Saving...

Ethereum Market Insights: Rapid Trader Briefing

Saving...

Saving...

Saving...

Saving...

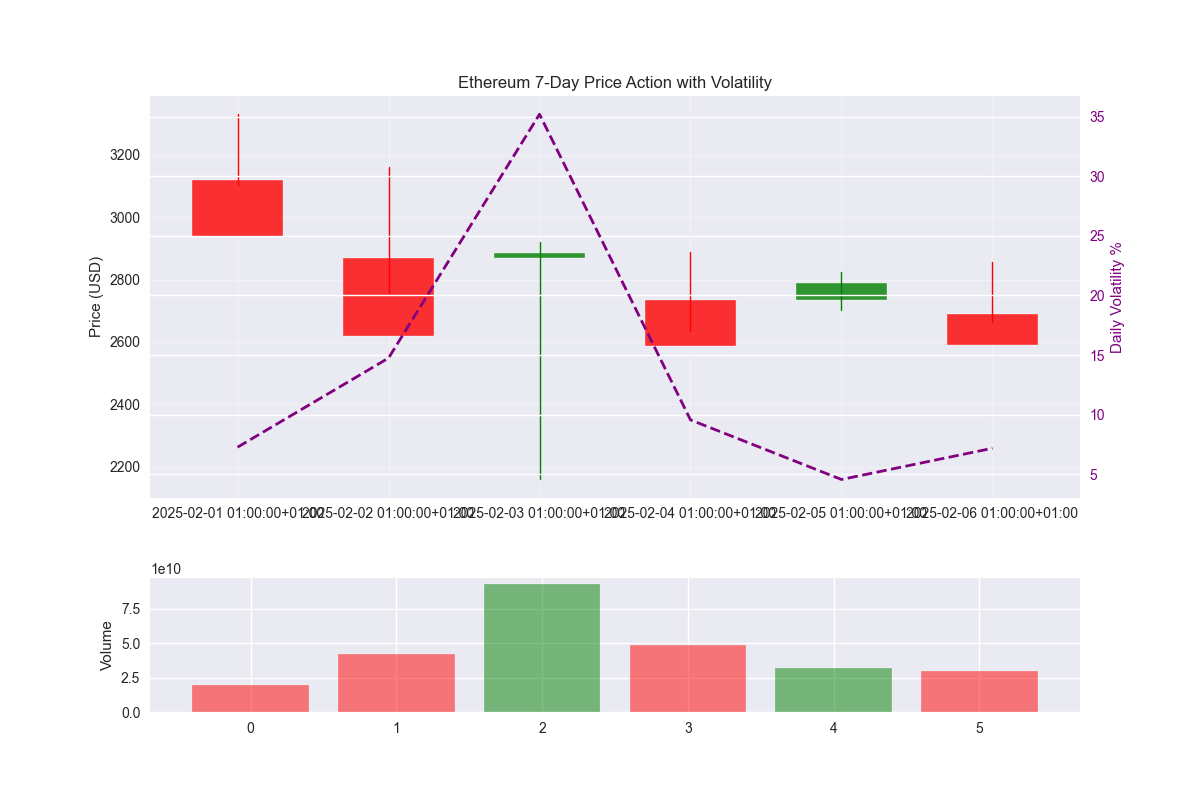

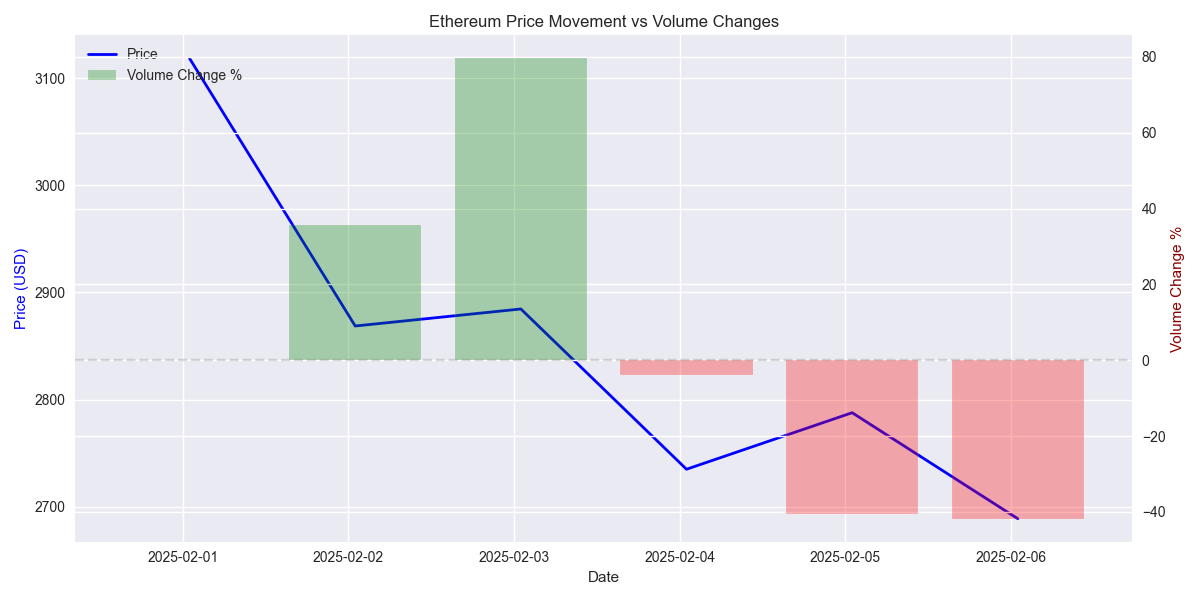

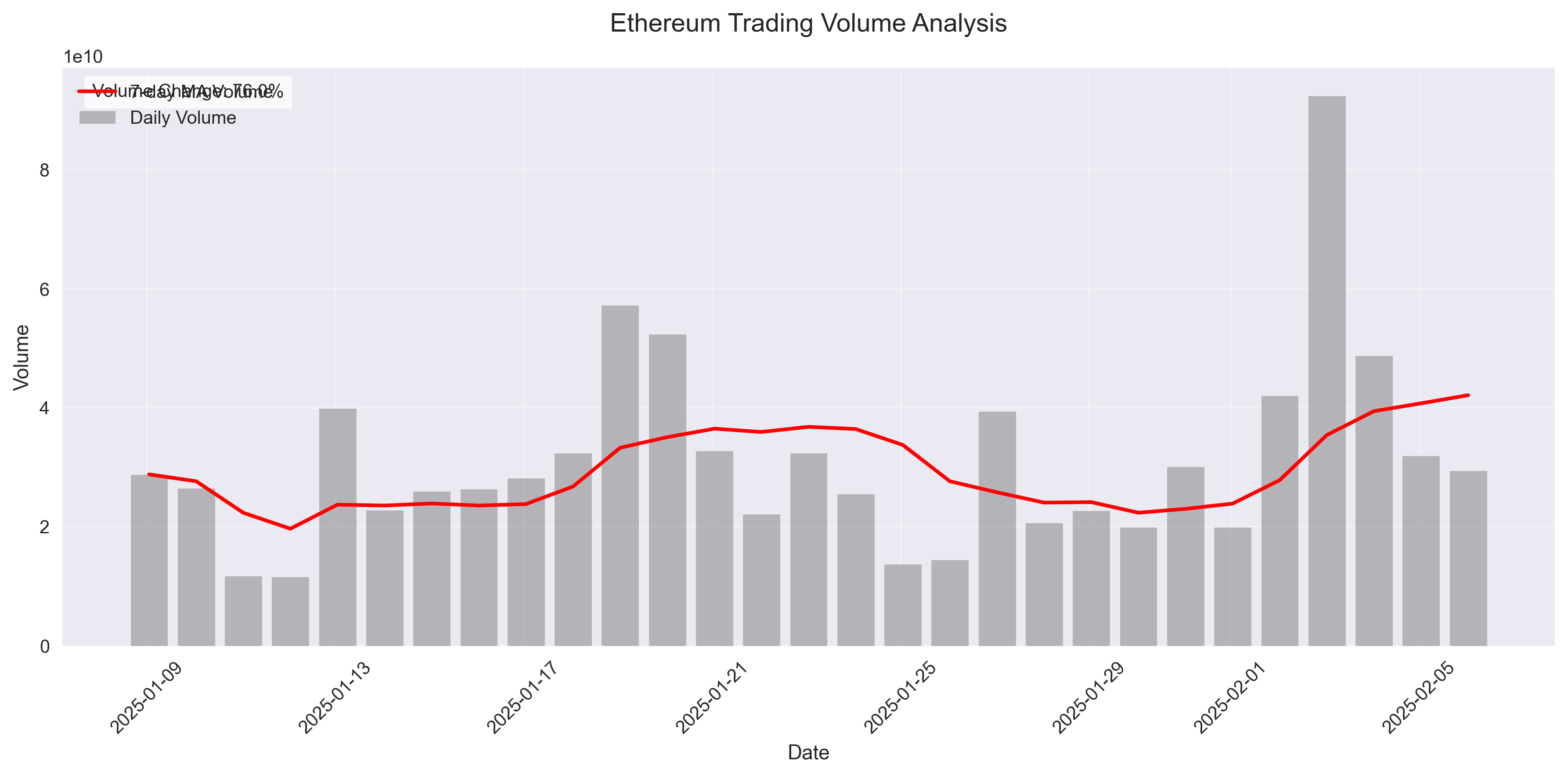

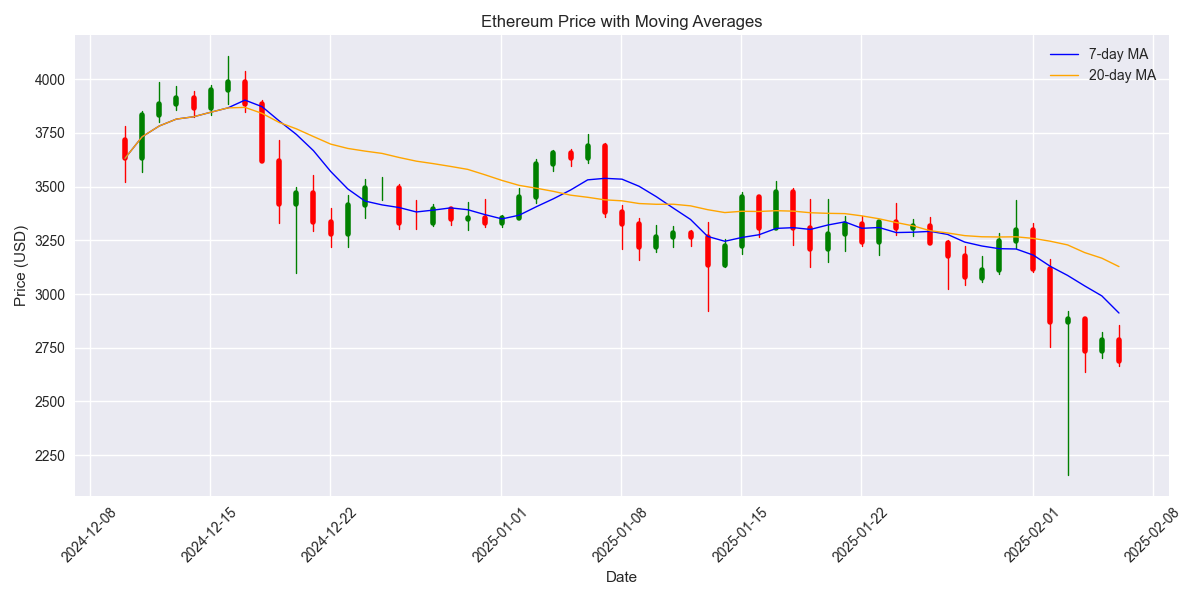

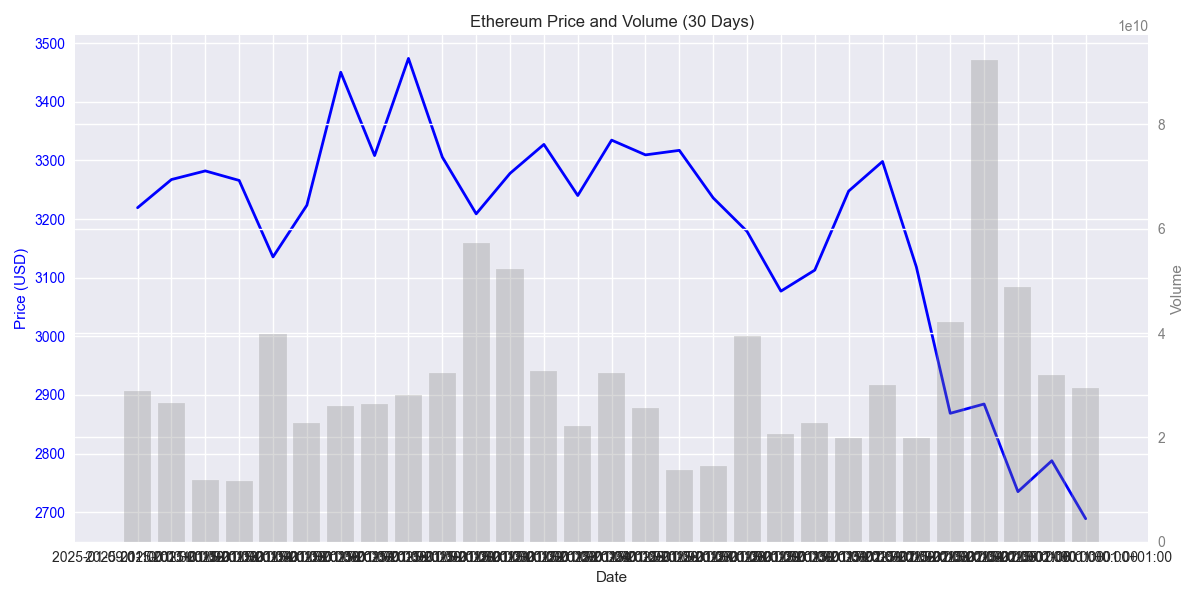

Ethereum Shows Significant Price Volatility with Recent Bearish Trend

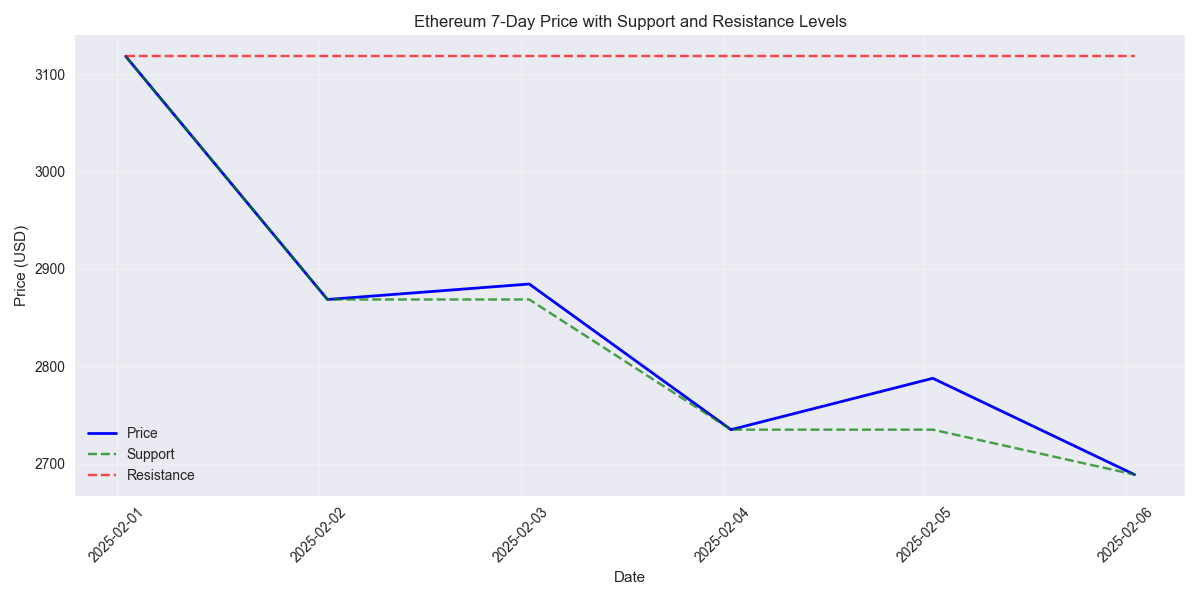

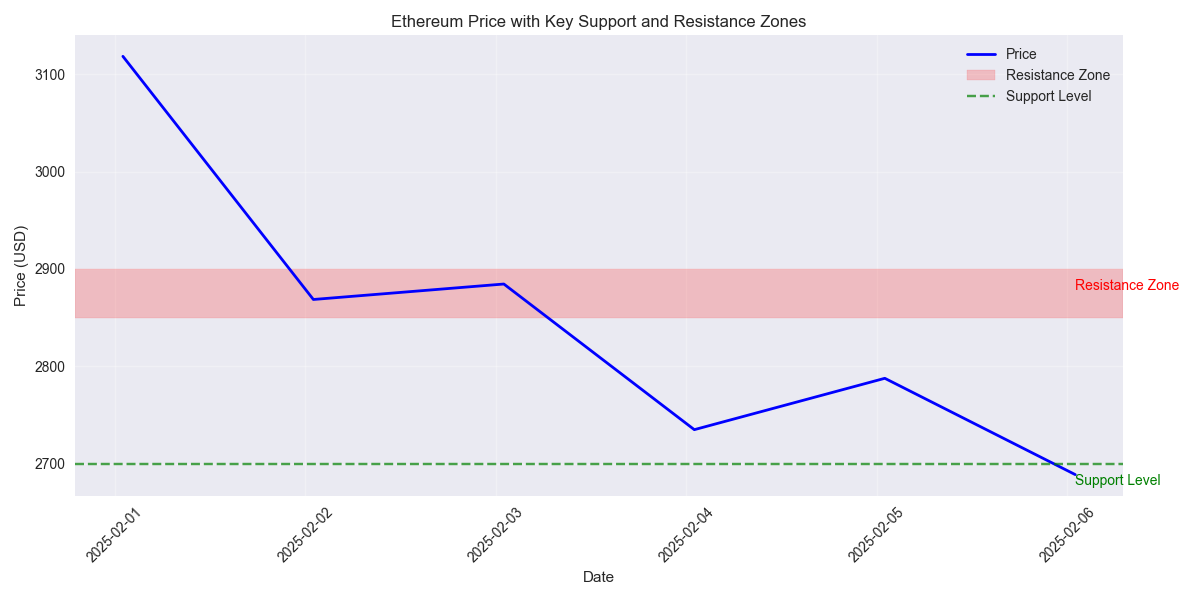

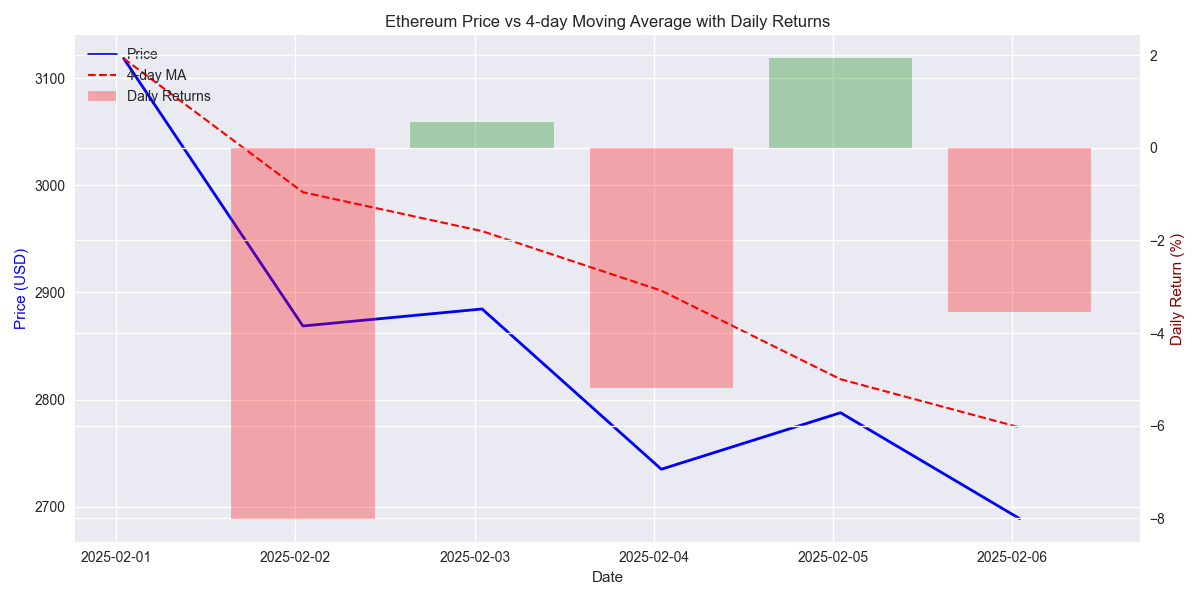

Recent Price Action Shows Critical Technical Levels

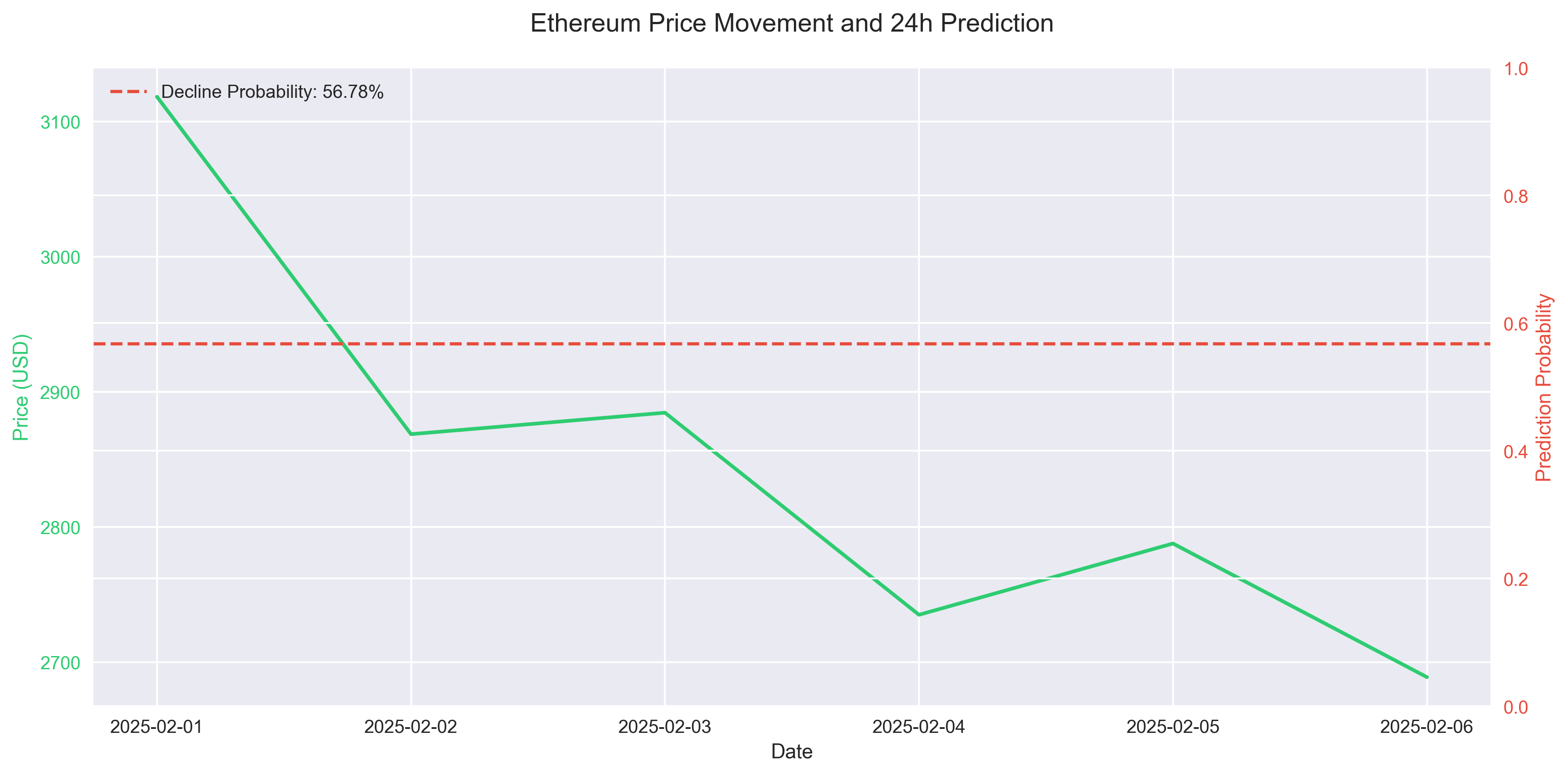

Short-Term Momentum Analysis Reveals Weakening Market Structure

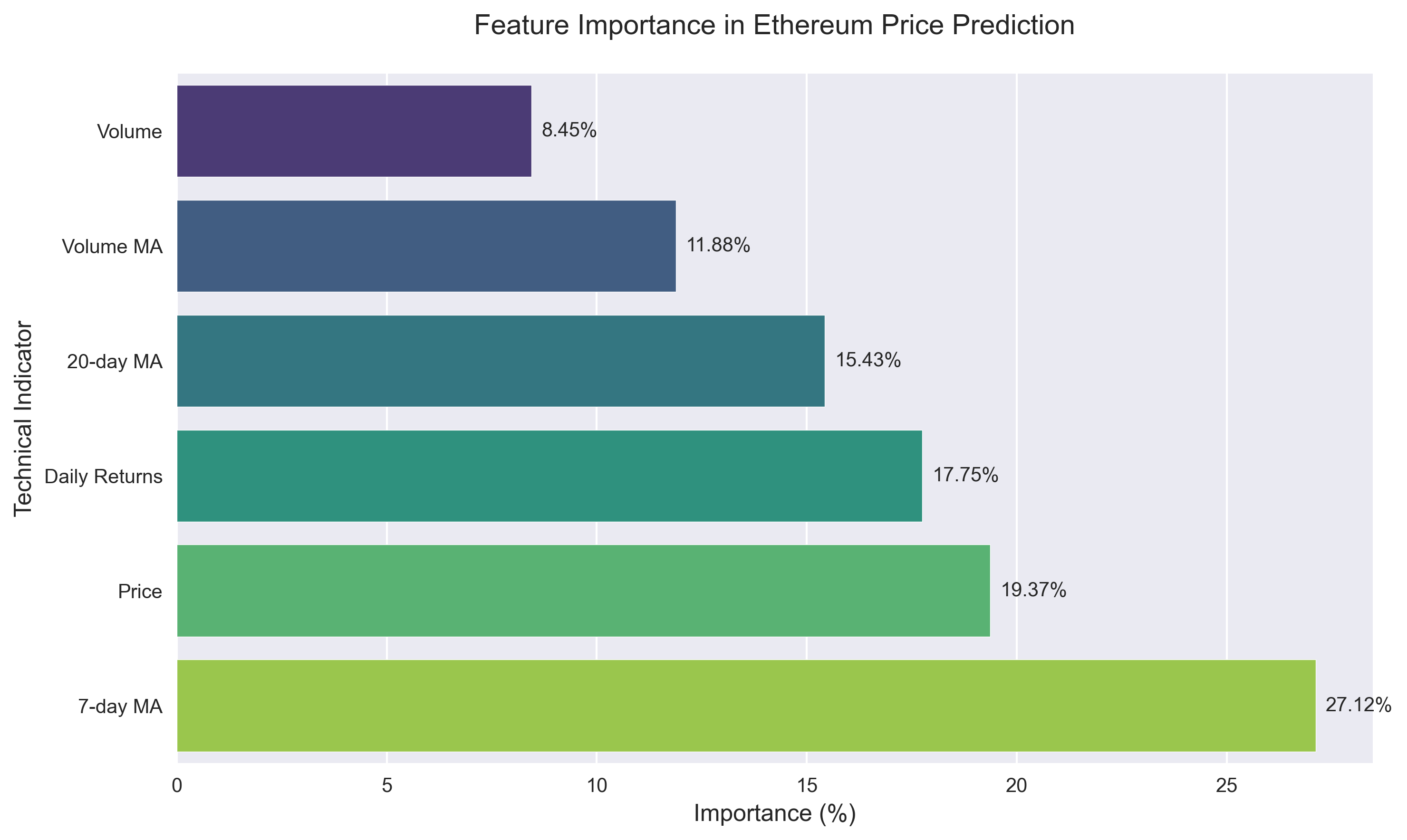

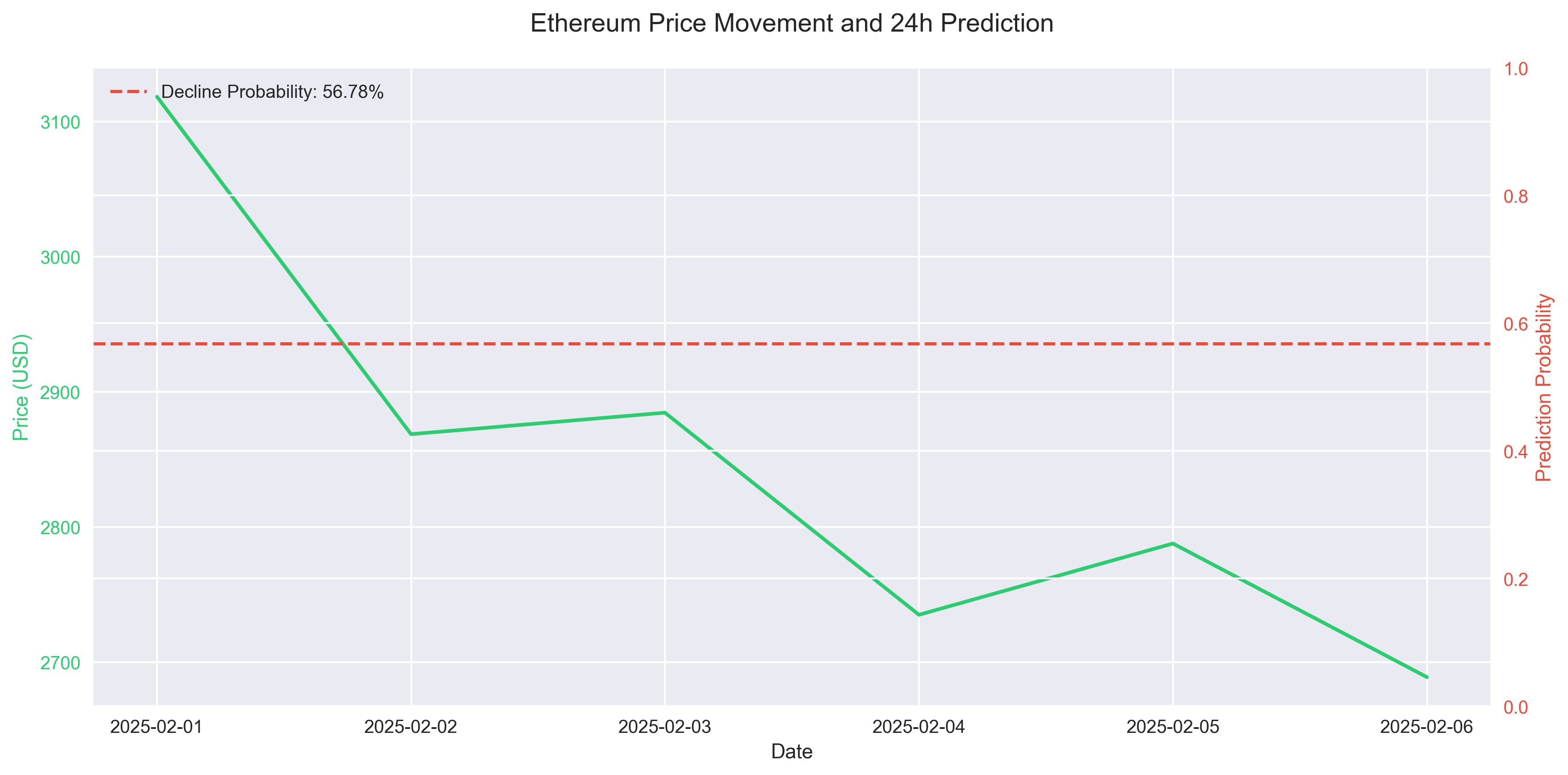

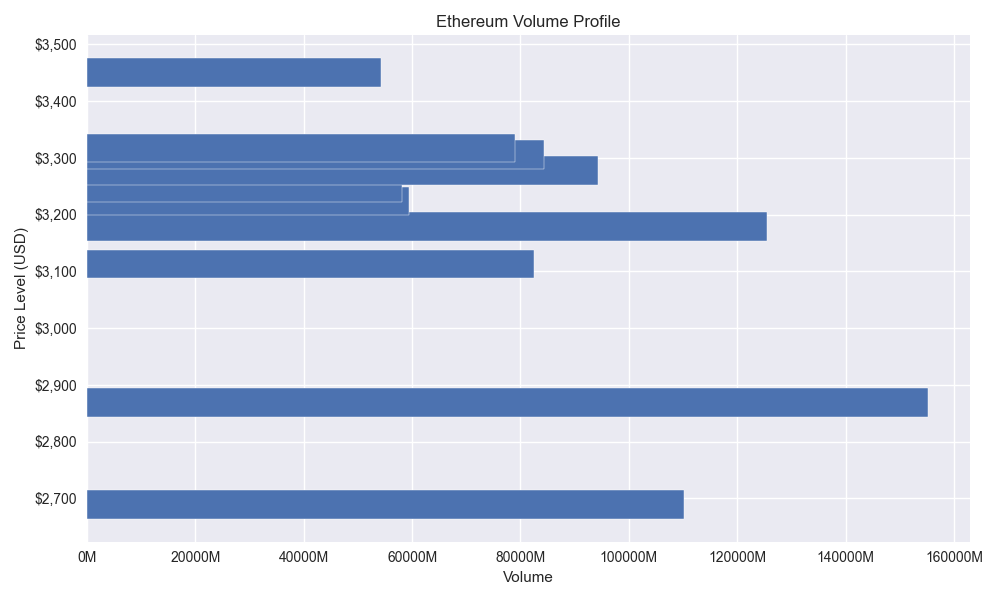

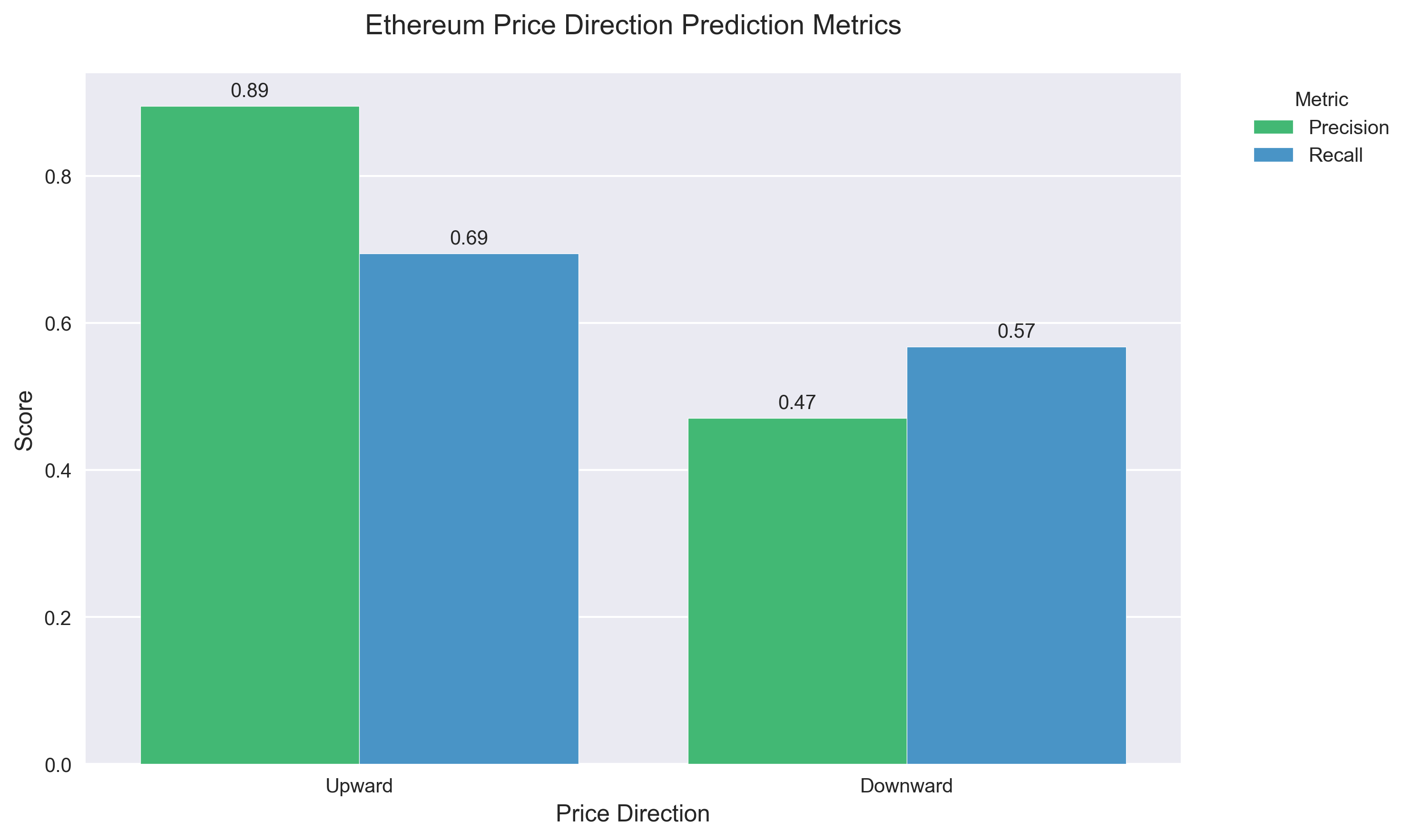

Ethereum Price Direction Analysis and Predictions

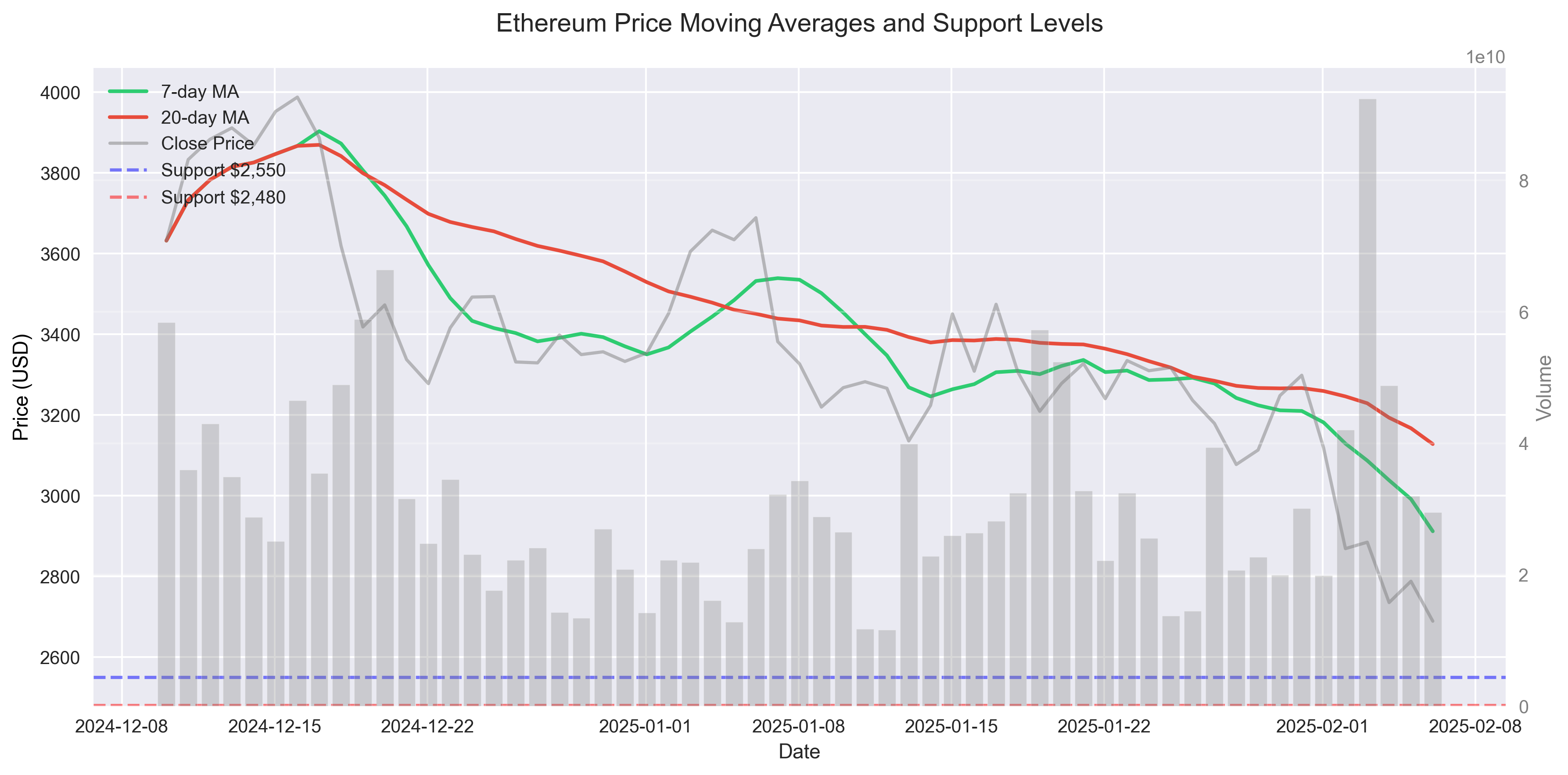

Long-term Ethereum Price Forecast and Market Analysis

Ethereum Price Forecast and Risk Analysis