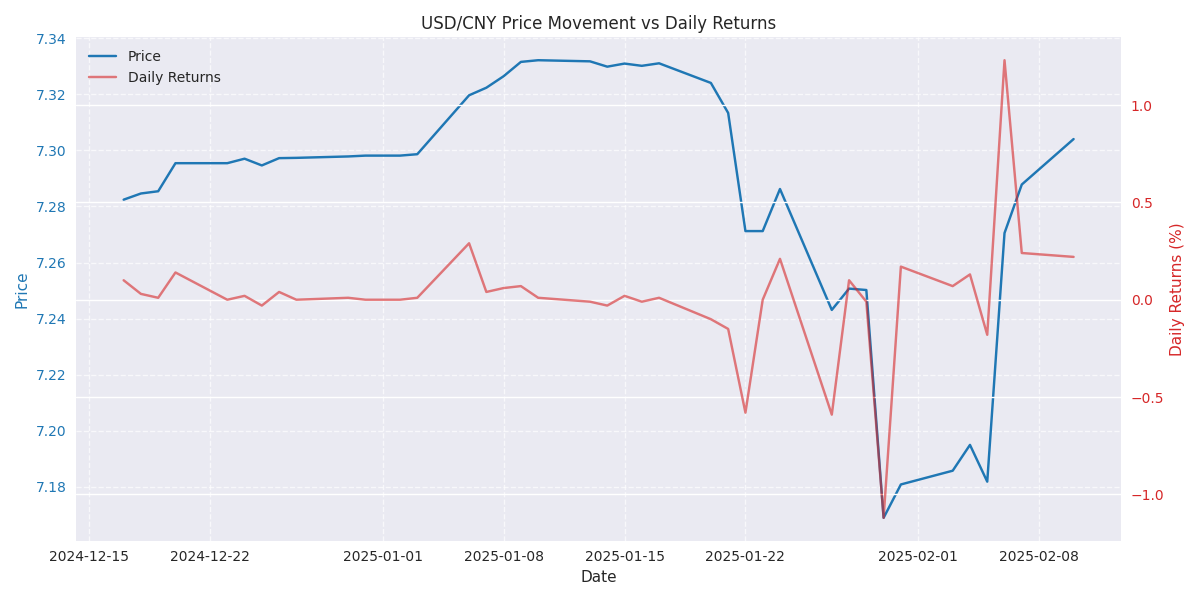

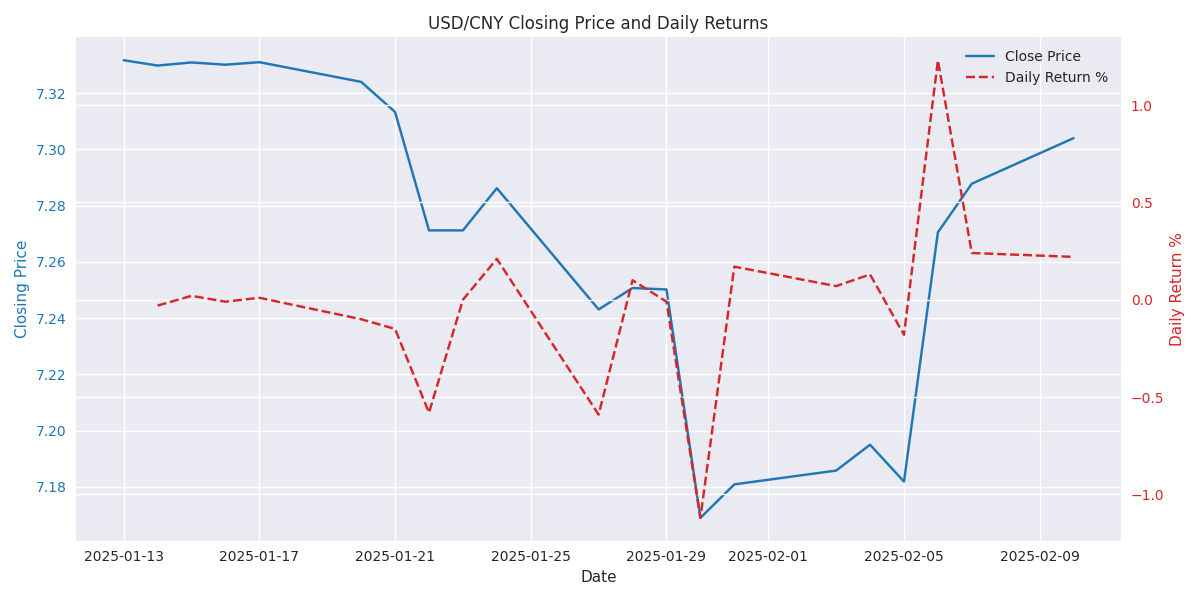

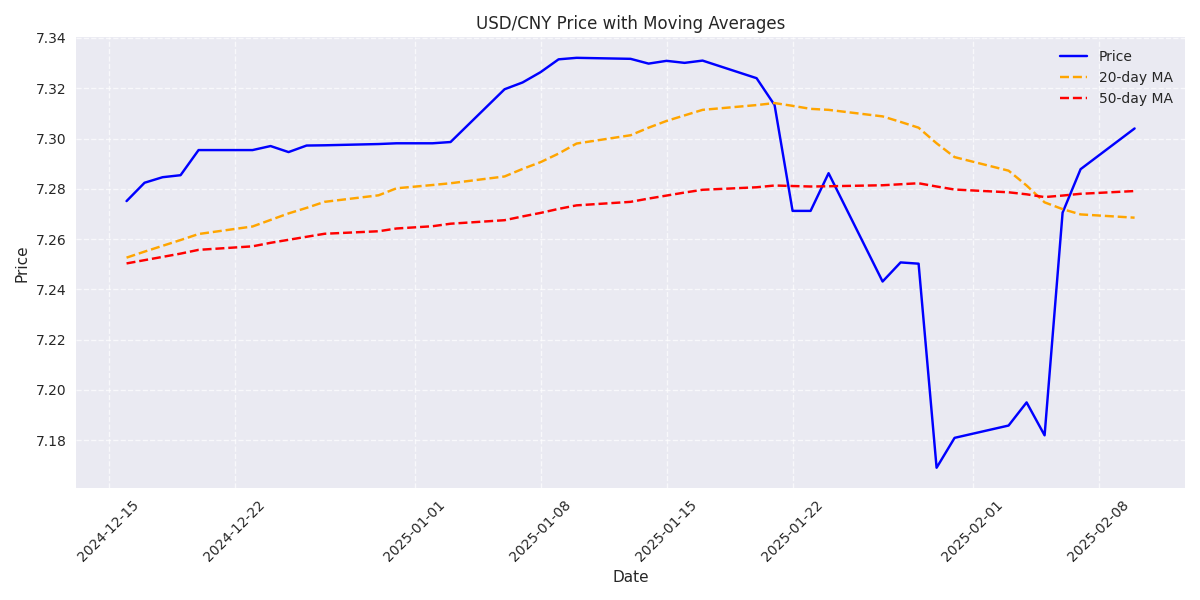

Recent USD/CNY Price Analysis Shows Downward Trend with Increased Volatility

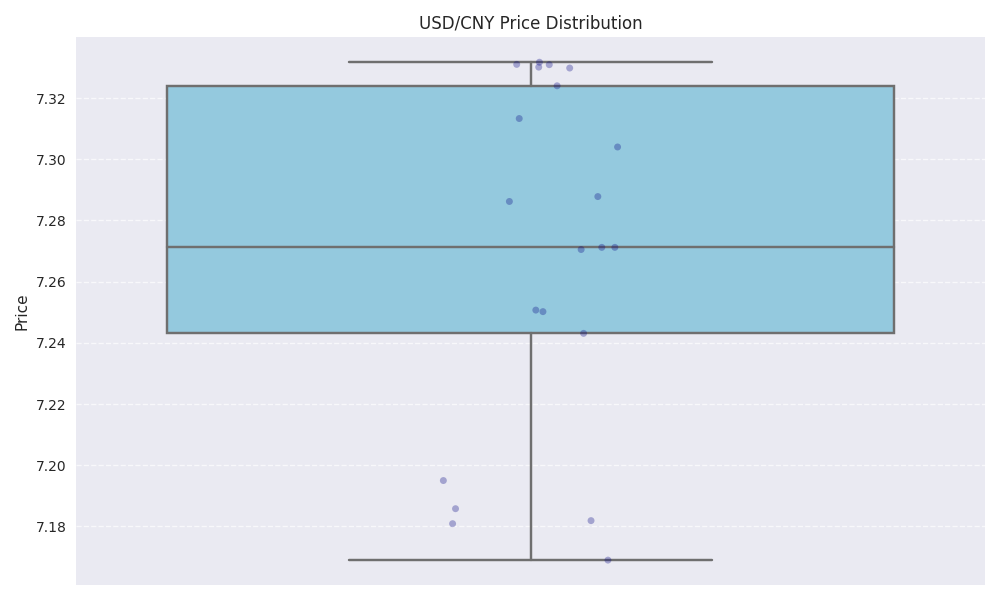

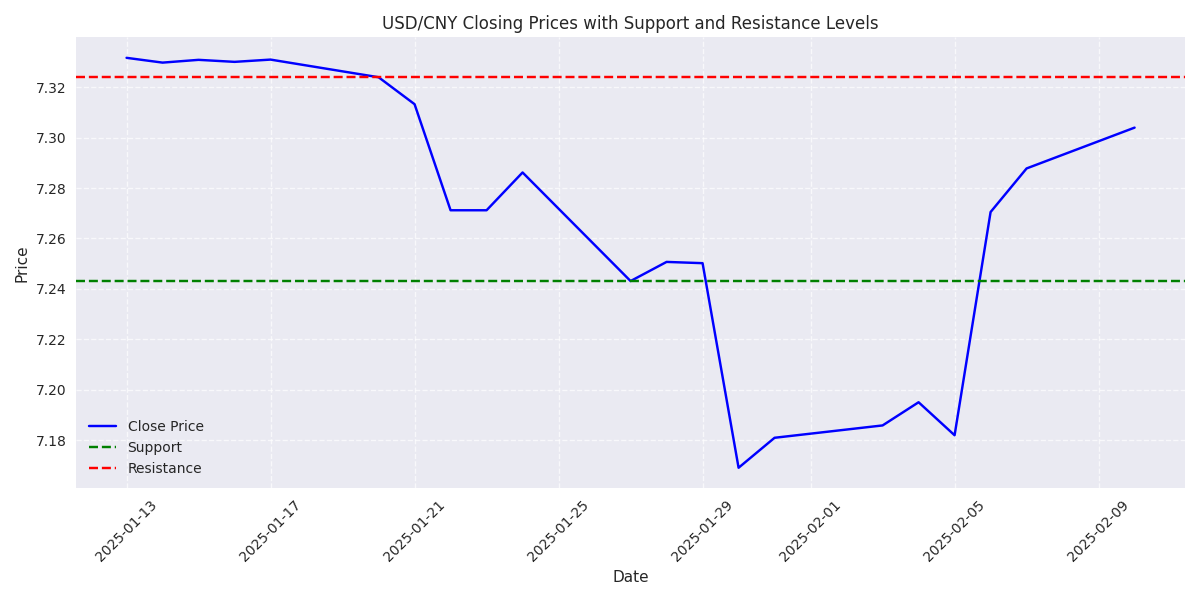

USD/CNY Key Support and Resistance Levels Identified

USD/CNY Shows Bearish Trend with Recent Signs of Reversal

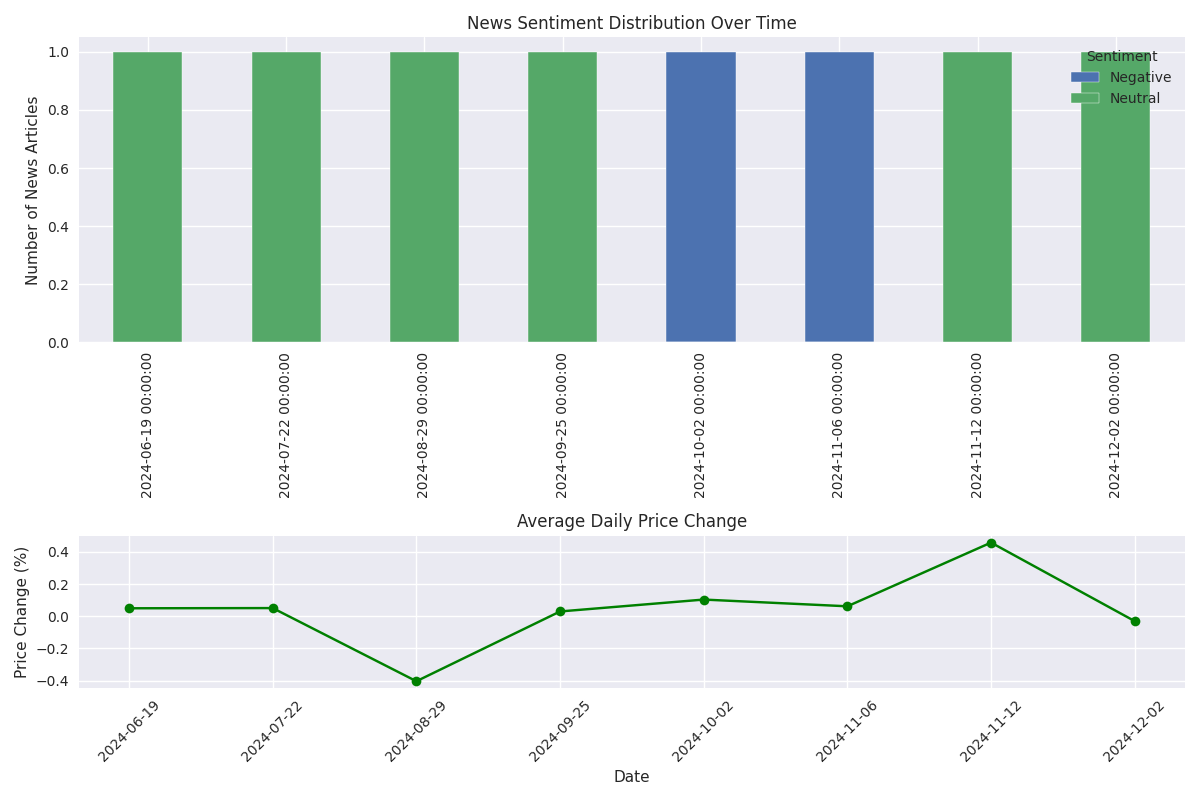

Key Market Events and News Impact on USD/CNY

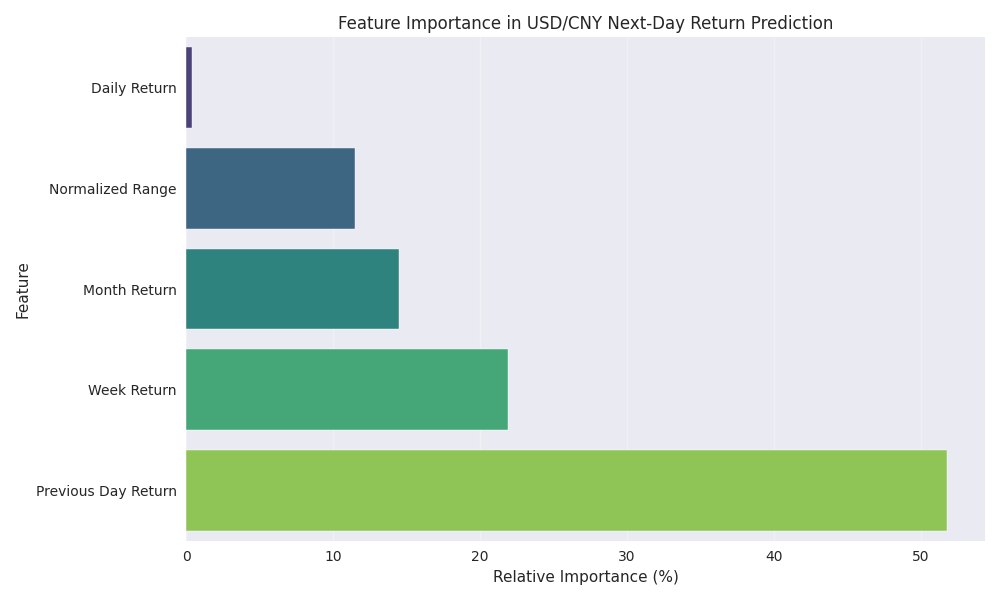

USD/CNY Short-term Price Movement Analysis

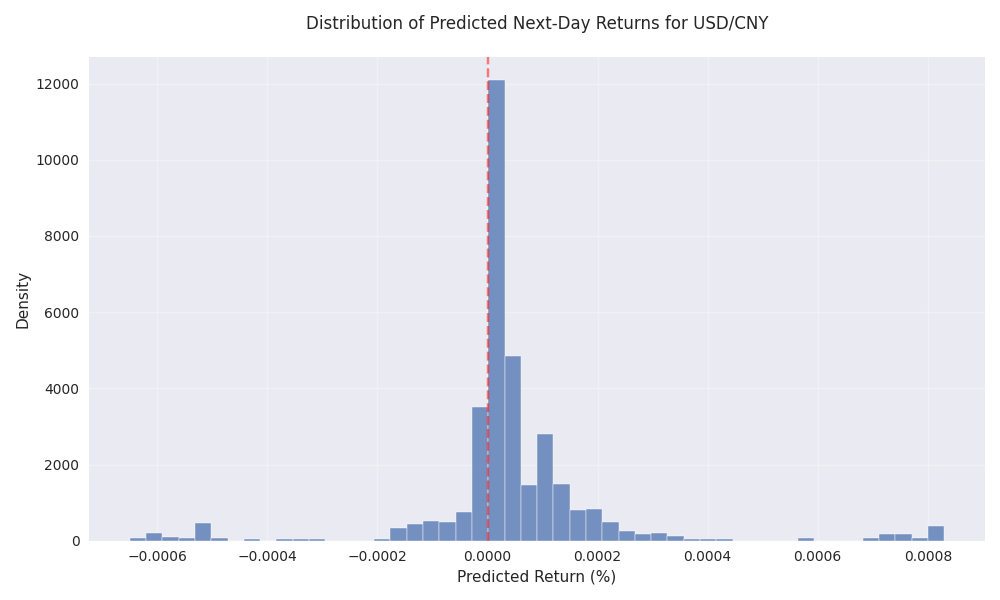

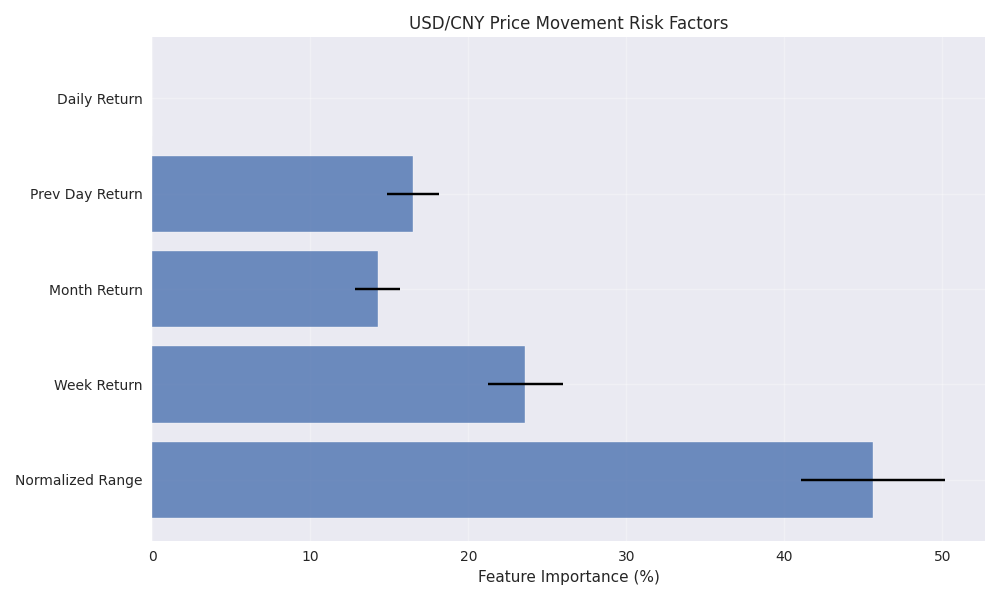

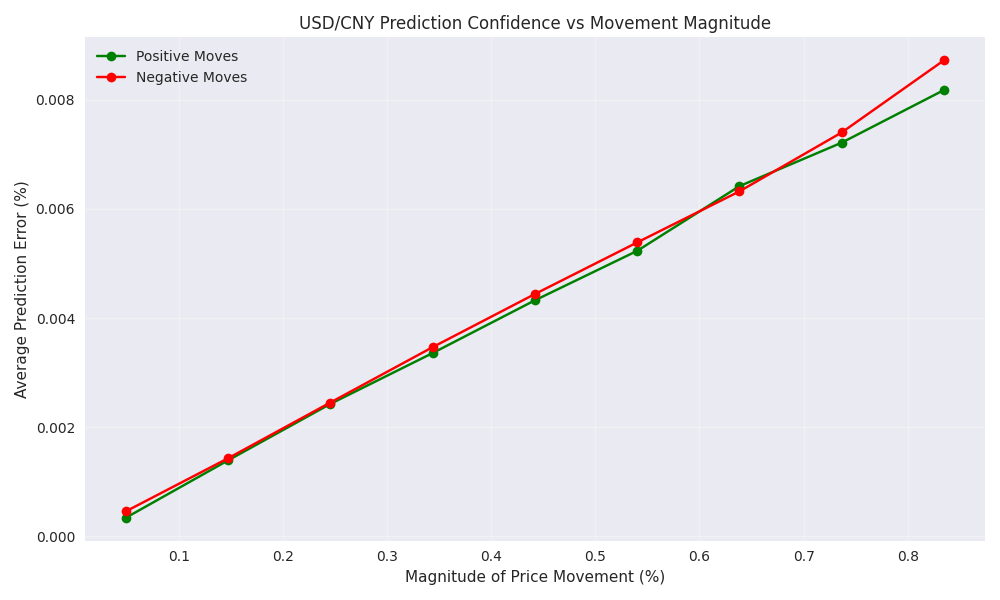

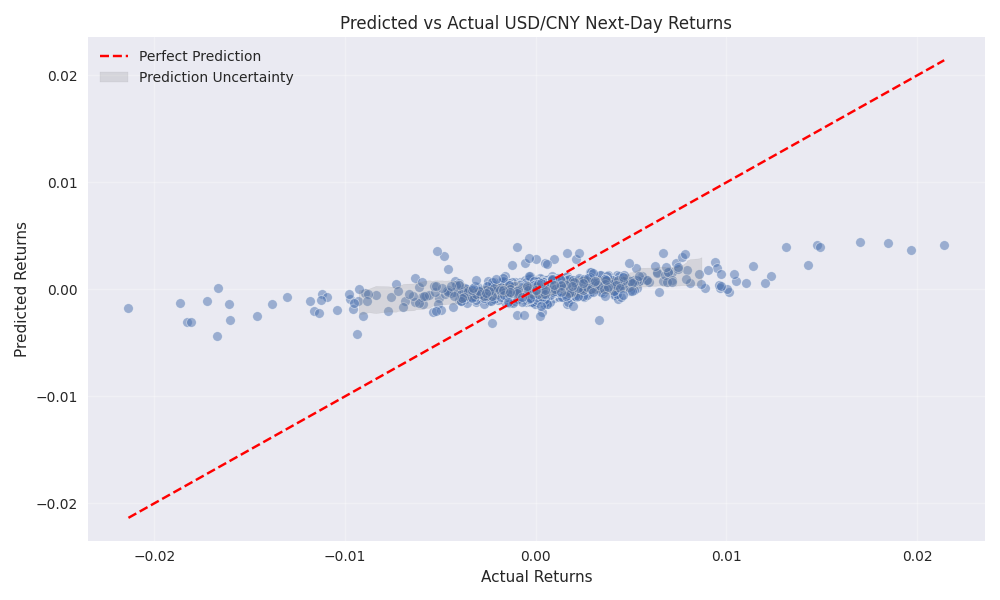

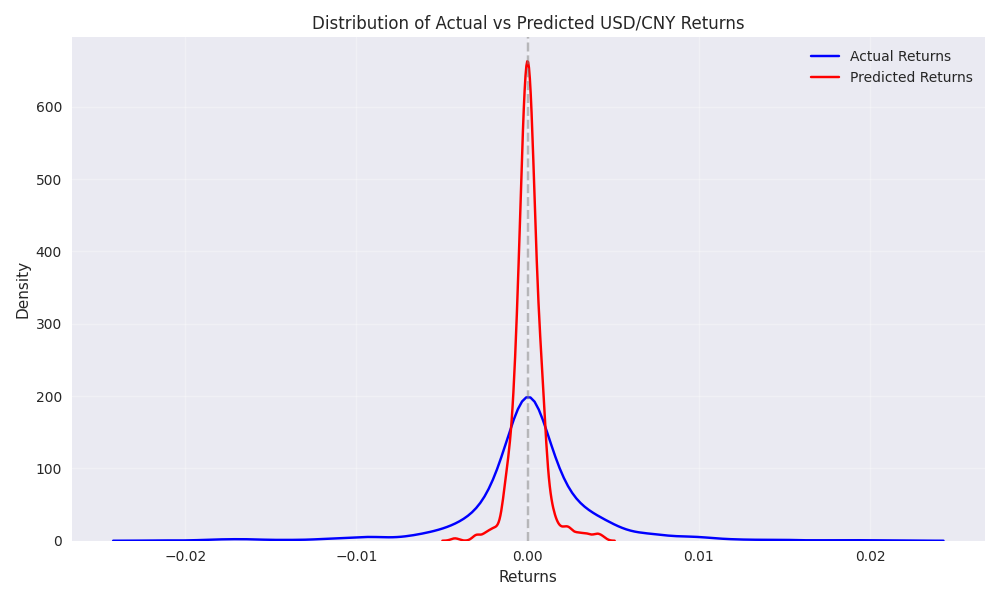

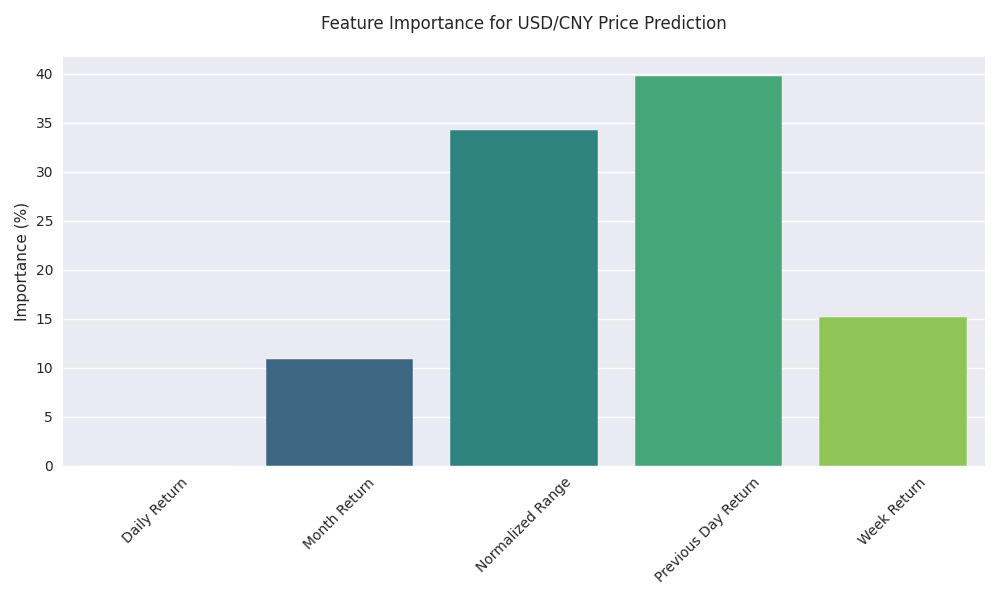

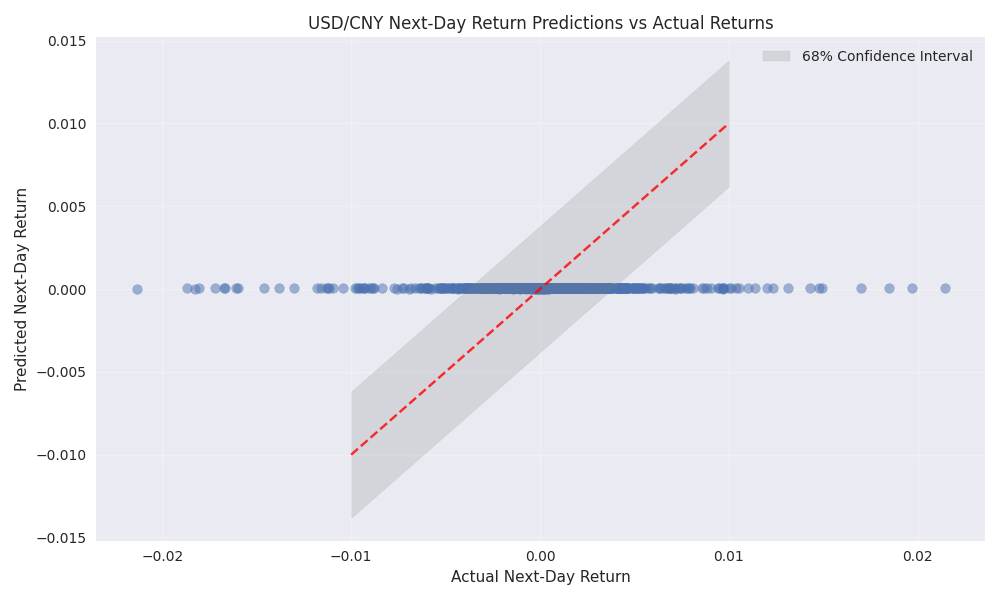

USD/CNY Prediction Confidence and Risk Analysis

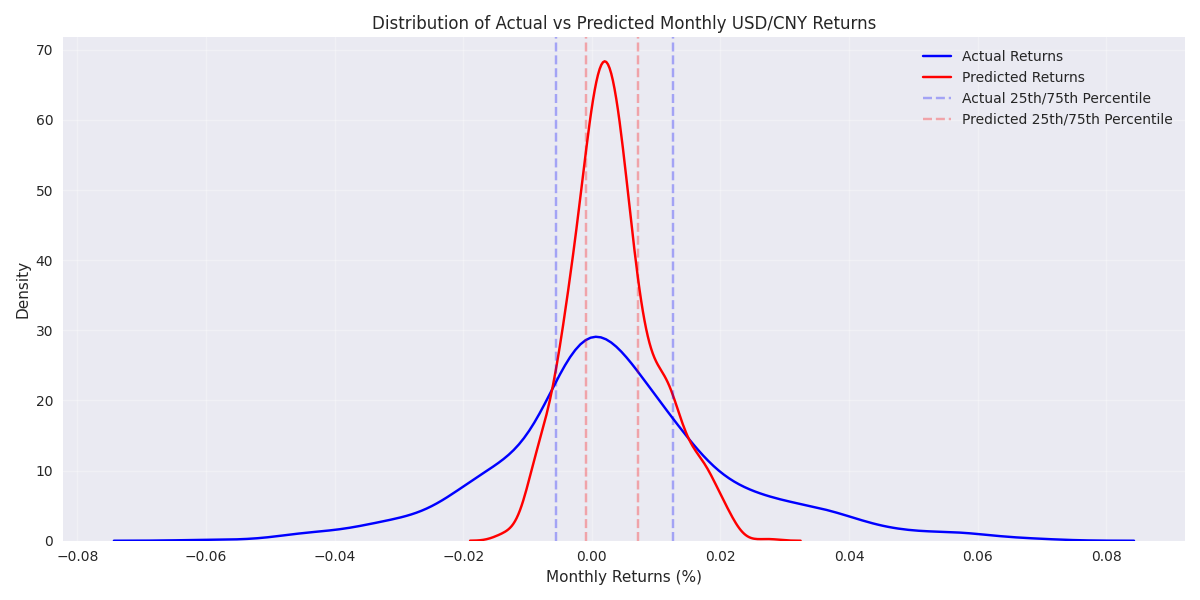

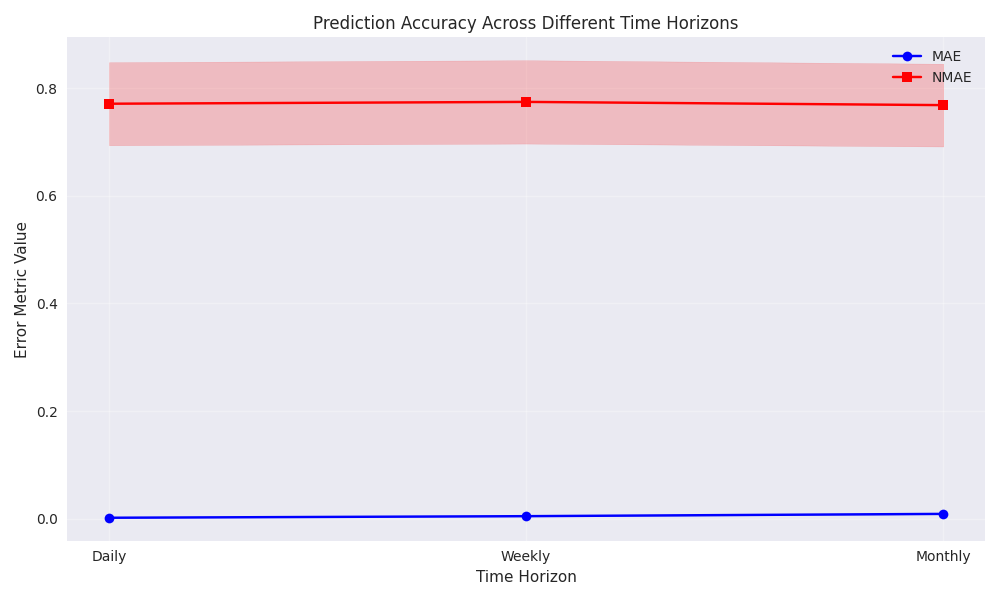

Multi-Horizon USD/CNY Price Prediction Analysis

Long-term USD/CNY Price Movement Analysis and Risk Assessment