Saving...

Cotton Market Breaks Silence: Traders' Quick Guide to Emerging Price Signals

Saving...

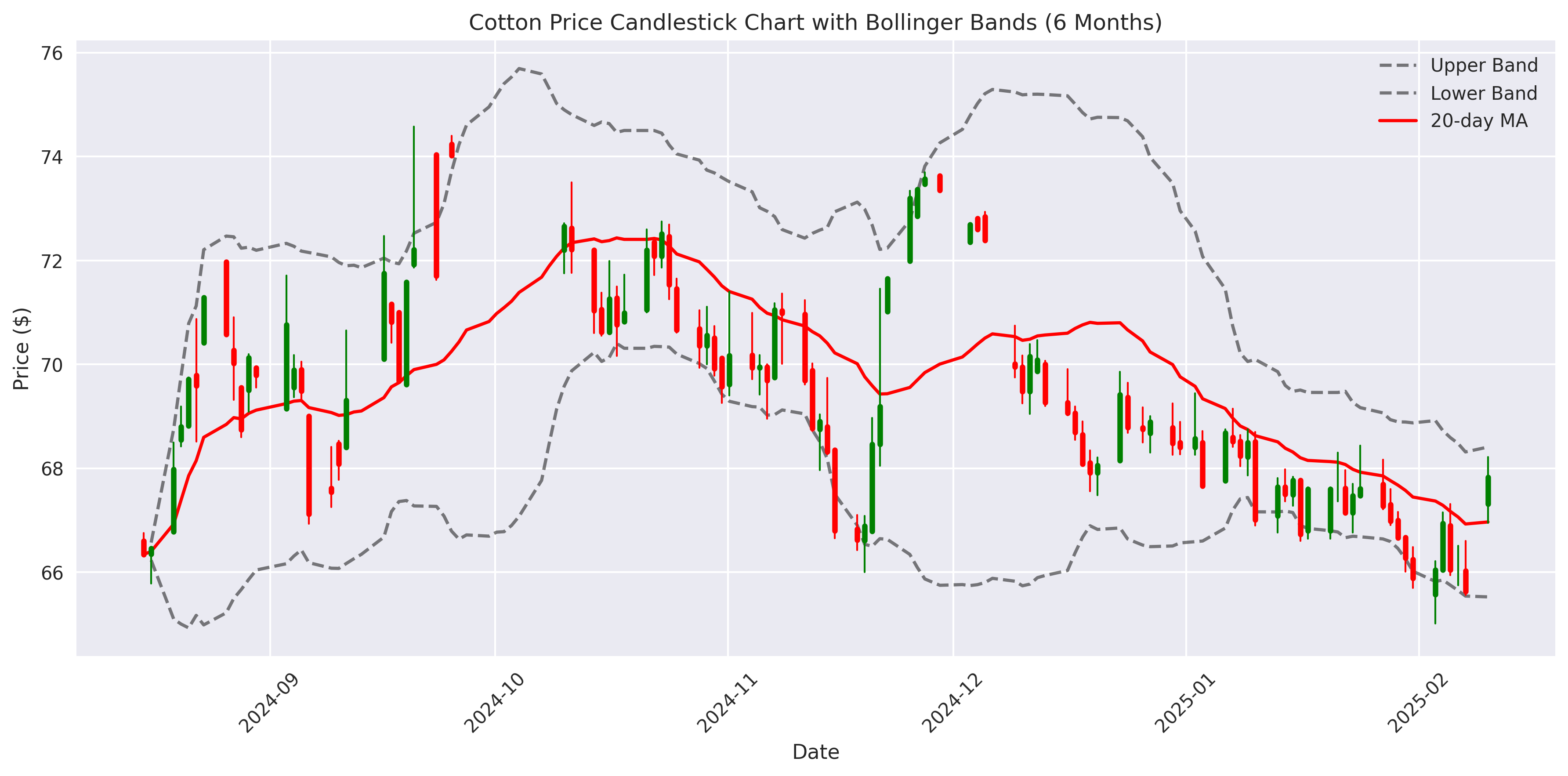

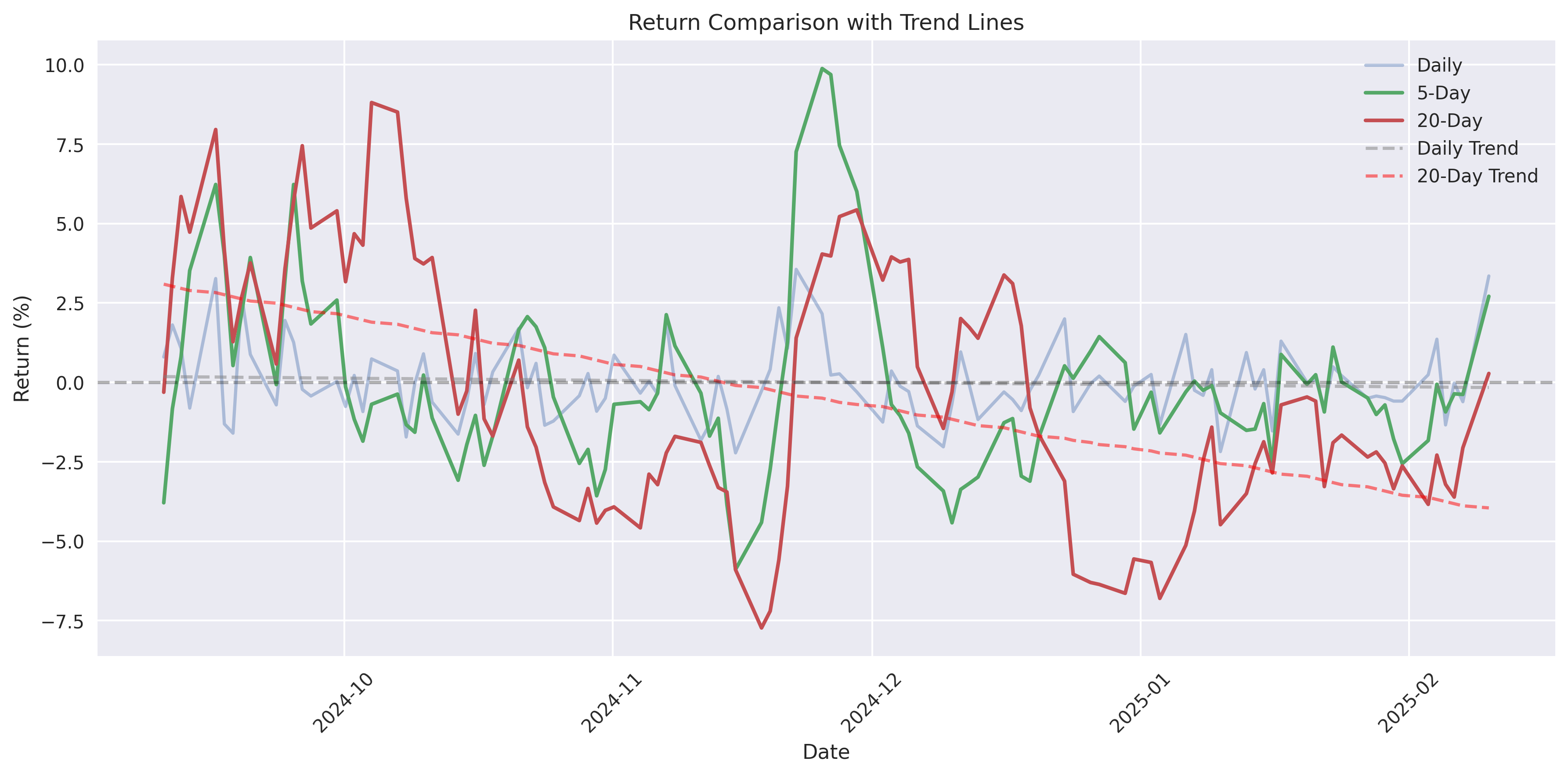

Cotton Shows Strong Bullish Breakout Potential

Saving...

Cotton Shows Strong Bullish Breakout Potential

Saving...

Saving...

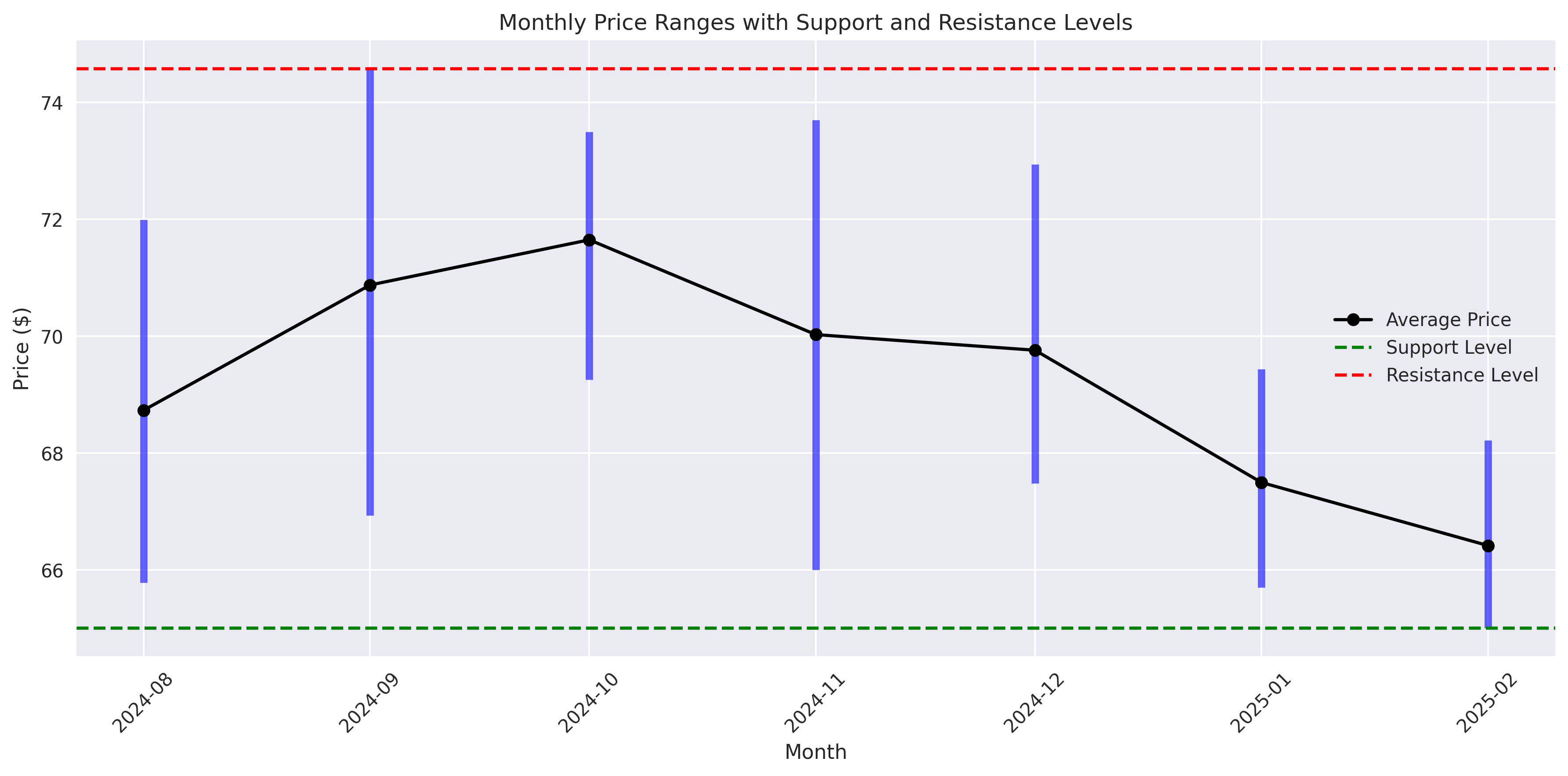

Clear Trading Range Offers Actionable Entry Points

Saving...

Clear Trading Range Offers Actionable Entry Points

Saving...

Saving...

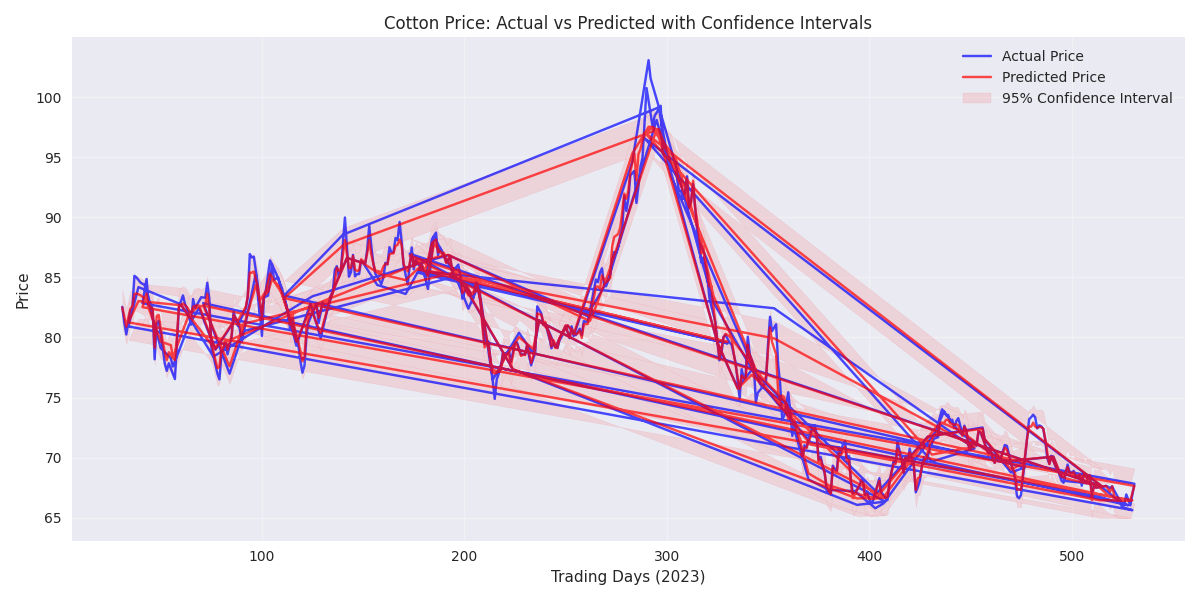

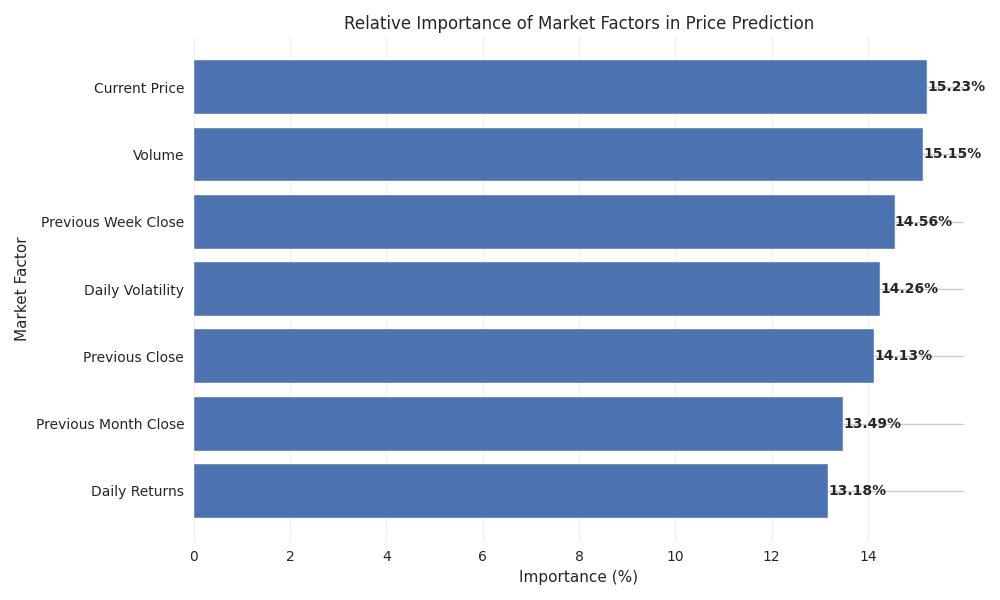

Predictive Models Signal Strong Upward Bias

Saving...

Predictive Models Signal Strong Upward Bias

Saving...

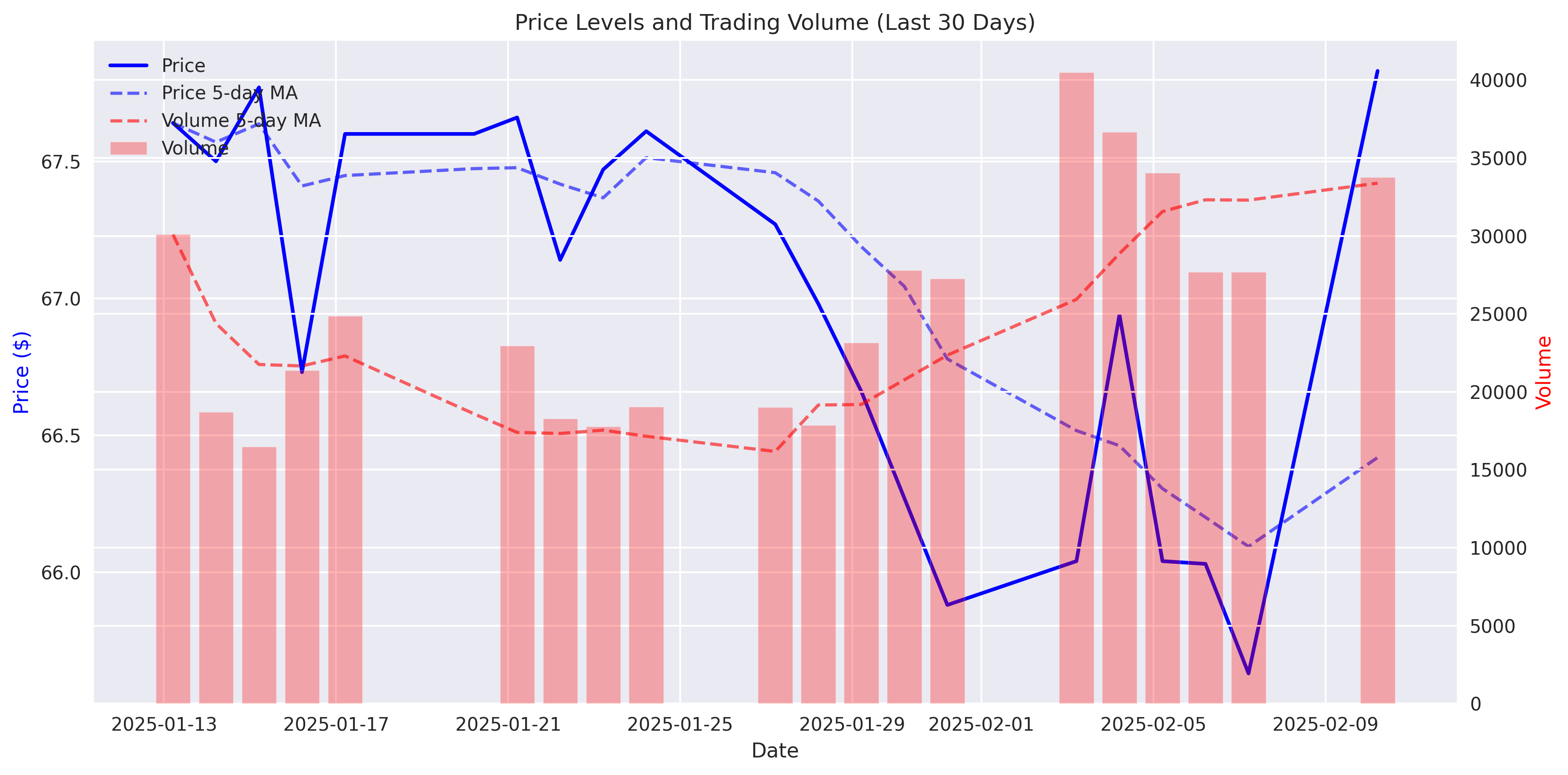

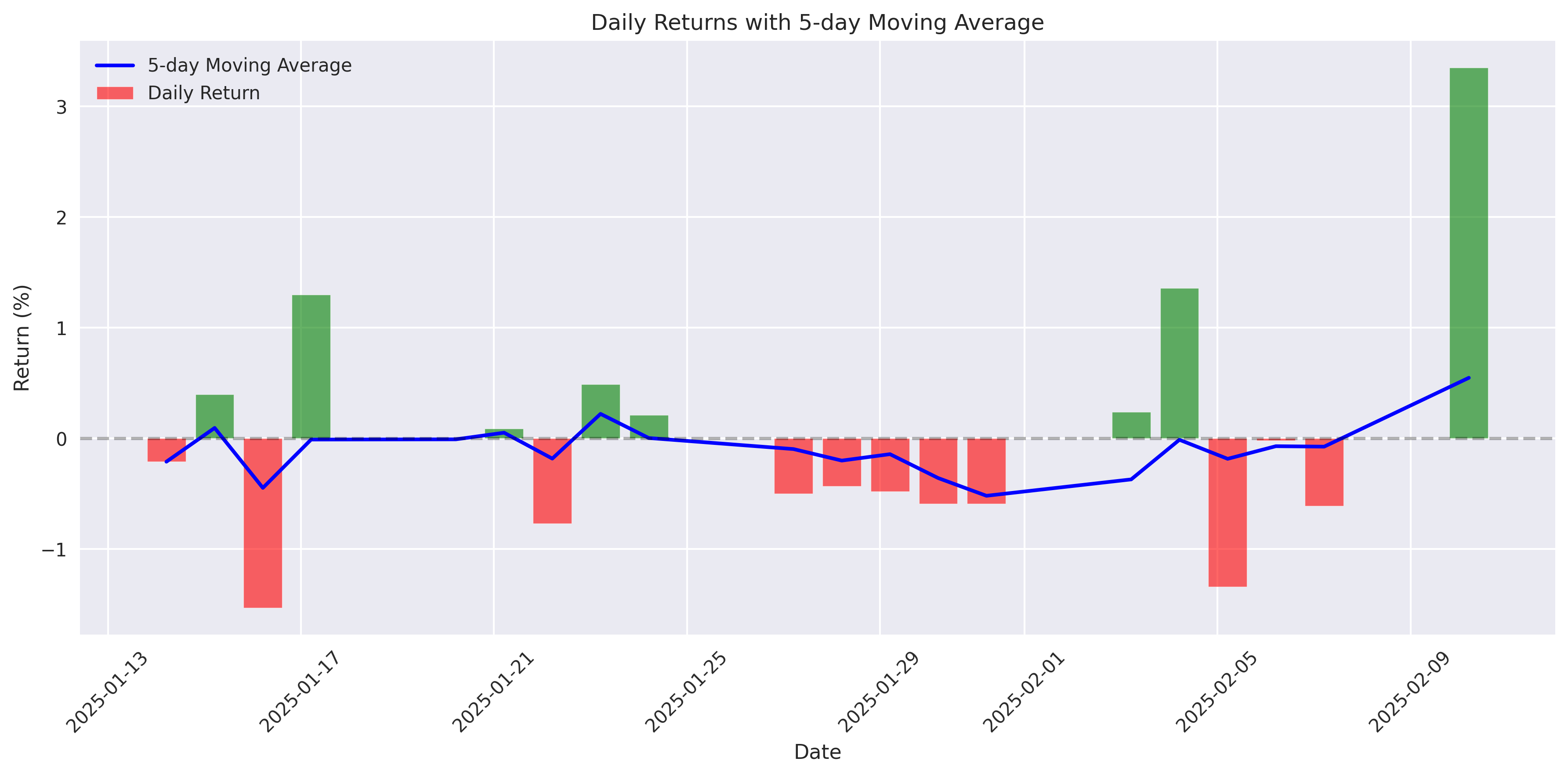

Cotton Price Shows Moderate Volatility with Recent Upward Momentum

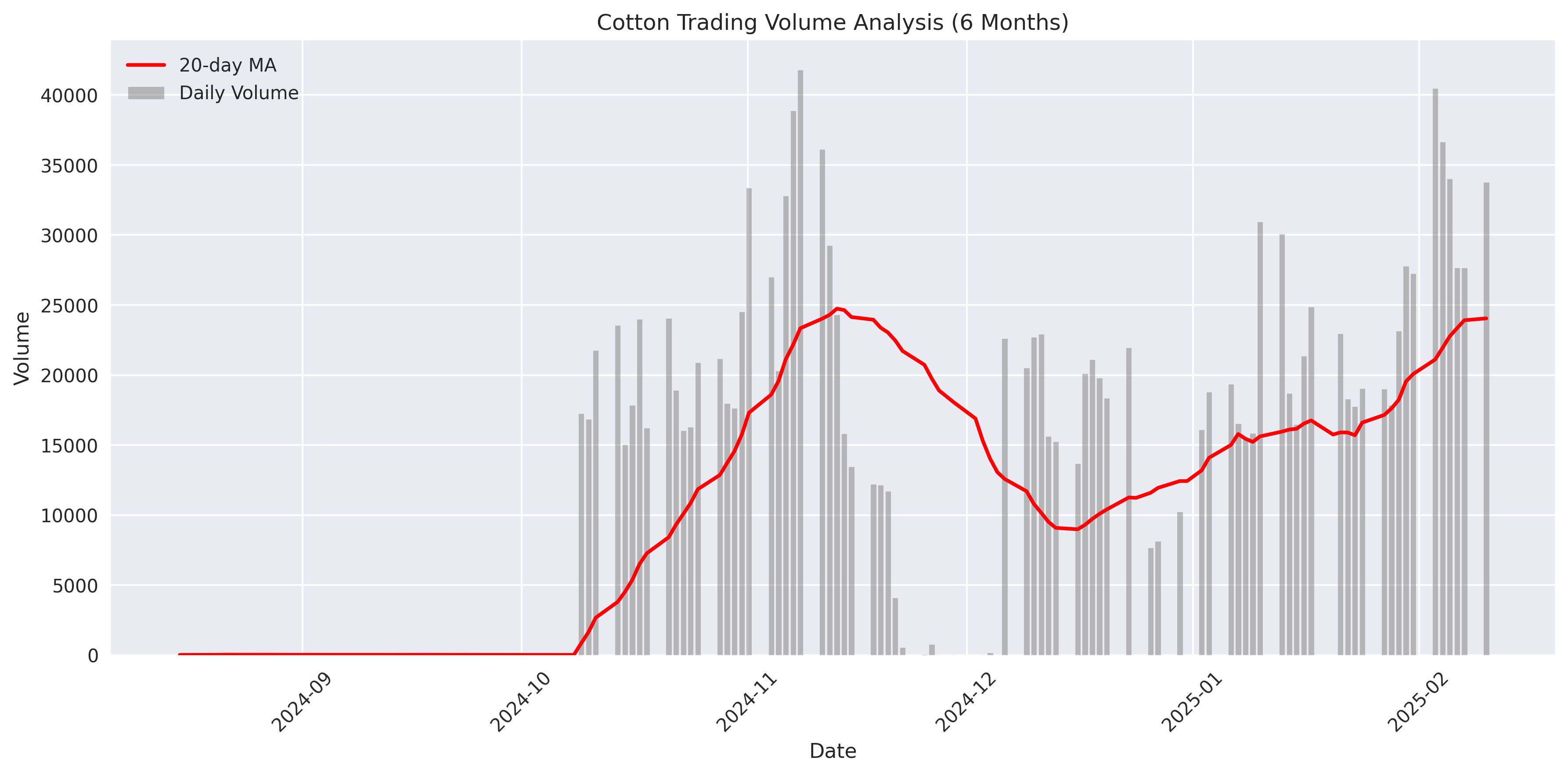

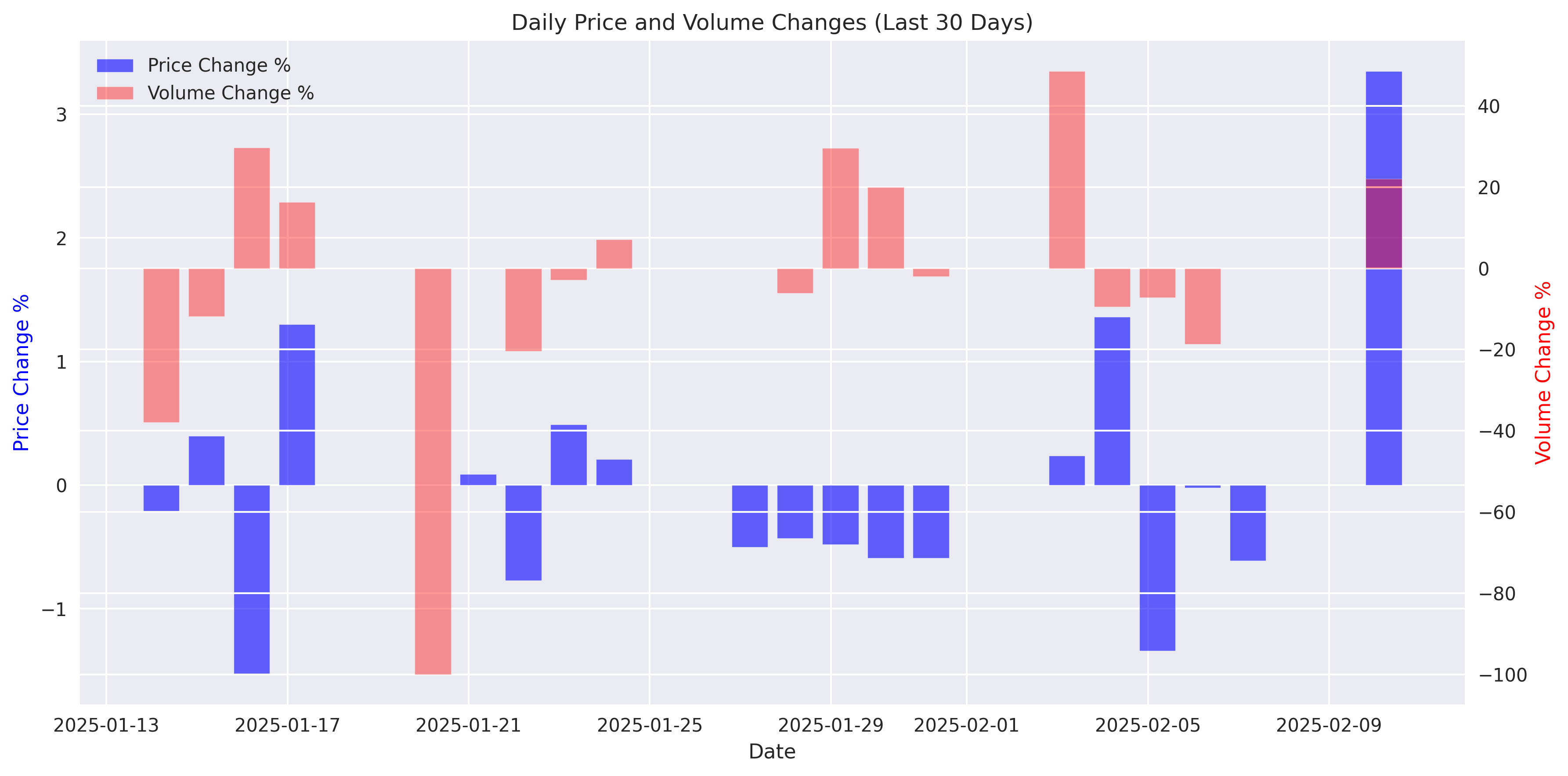

Recent Market Dynamics Show Significant Price Recovery and Volume Patterns

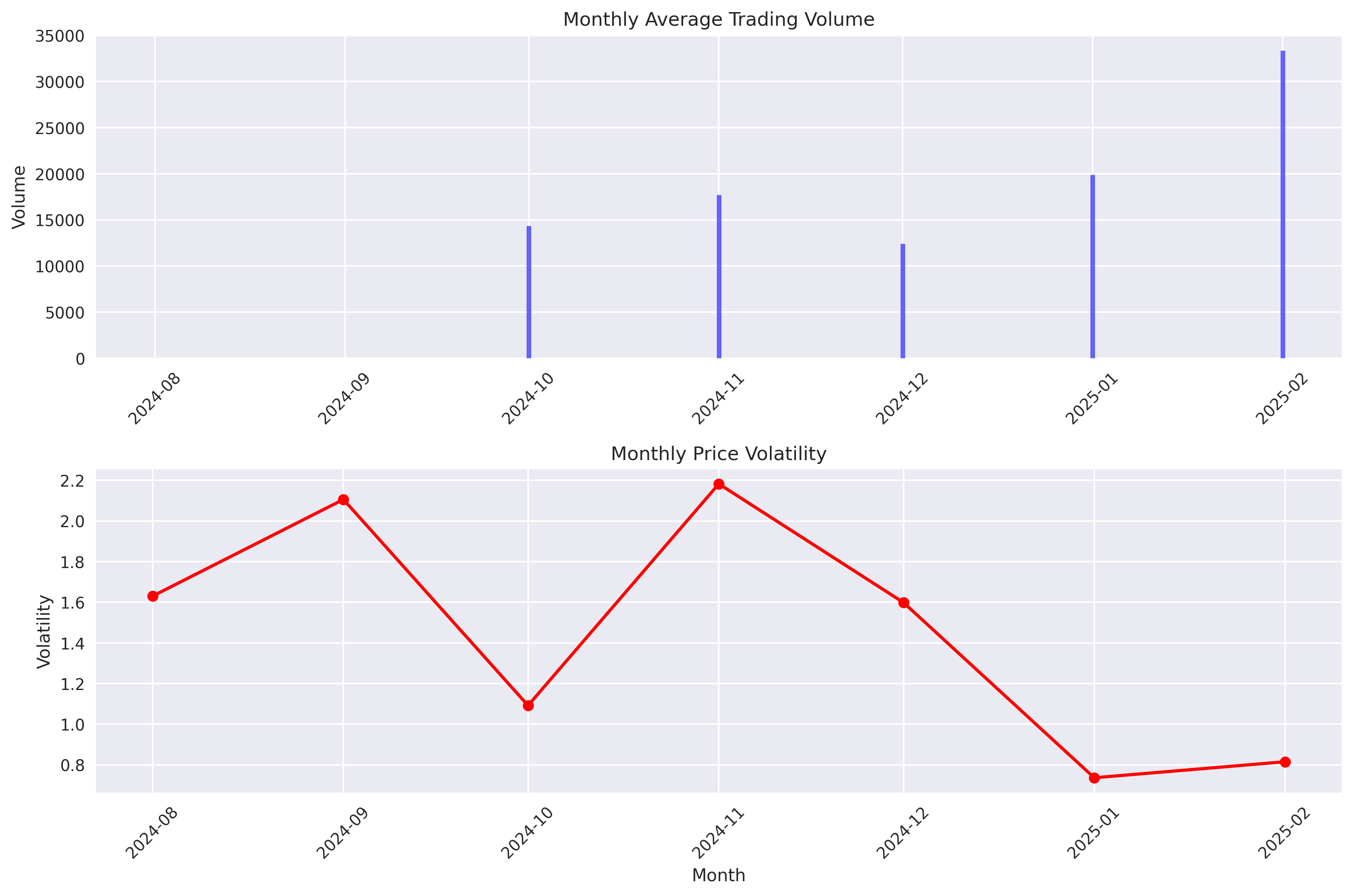

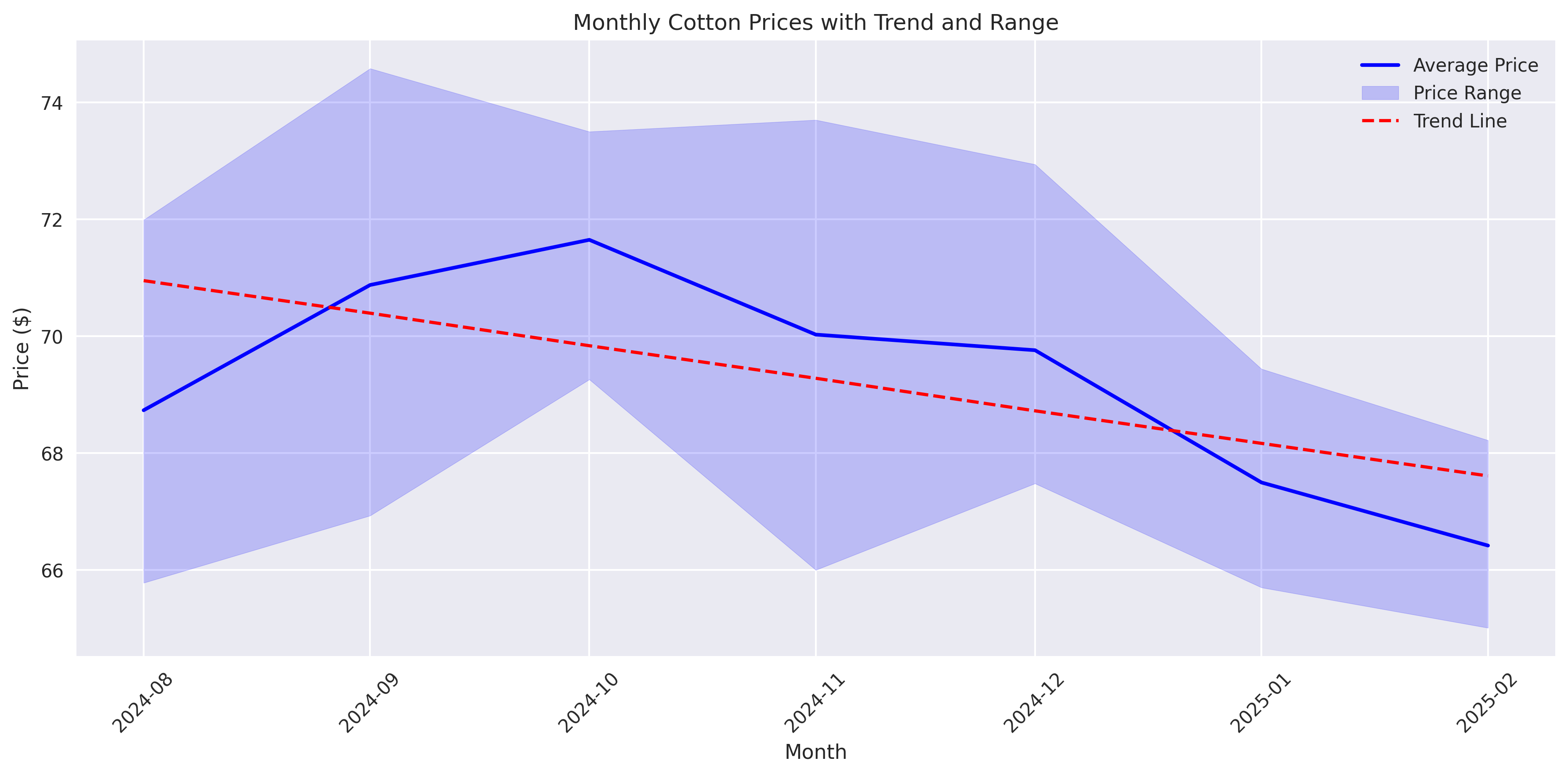

Monthly Analysis Reveals Declining Price Trend with Increasing Market Activity

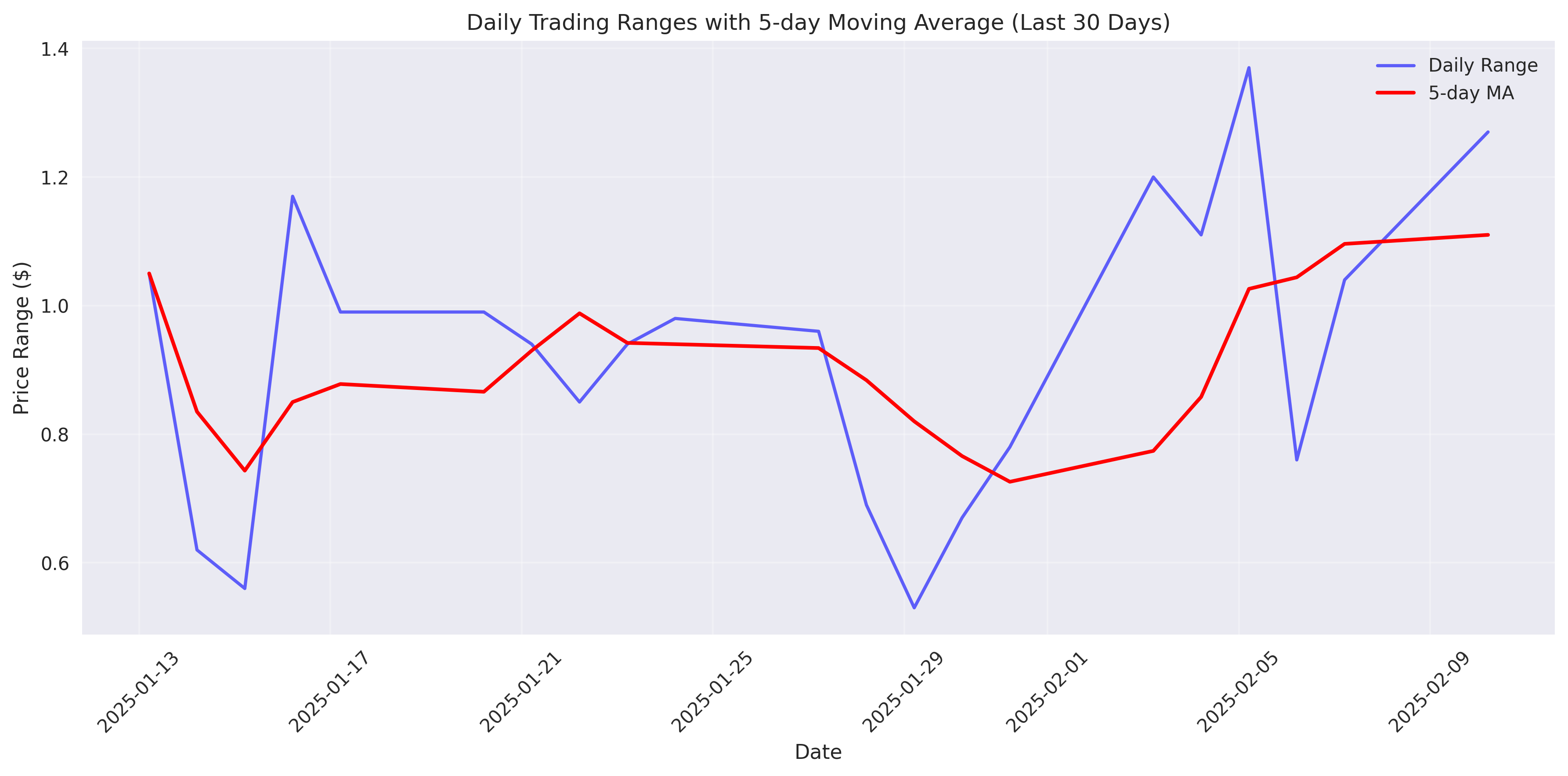

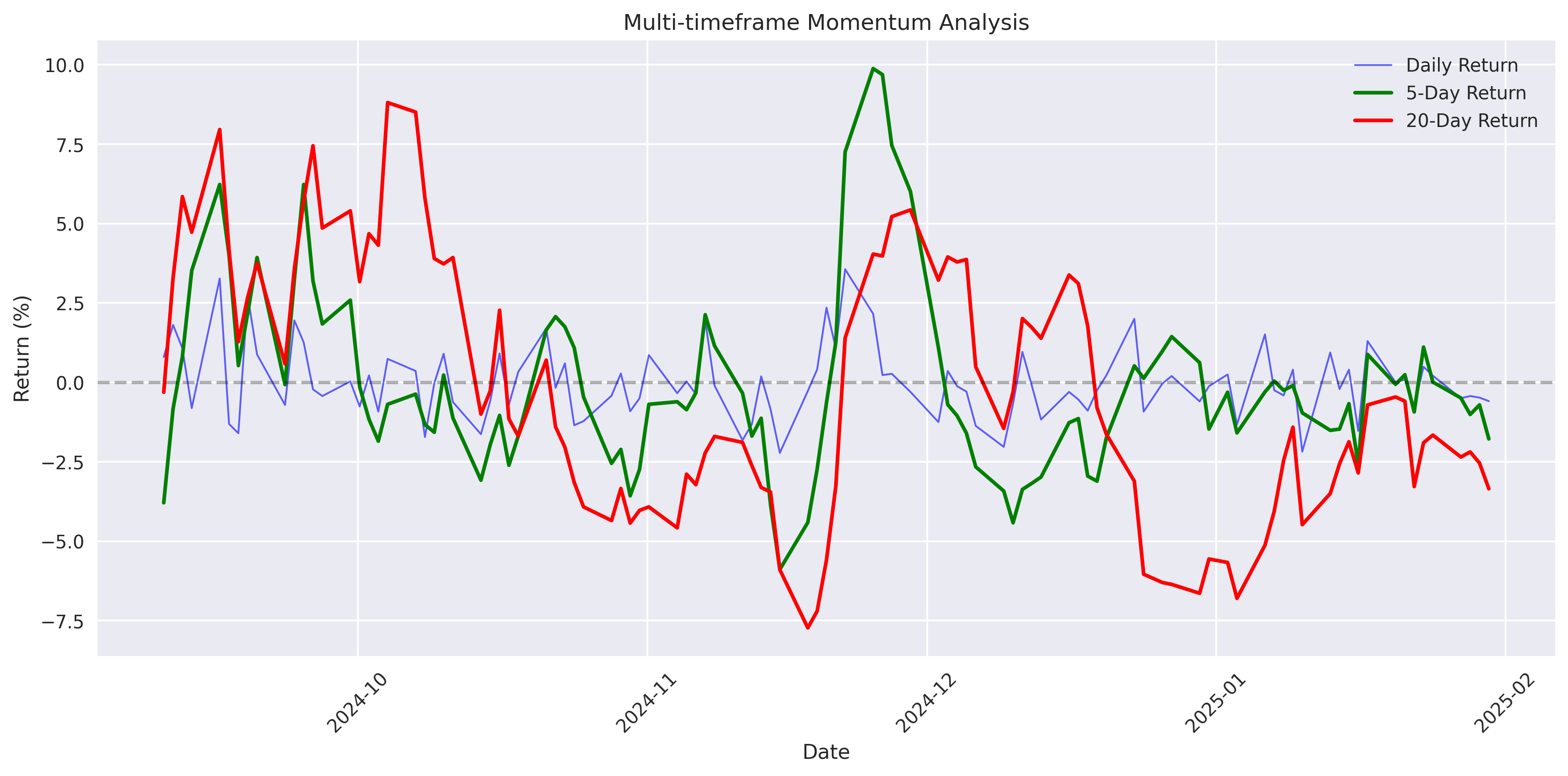

Price Momentum Analysis Shows Mixed Signals with Recent Positive Shift

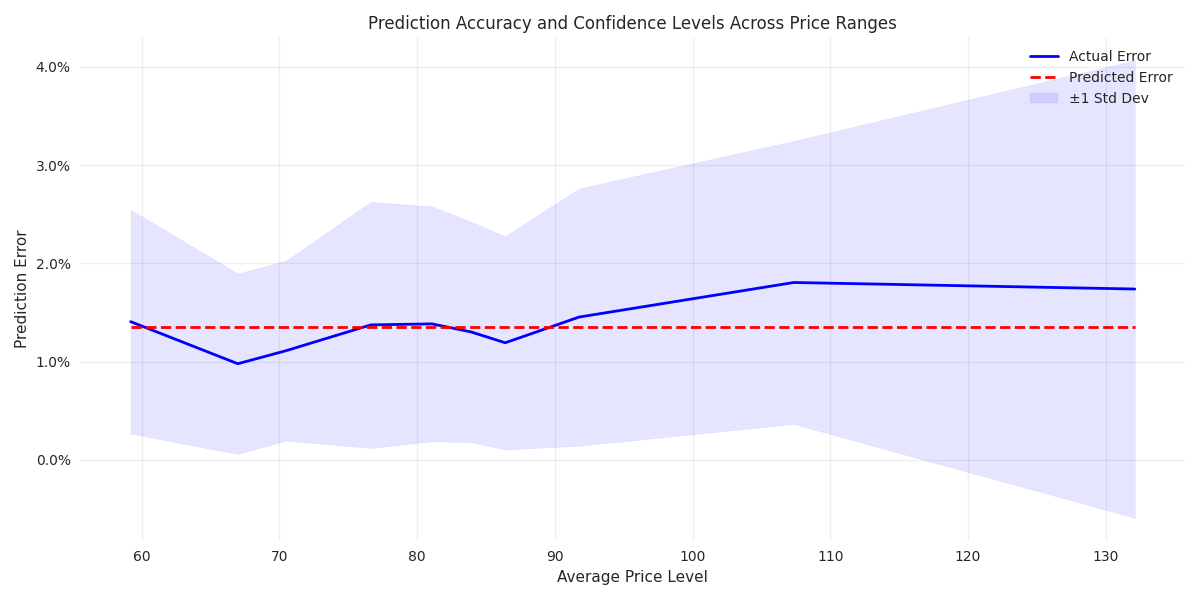

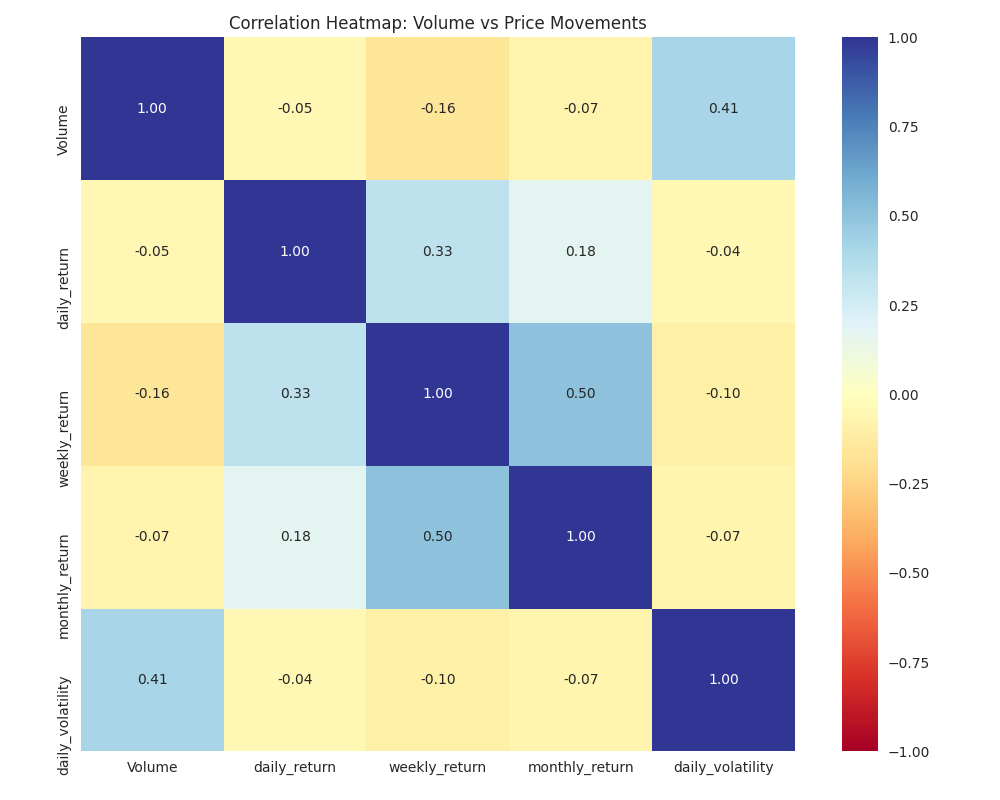

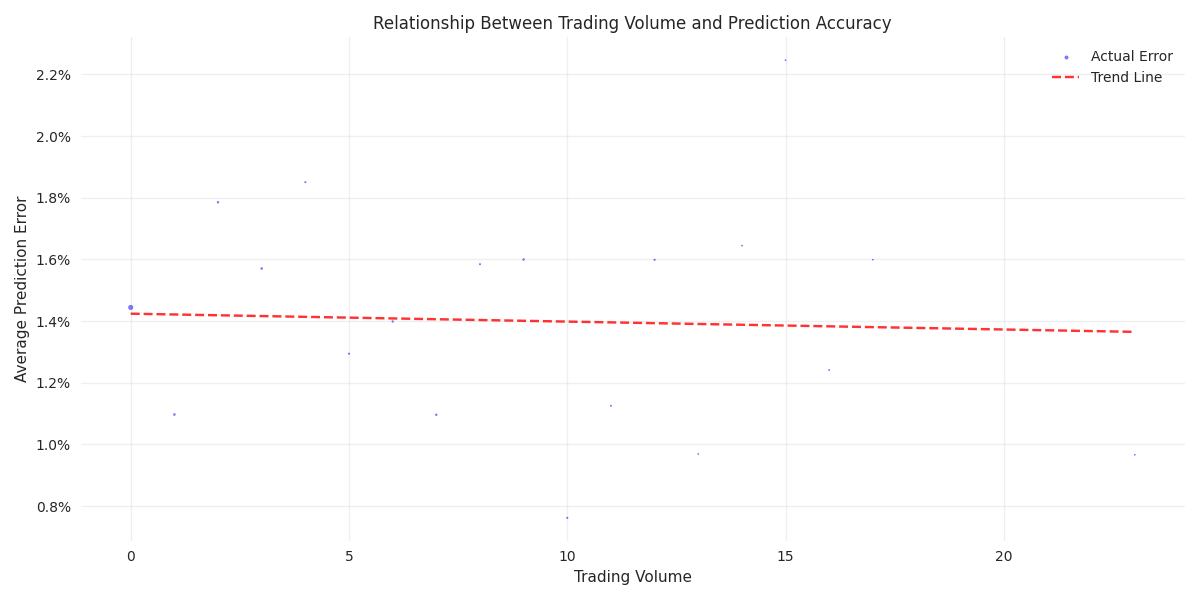

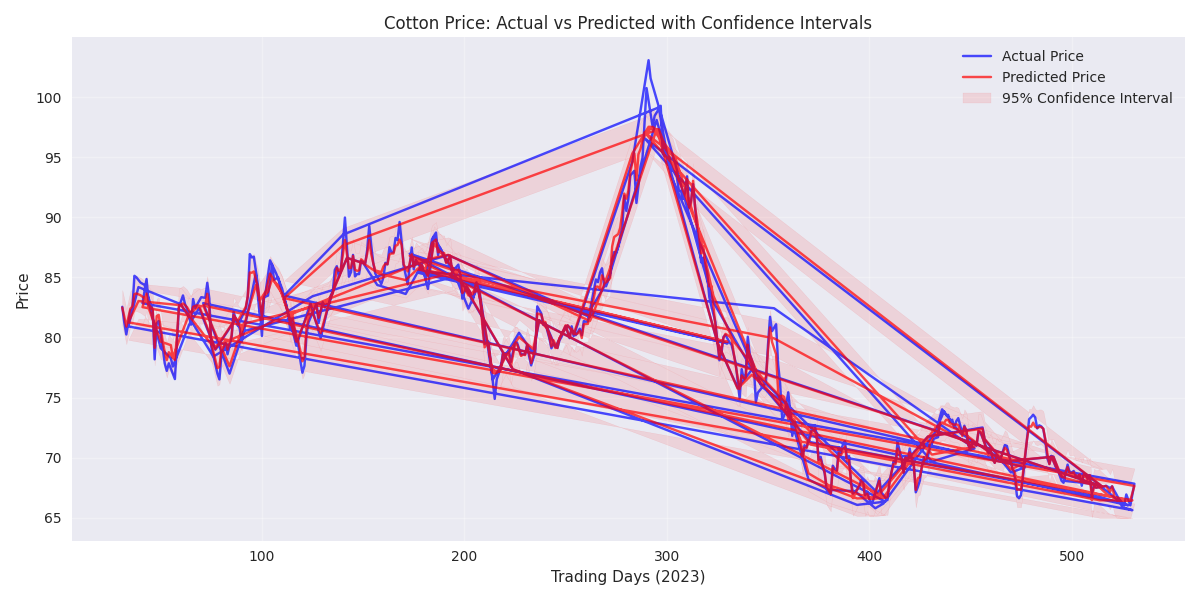

Cotton Price Prediction Analysis: Next-Day Price Movements and Key Factors

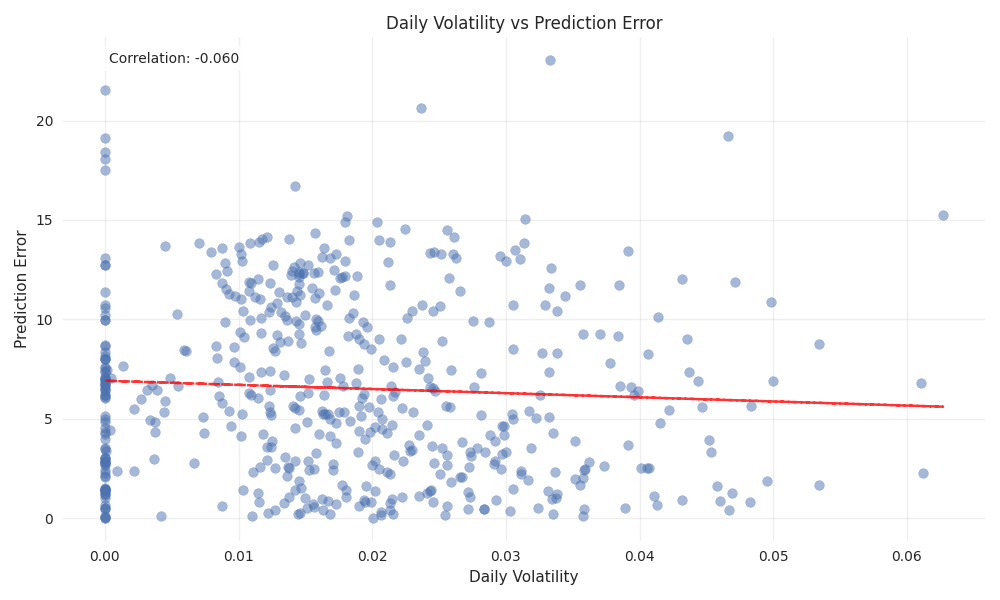

Cotton Price Prediction Analysis: Multi-Horizon Forecasts and Risk Assessment

Cotton Price Direction Prediction and Risk Analysis