Saving...

EUR/JPY Market Pulse: Traders' Quick Guide to Currency Movements and Opportunities

Saving...

Saving...

Saving...

Saving...

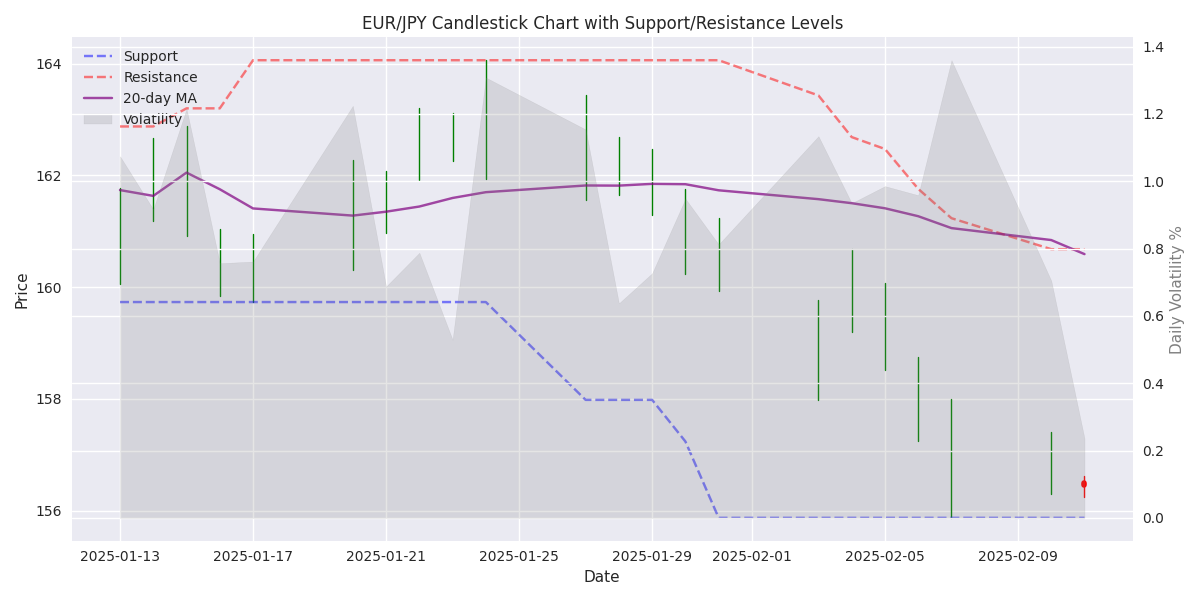

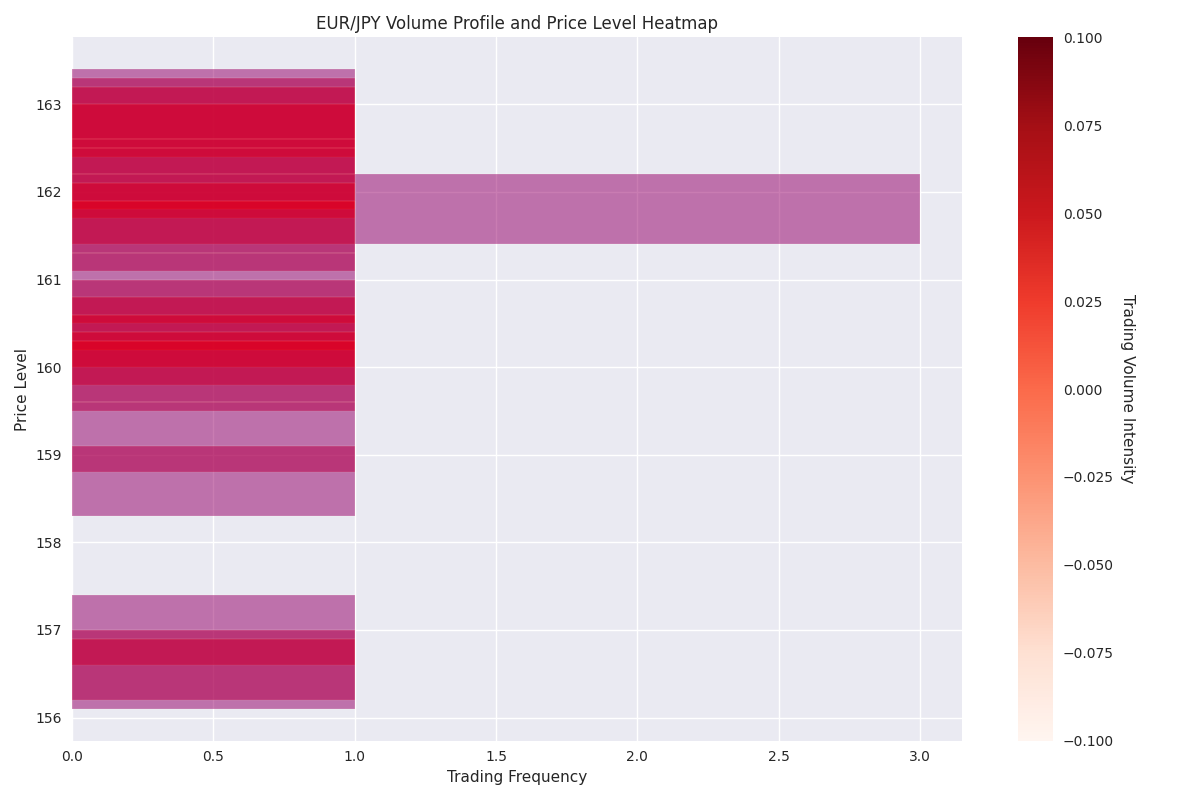

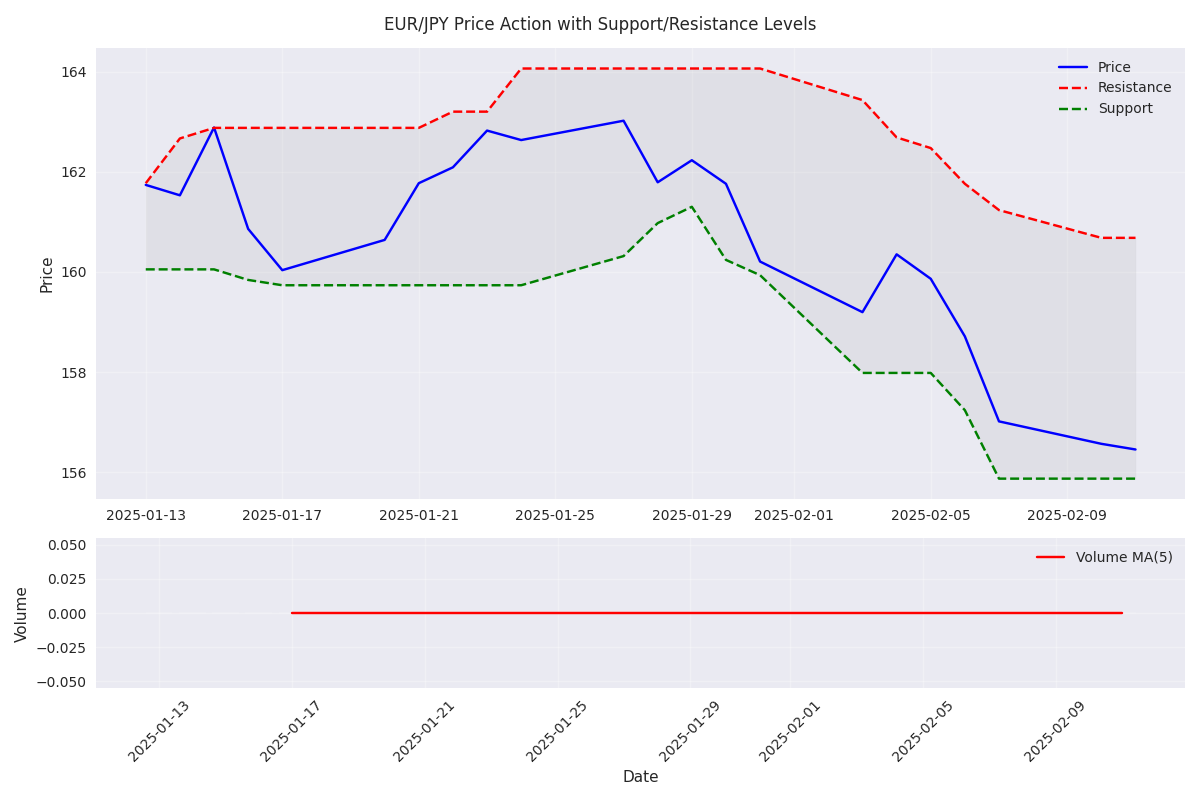

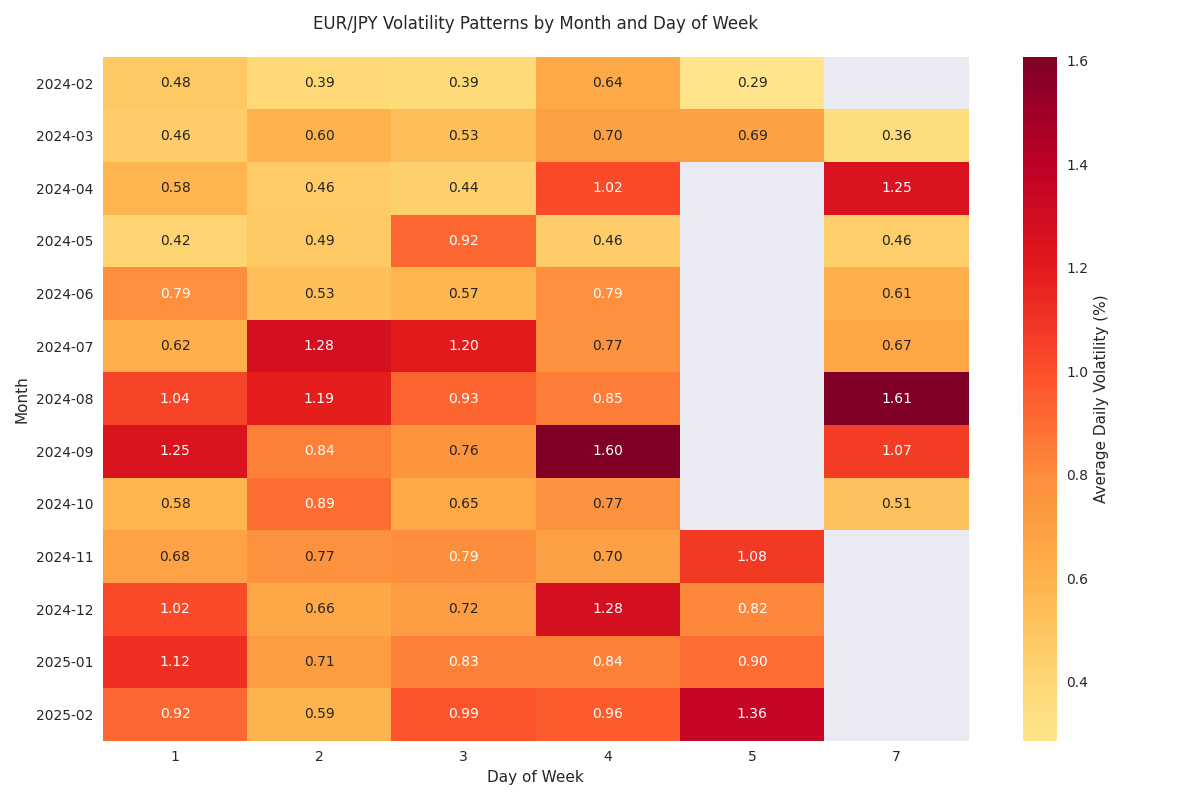

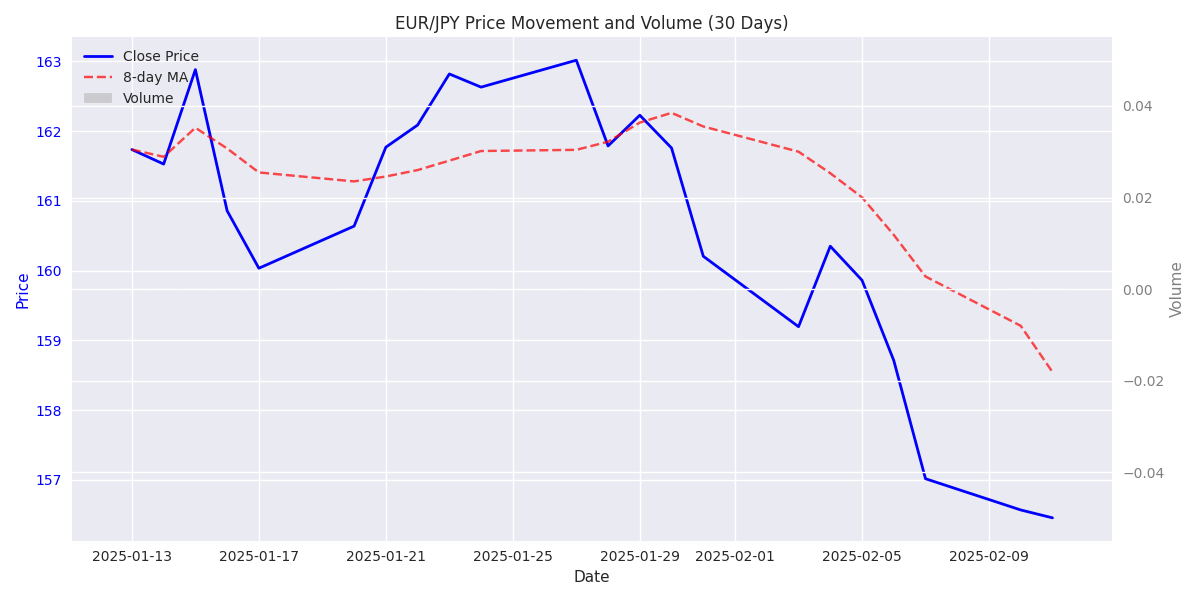

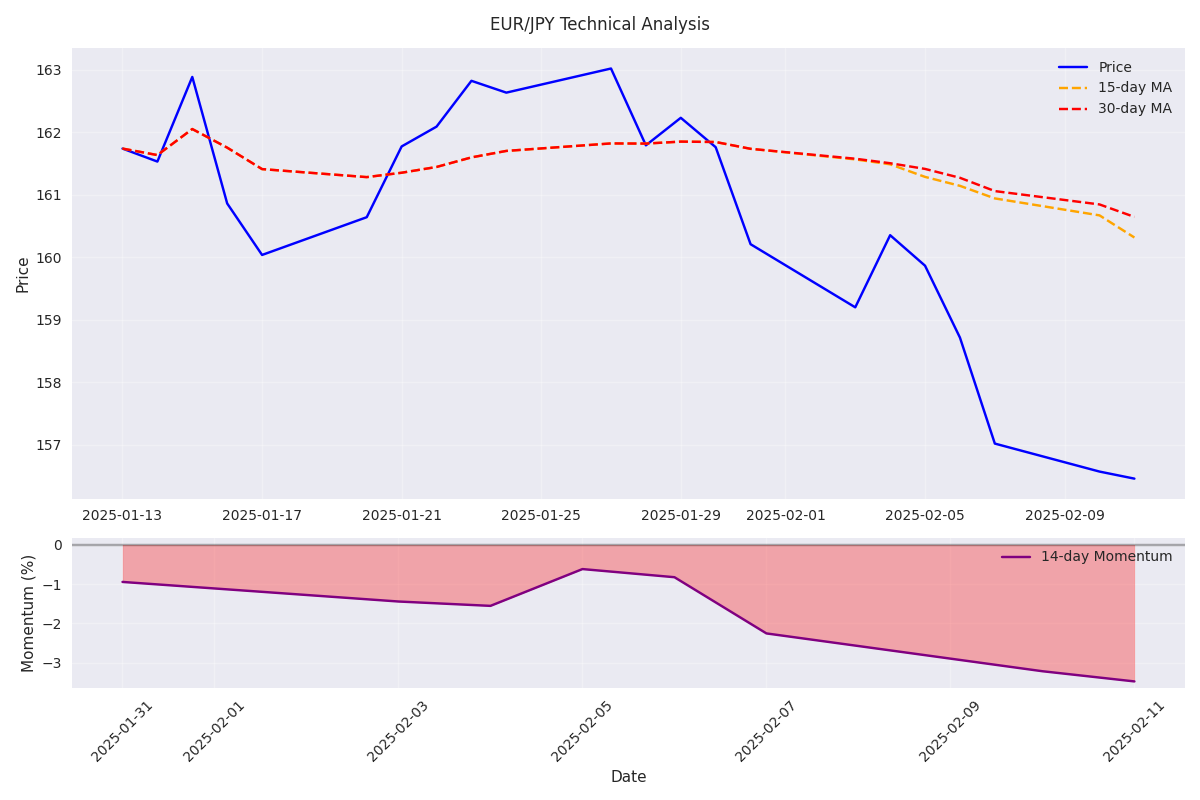

EUR/JPY Analysis: Bearish Trend with Increasing Volatility

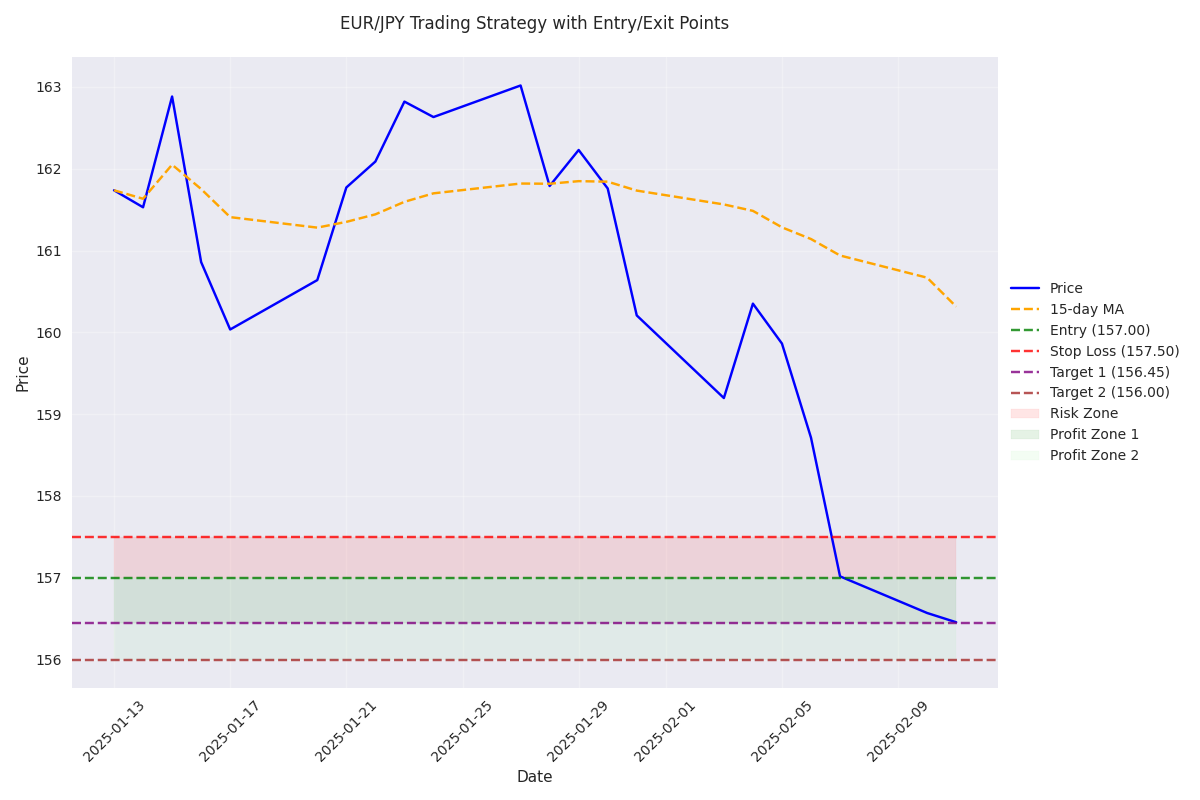

EUR/JPY Trading Signals: Persistent Bearish Momentum with Key Technical Levels

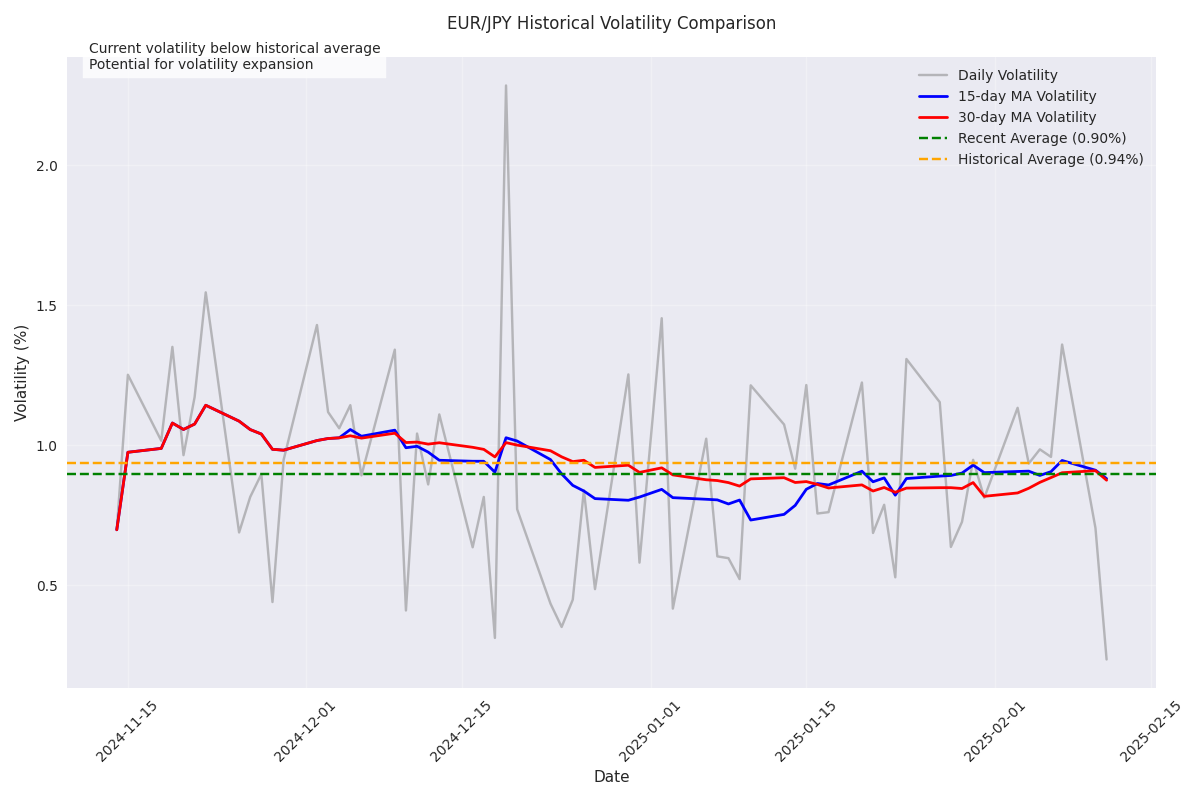

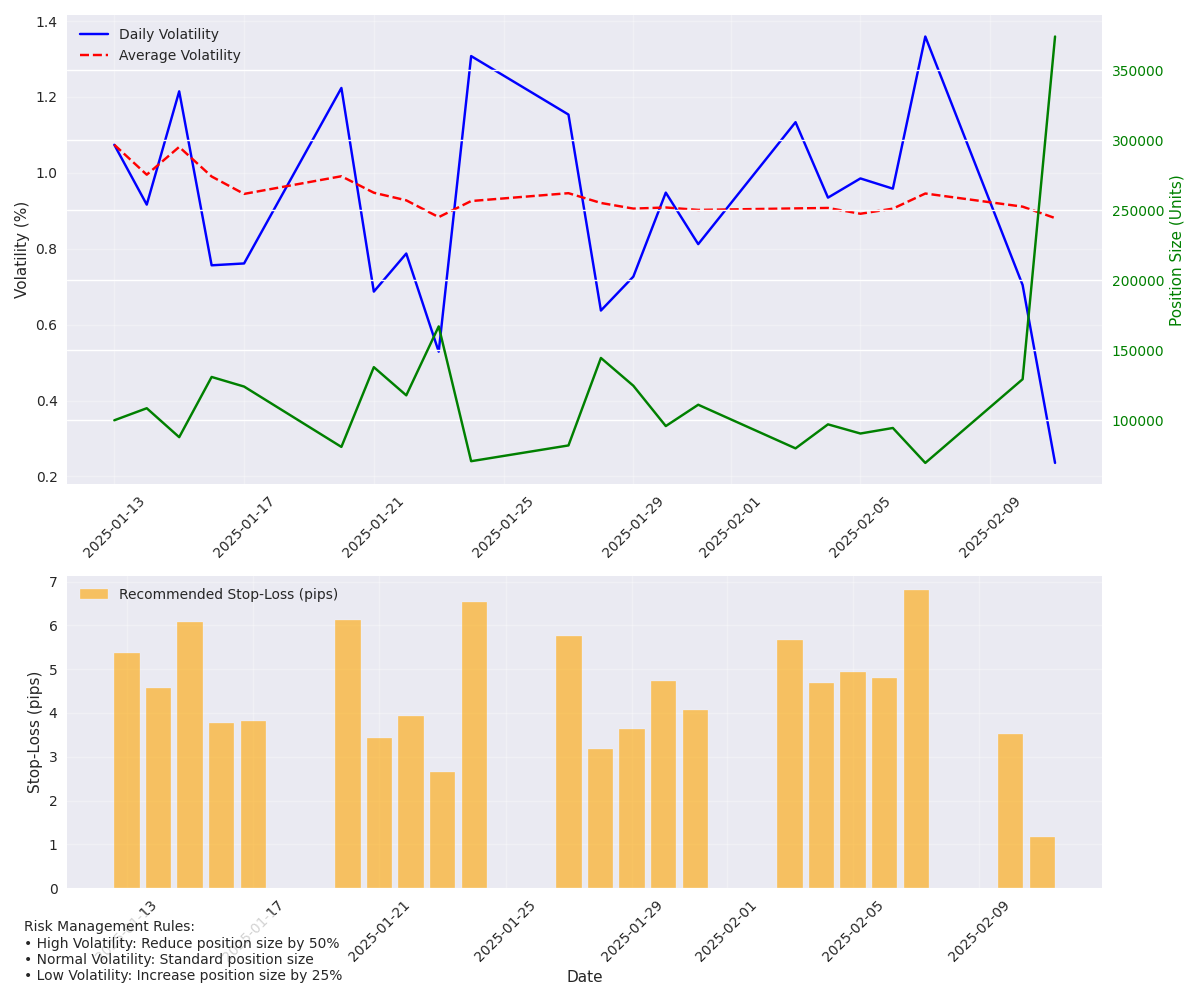

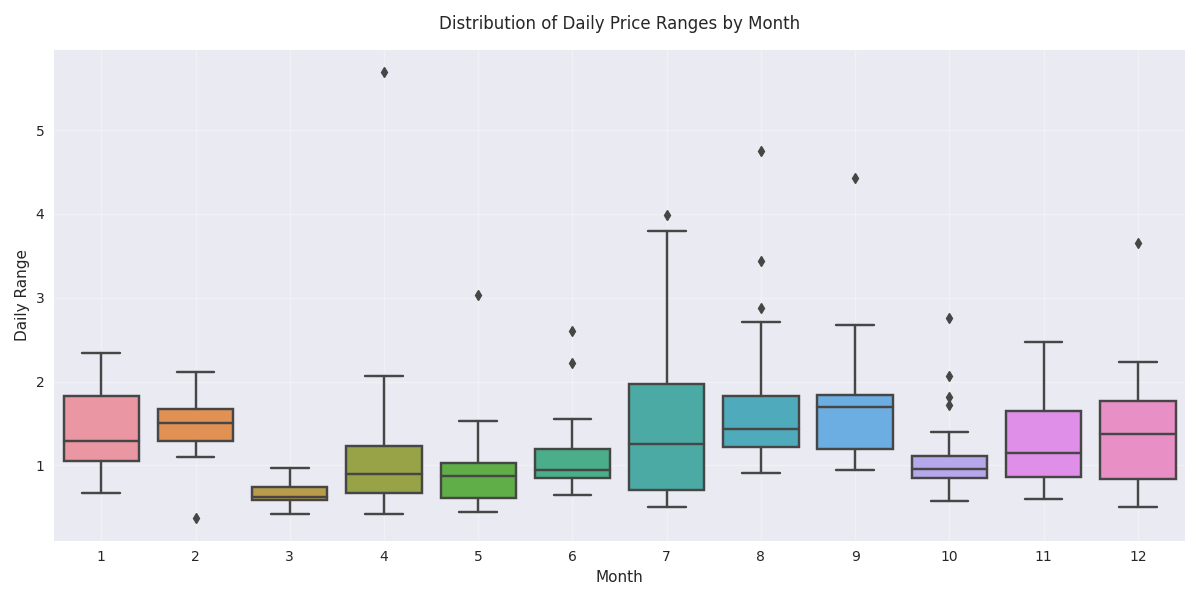

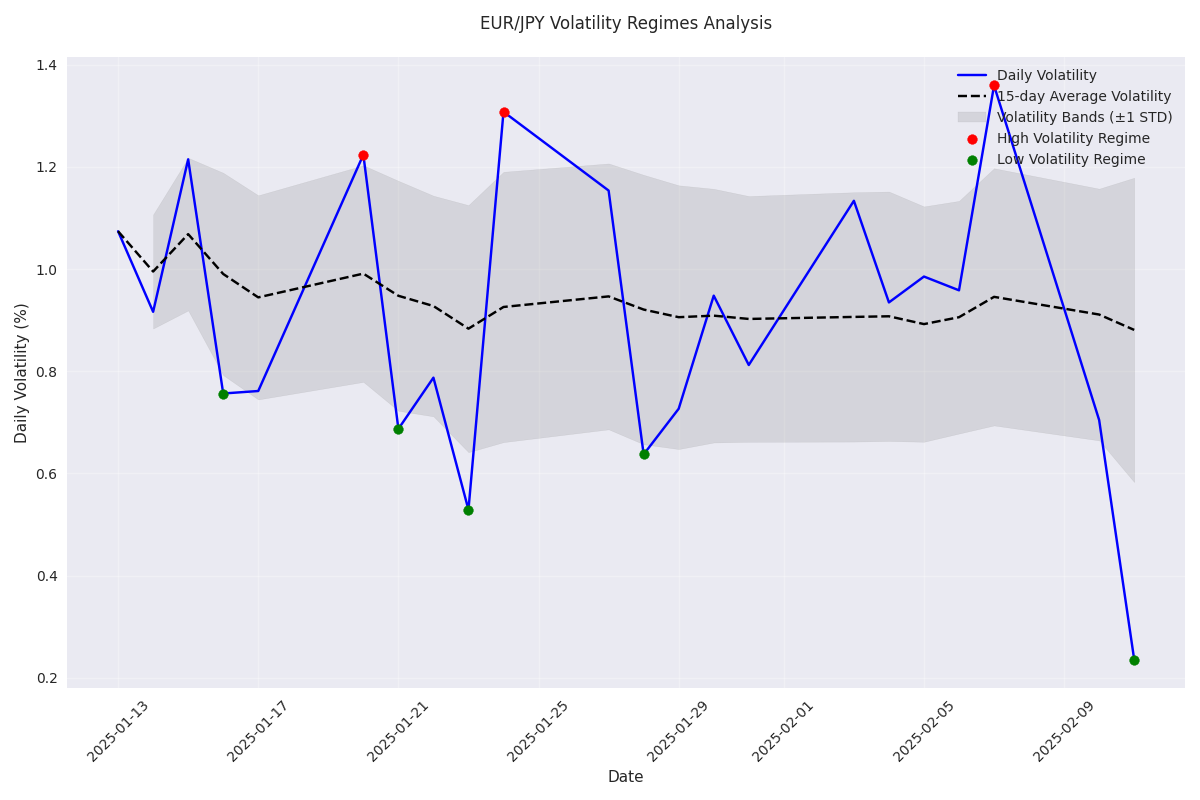

EUR/JPY Volatility Analysis: Risk Management Implications

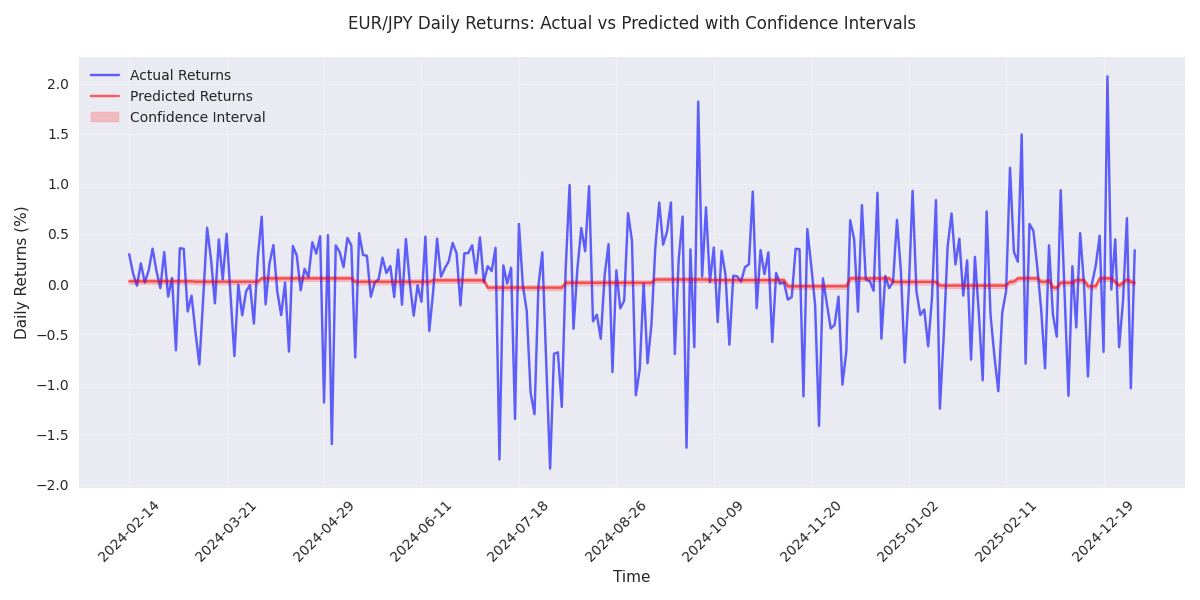

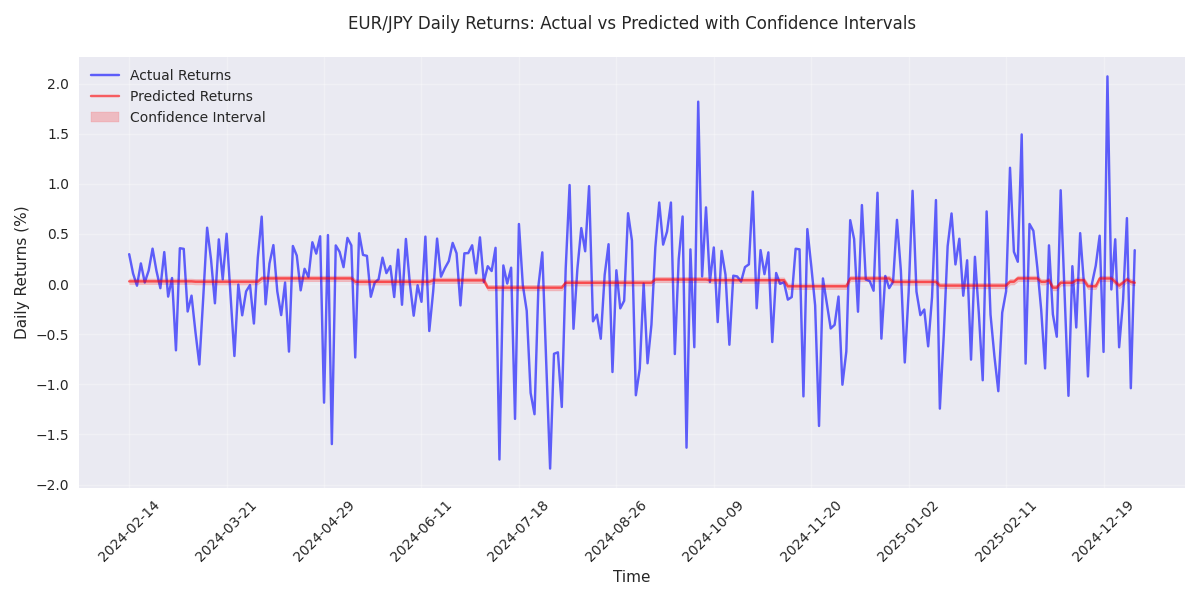

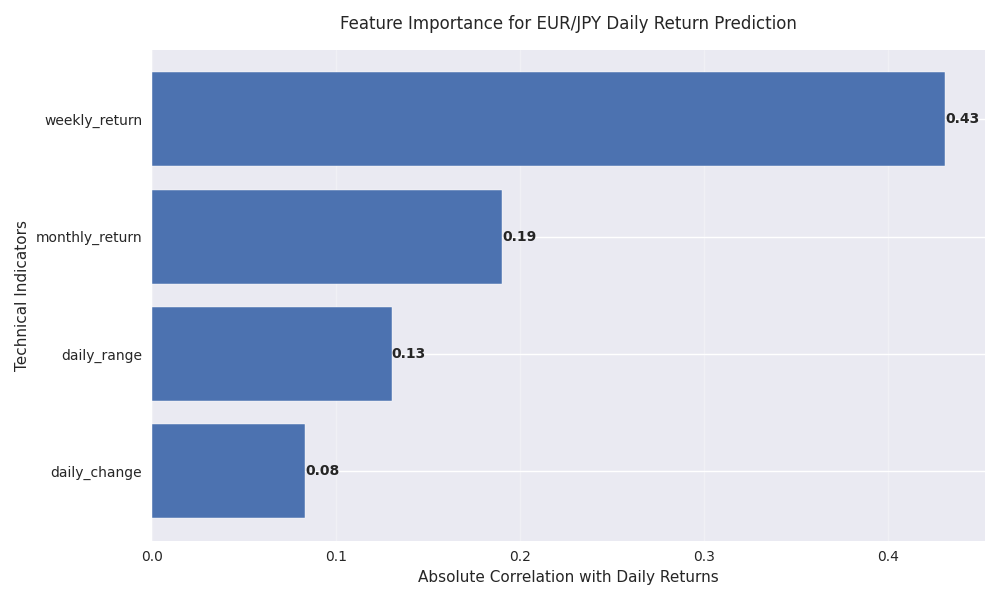

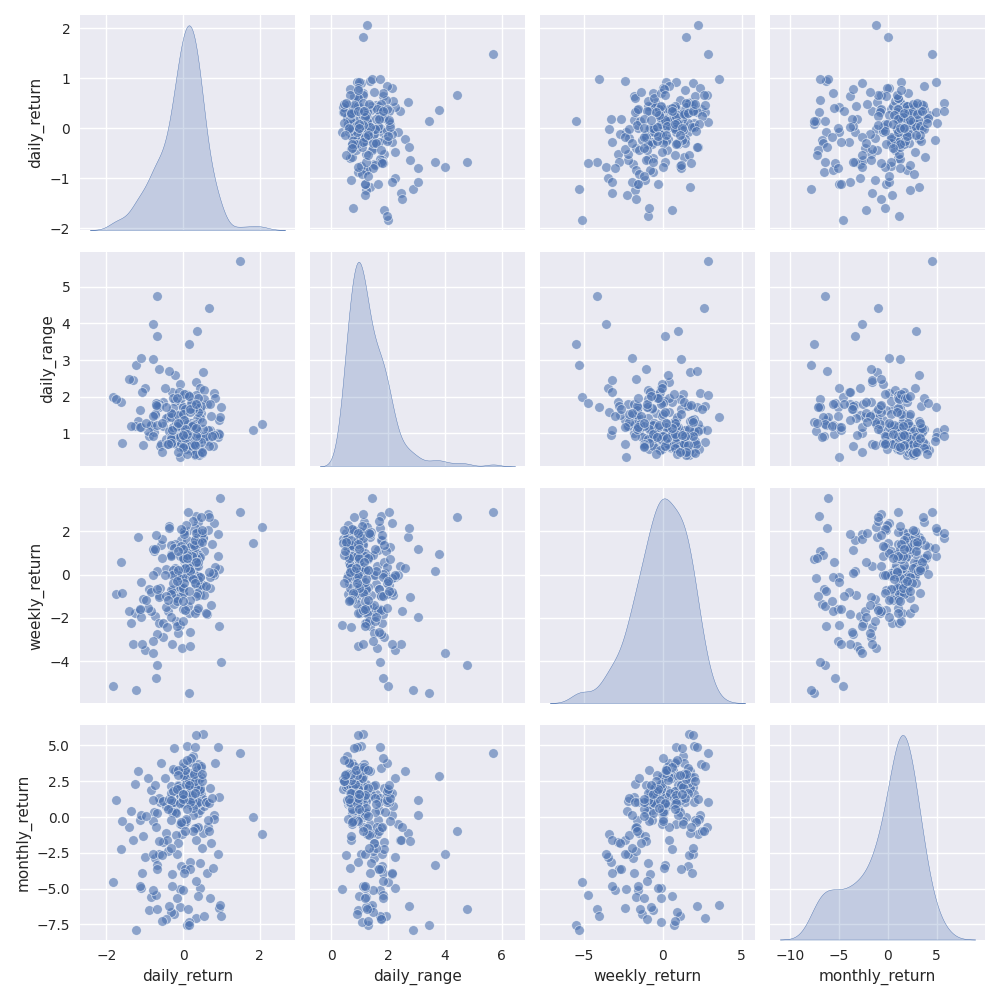

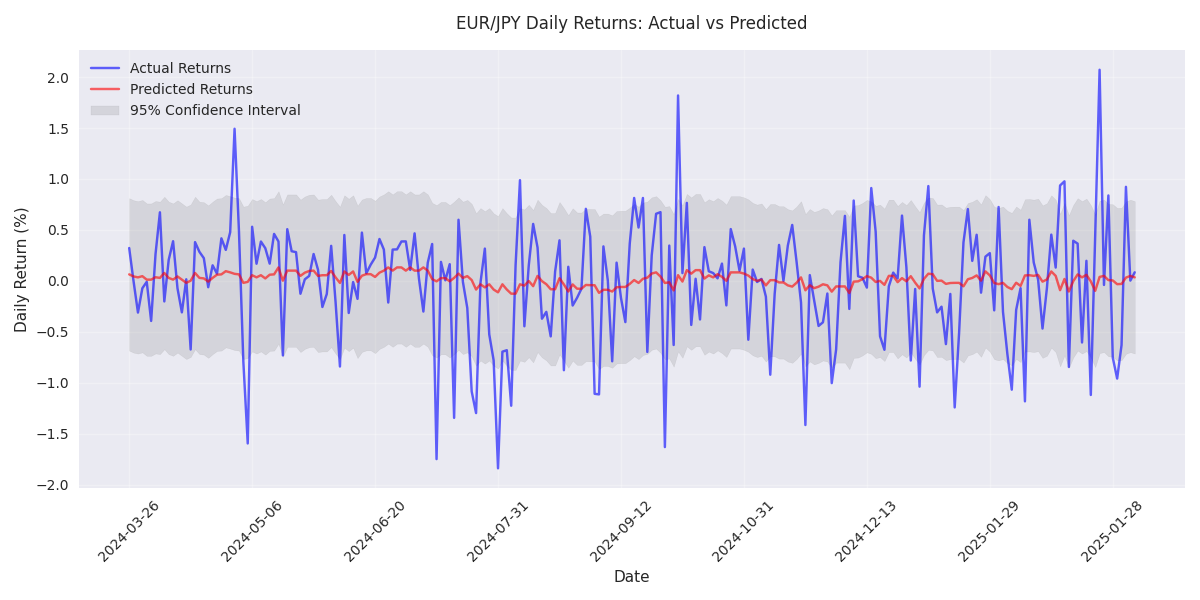

EUR/JPY Price Movement Analysis and Predictions

EUR/JPY Short-term Price Forecasts and Risk Analysis