Treasury Futures Trading Insights and Predictions

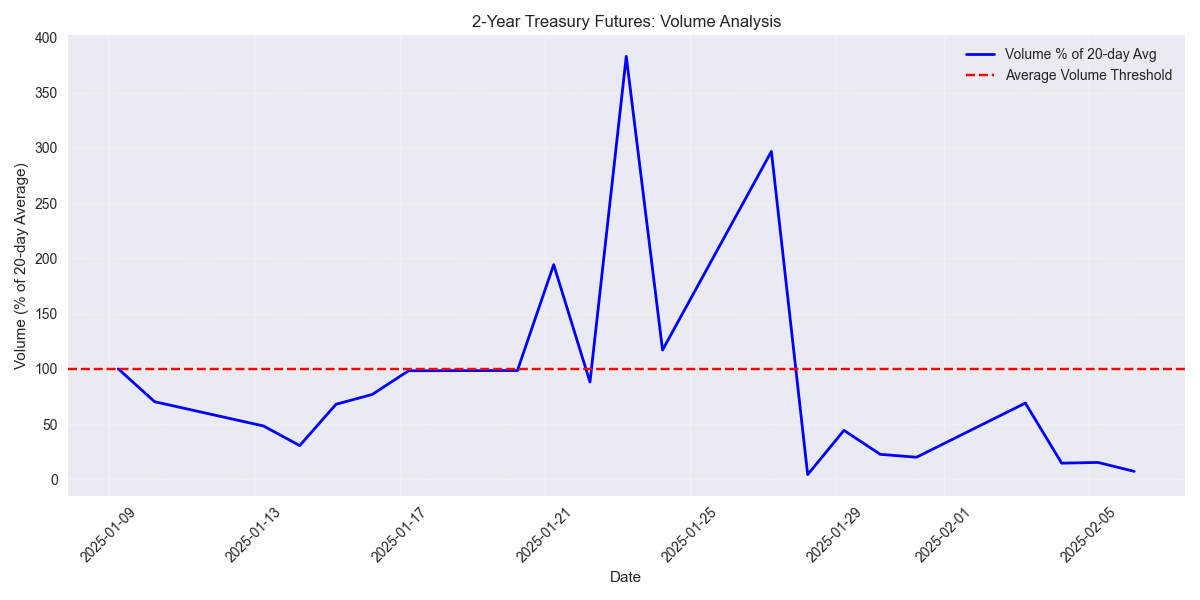

2Y Treasury Futures Set for Major Move as Volume Dries Up

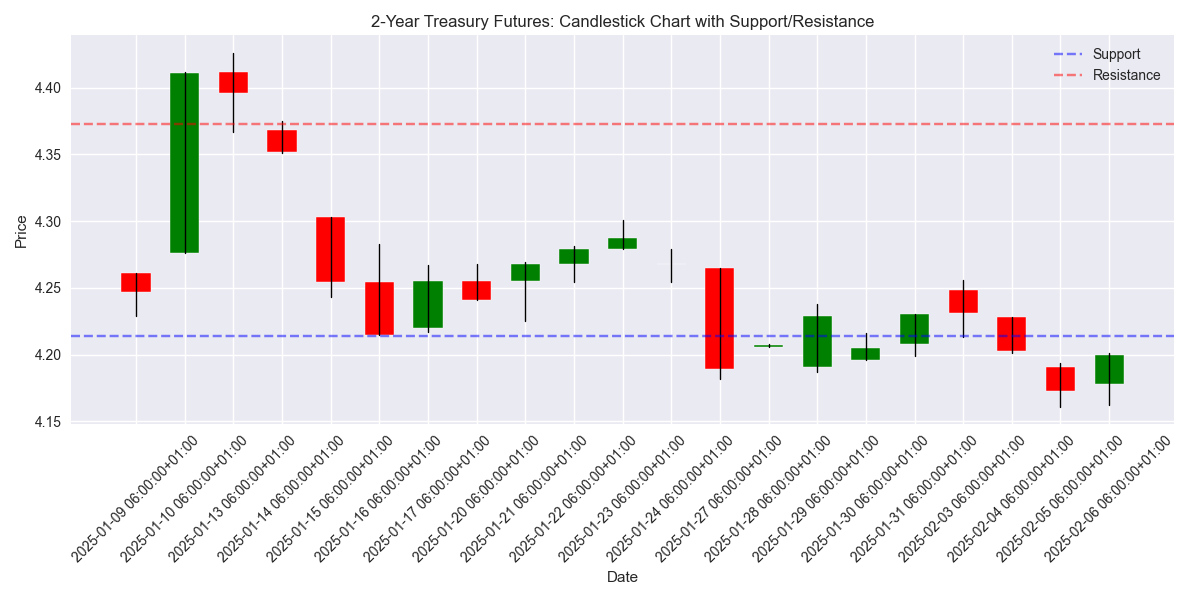

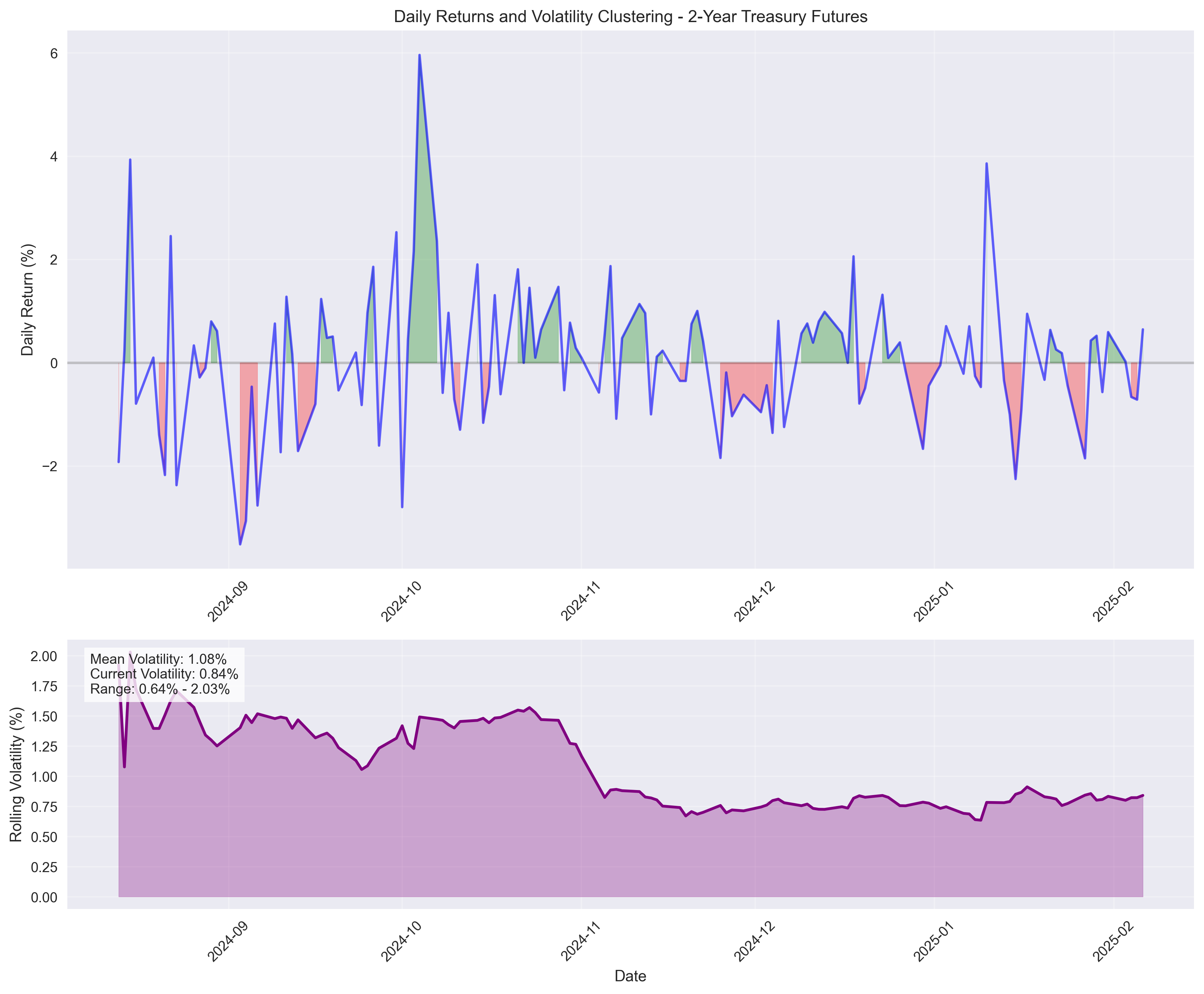

Bearish Pressure Persists Despite Price Stabilization

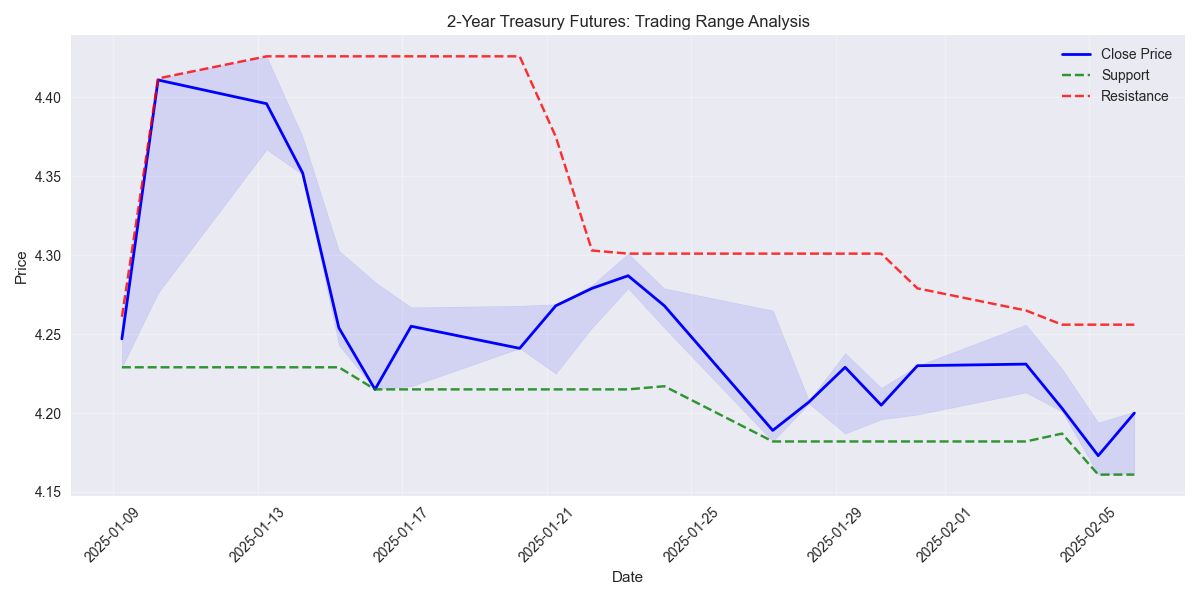

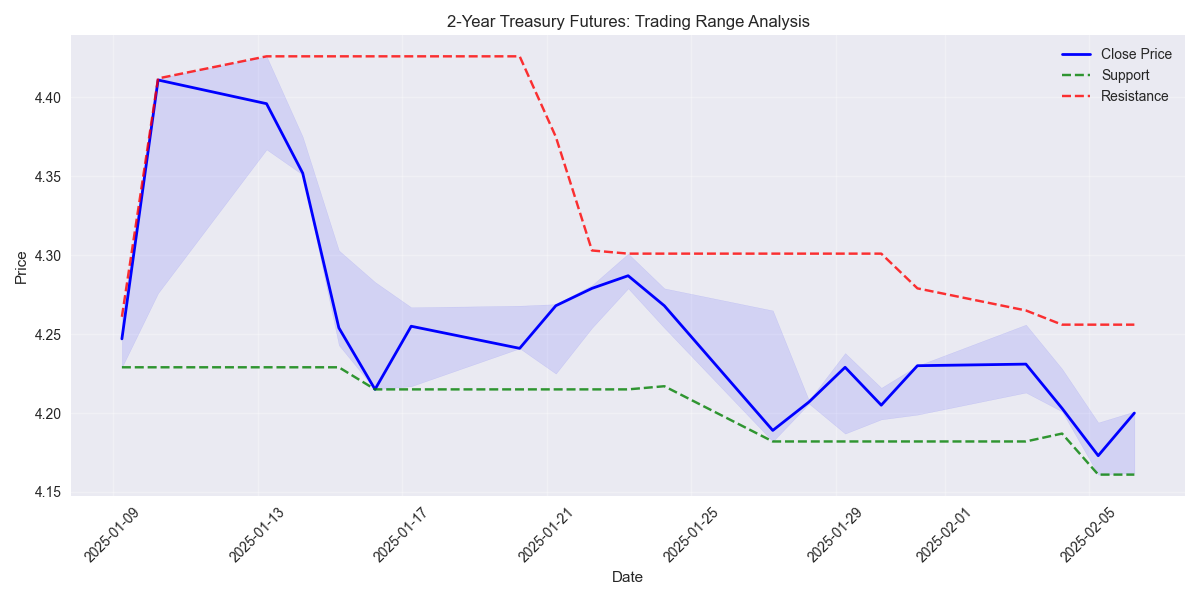

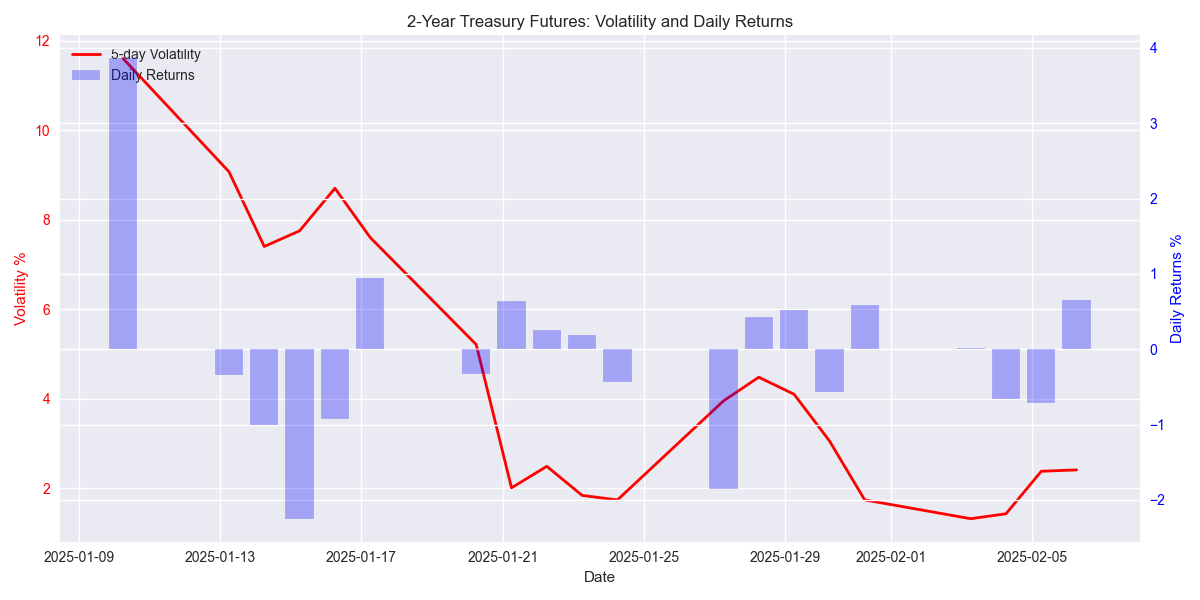

Trading Range Narrows as Volatility Stabilizes

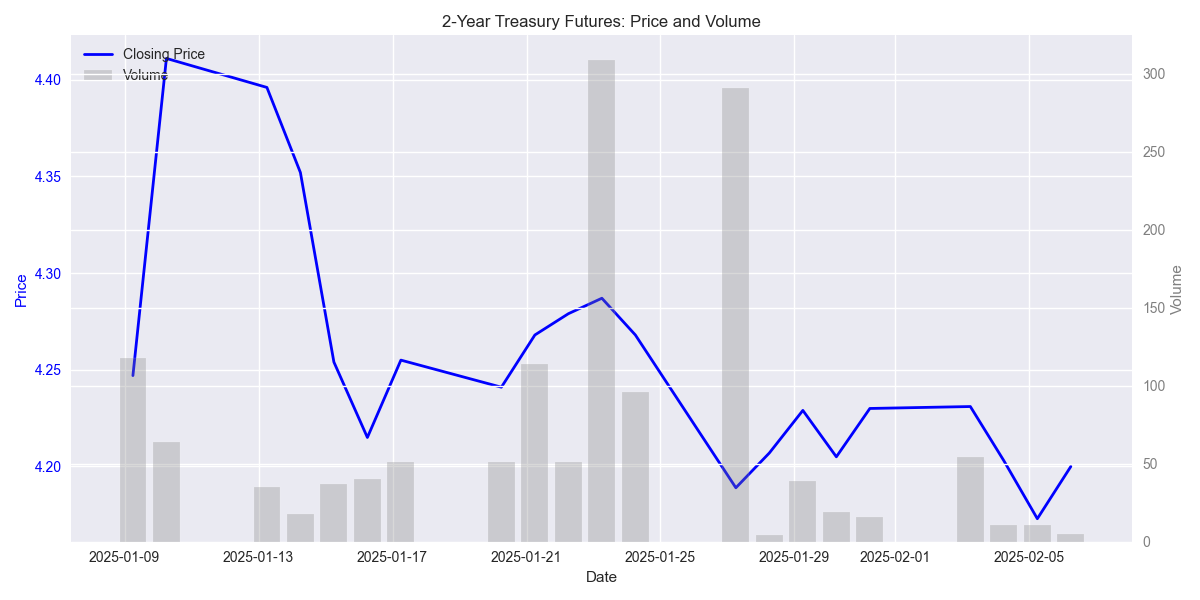

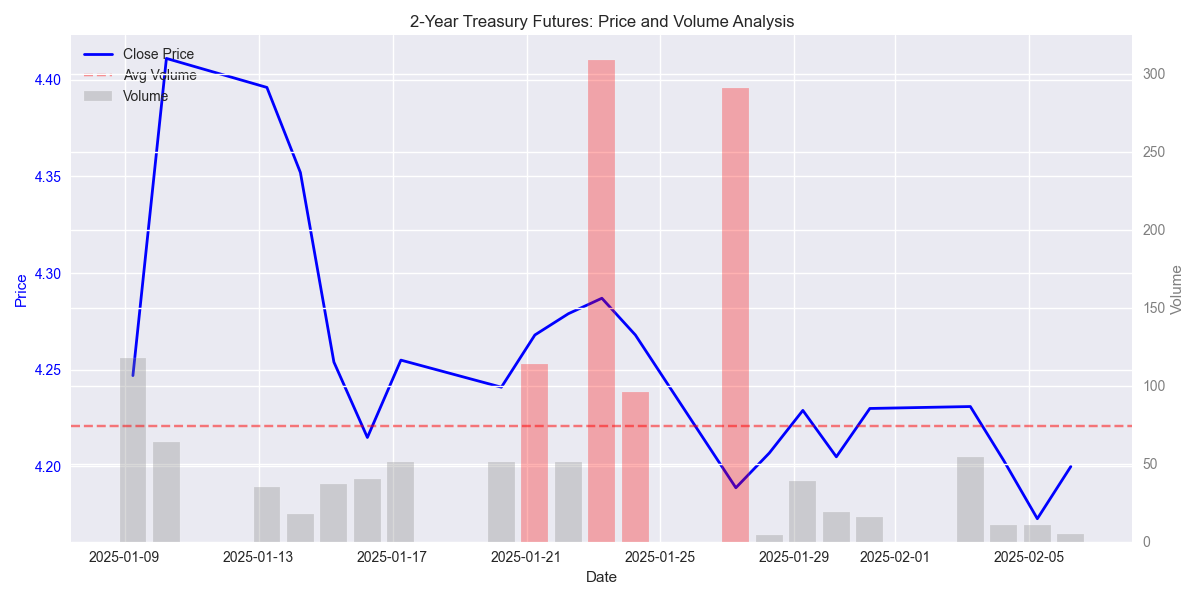

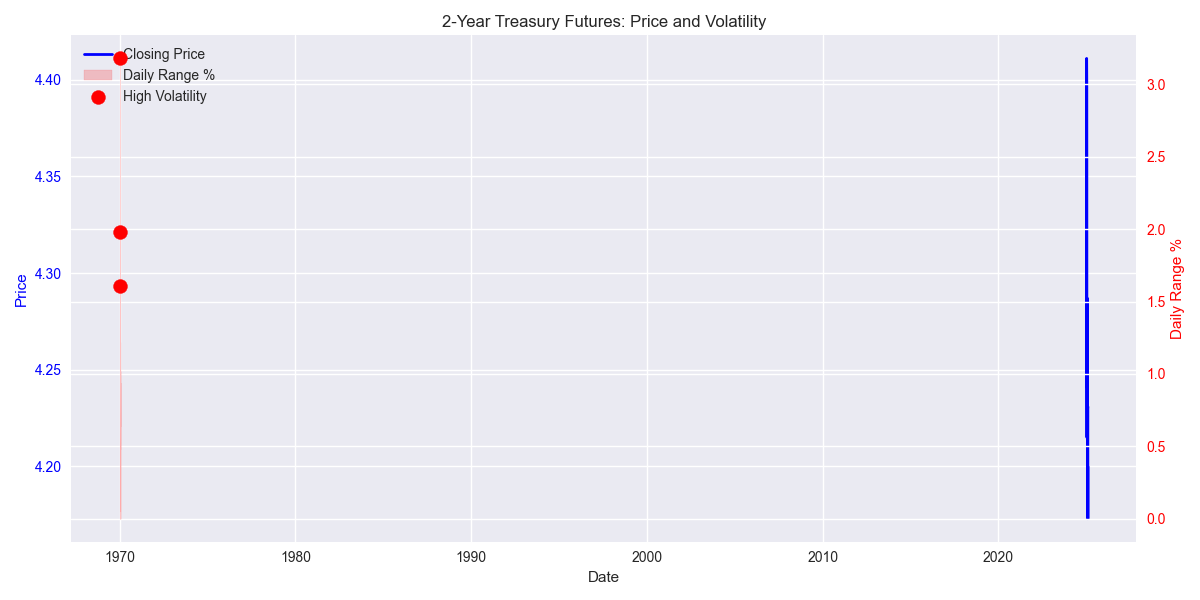

Recent Price Action Shows Increased Volatility and Bearish Trend

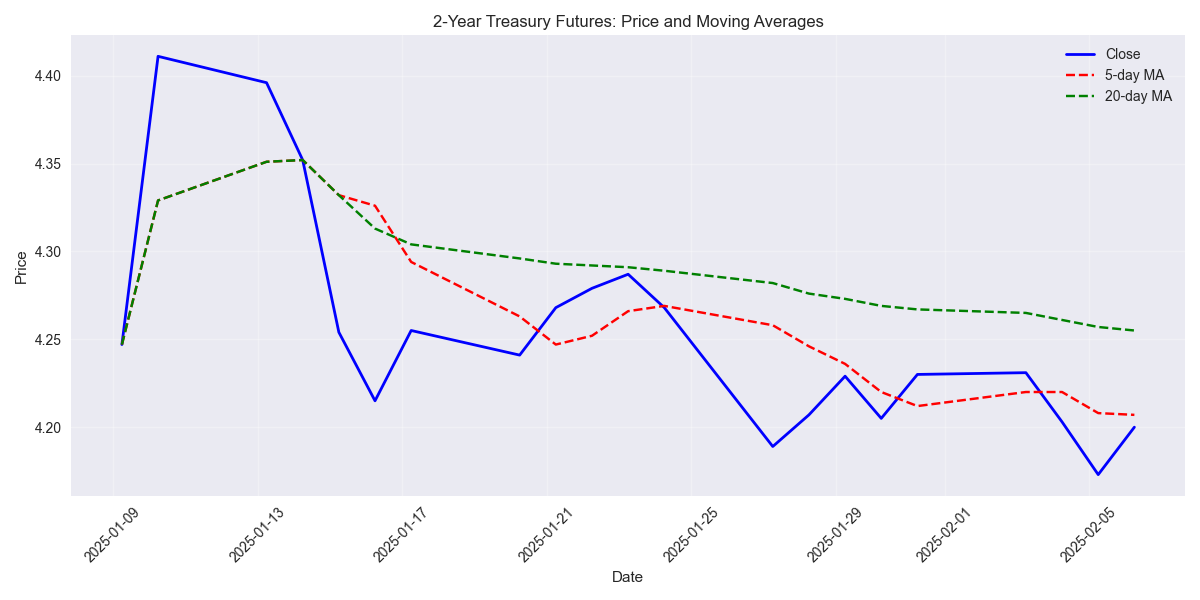

Technical Analysis Signals Point to Continued Bearish Pressure

Short-term Volatility and Trading Range Analysis Reveals Key Levels

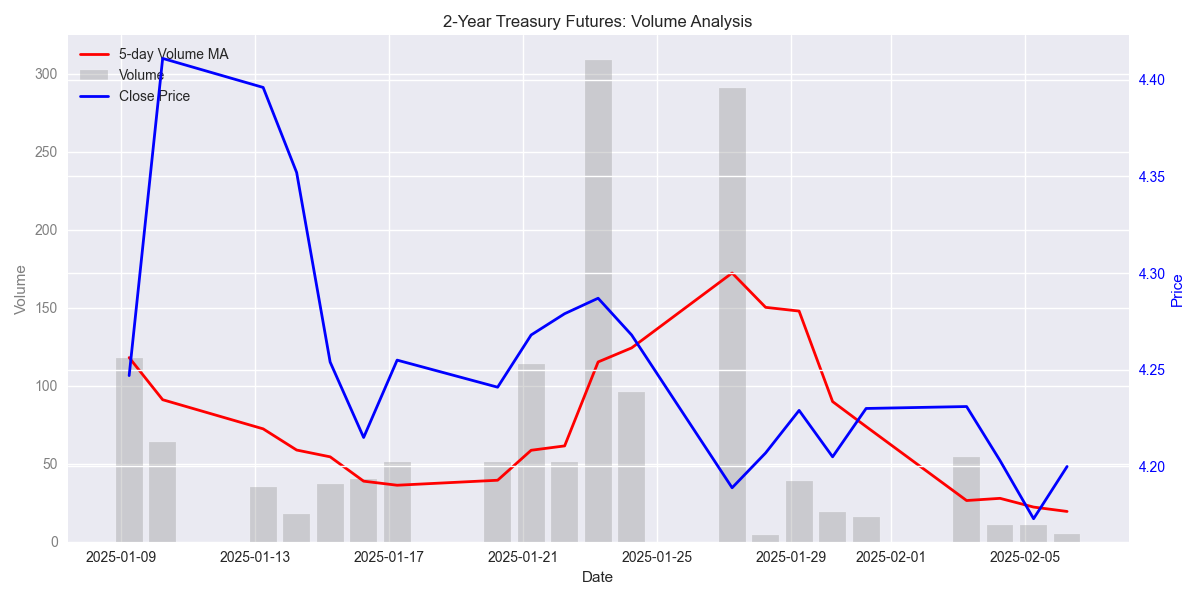

Volume Analysis Reveals Potential Market Exhaustion

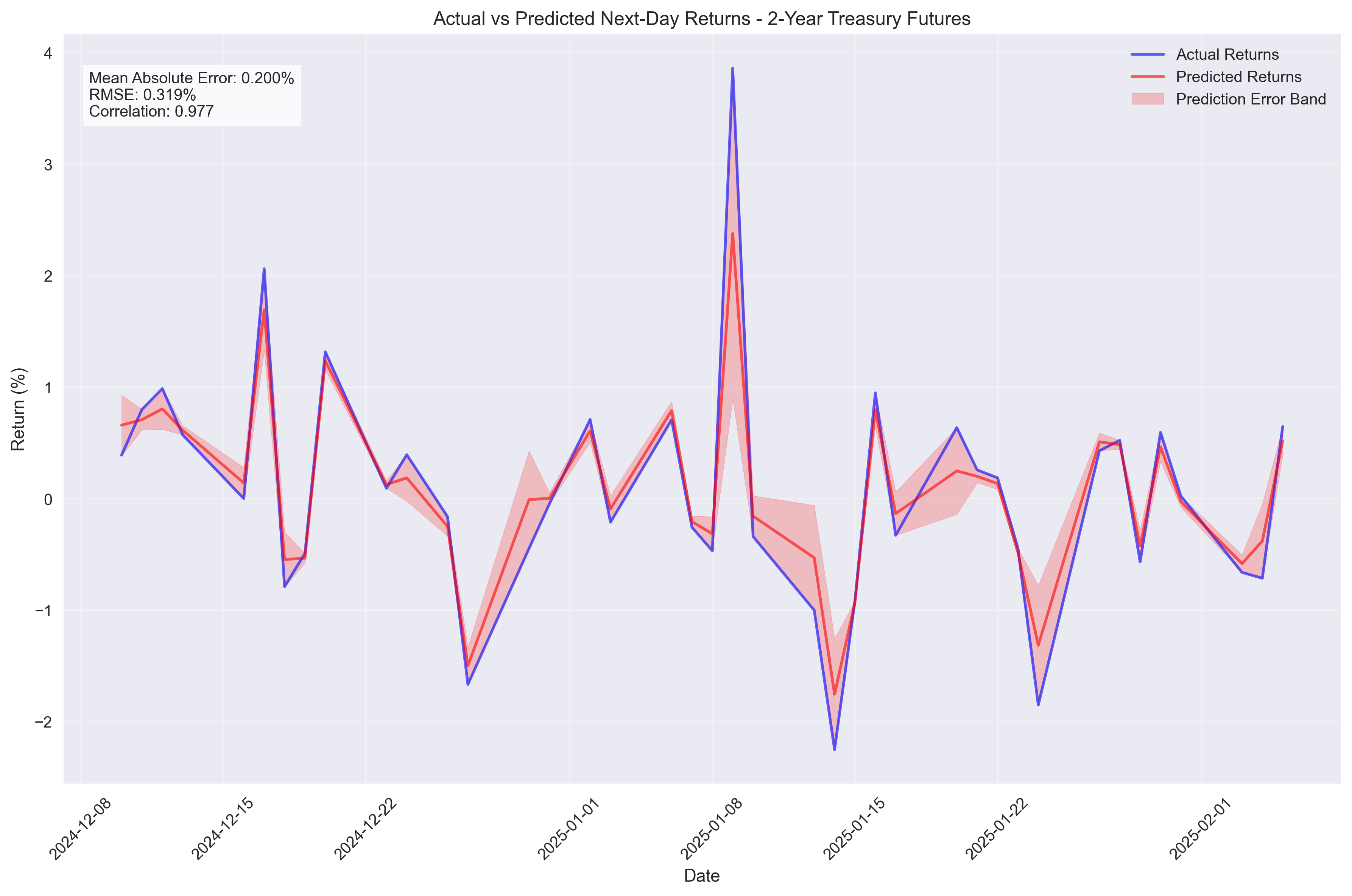

Initial Price Prediction Model Analysis for 2-Year Treasury Futures